Yen Strengthens Within Narrow Range, USD/JPY Eyes Crucial Support Near 148.12

Technical Analysis:

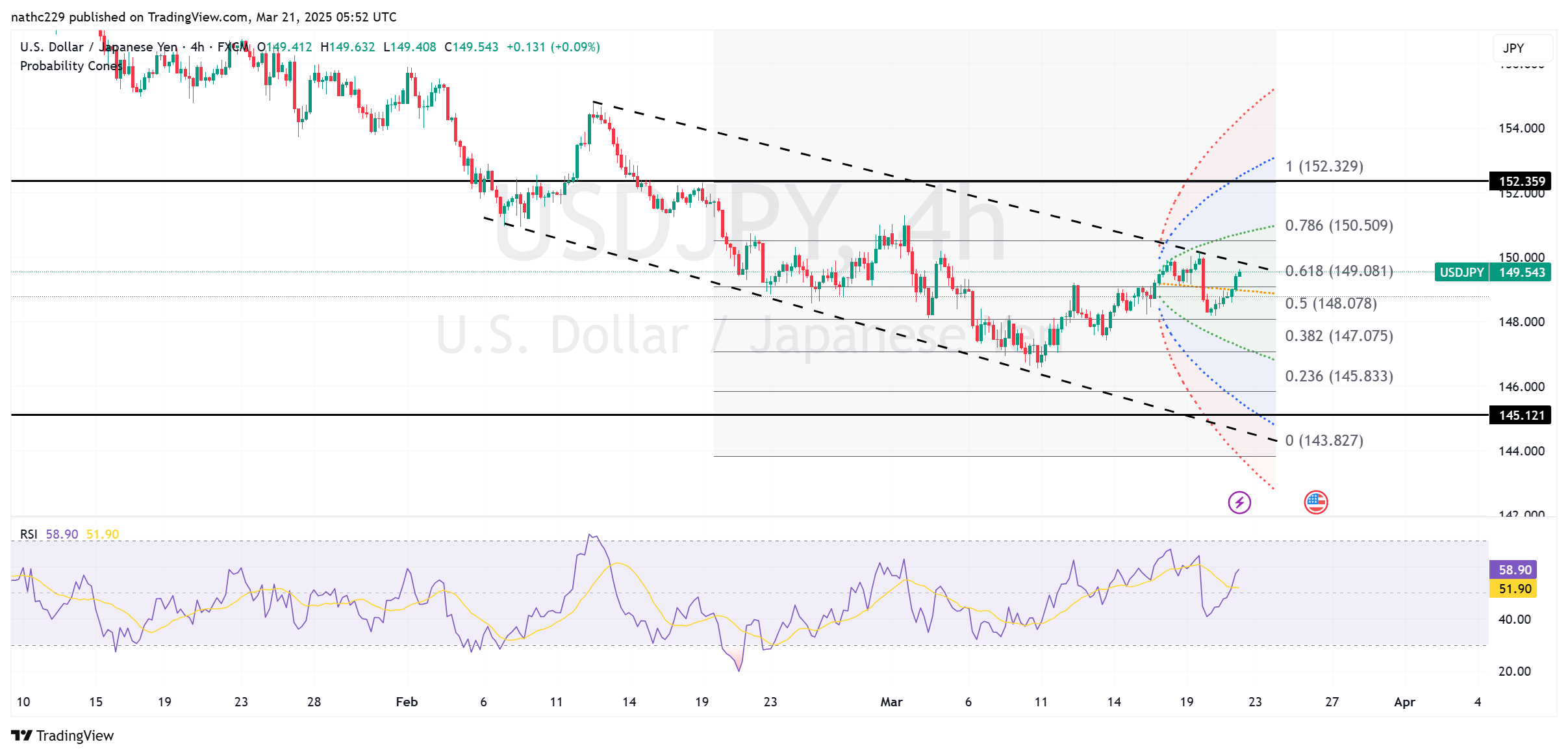

USD/JPY displayed persistent consolidation behavior on Thursday, finishing little changed near 148.70 amid recovering U.S. Treasury yields and mixed market sentiment following key central bank events. Technically, the pair remains confined within the familiar trading range of 148.00-150.00. The intraday low of 148.18, just above crucial support at 148.12 (the March 11 bearish reversal high), reinforces cautious bearish pressure and suggests bears may attempt a renewed test of this critical support level soon.

A sustained breach below 148.12 would significantly deteriorate the short-term technical outlook, targeting subsequent supports at the March 12 low (147.78) and the March 13 low (147.42), with deeper downside risk toward the 2025 low at 146.55. Momentum indicators, including the daily RSI and MACD, currently show neutral-to-slightly bearish biases, reflecting traders' indecision amid conflicting fundamental influences, particularly heightened uncertainty around Fed and BOJ policy stances.

Conversely, a recovery above near-term resistance at 149.10 (March 18 low) is needed to alleviate bearish pressure, potentially setting the stage for another attempt toward the critical upper-bound resistance at 150.18 (March 5 high). However, USD/JPY bulls may remain hesitant unless the pair convincingly surpasses this upper bound, which has capped gains consistently over recent weeks. Traders will closely monitor upcoming Japan CPI data for directional clarity, with sustained yen buying likely if data reinforce BOJ tightening expectations, pushing USD/JPY firmly lower within its range.