Yen Rallies Ahead of BoJ Meeting; USD/JPY Stuck in Range as Market Awaits Clear Signals

The yen rose on Monday, but its rallies ahead of the Bank of Japan's (BoJ) July 31 policy meeting may remain fragile until the forex market receives clearer signals of the BoJ's intent to hike rates. Governor Kazuo Ueda’s leadership has been marked by media reports hinting at the BoJ's policy adjustments ahead of official announcements, although recent signals have been ambiguous. Bloomberg reported on Monday that BoJ officials are concerned about weak consumer spending complicating their decision on raising rates, while some officials fear missing the opportunity to hike. This uncertainty poses a significant challenge for the yen.

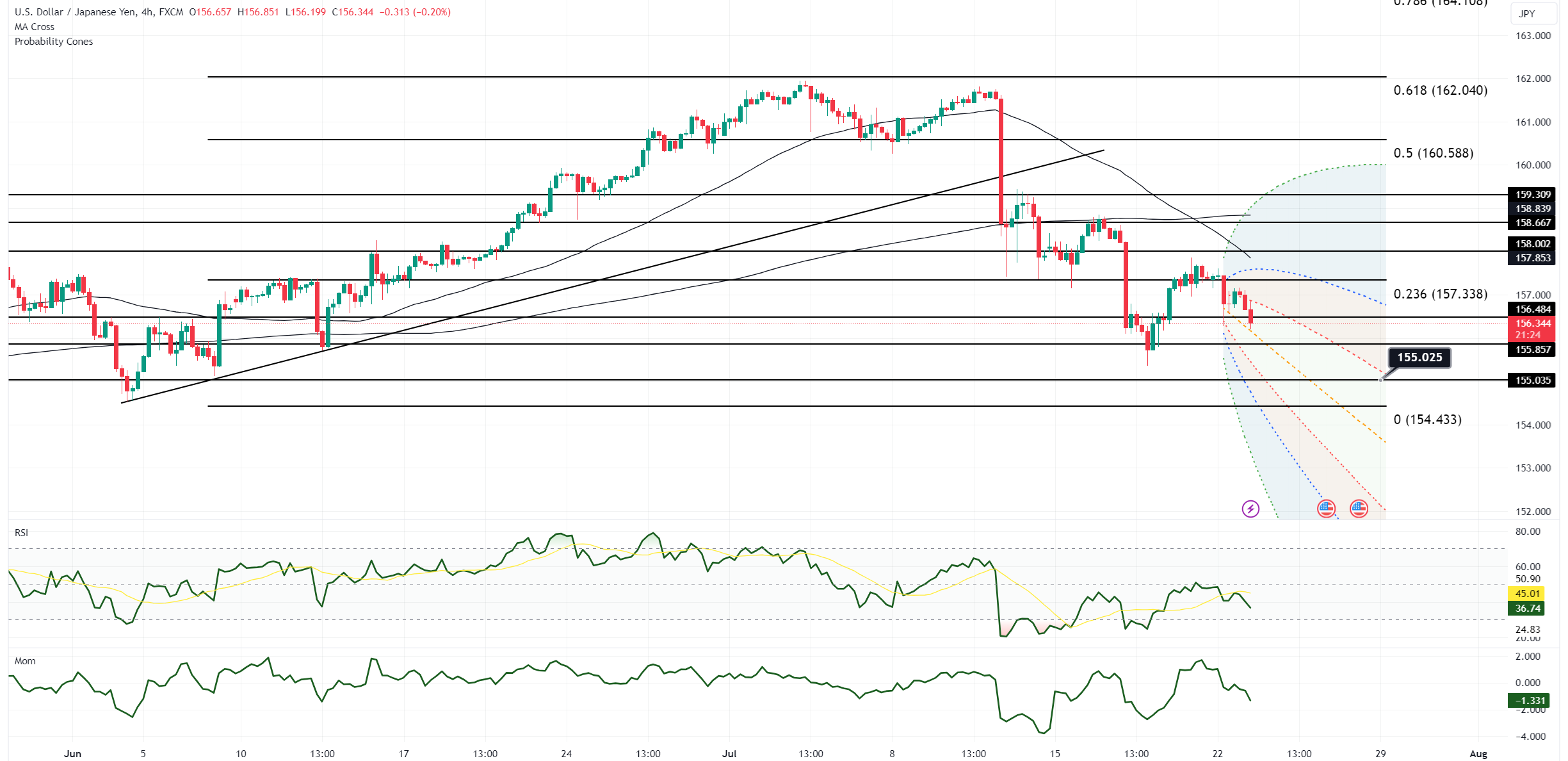

With the BoJ taking a cautious approach to normalizing policy, it becomes difficult for the yen to sustain gains against the high-yielding dollar. Consequently, the risks for USD/JPY remain tilted to the upside. Currently, the pair's range is defined by the 100 and 55 daily moving averages at 155.28-157.81. However, as yields drift higher, USD/JPY is likely to remain in an upward trajectory. Bulls will need a daily close above the 55-DMA to alleviate downside momentum; failing to do so could keep the door open for a test of the 155.00-30 range.

In recent trading, the yen outperformed across the board, with USD/JPY down 0.26%. However, the drift higher in yields took the yen off its best levels. For now, USD/JPY remains stuck between its 100-DMA and 55-DMA, ranging from 155.28 to 157.82. A data catalyst, such as U.S. PMIs, is likely needed to break this range. A close above the 55-DMA would pave the way for a move towards 159.00-50. However, remaining below this hurdle keeps the risk of a test of the 155.00-30 area on the table.

Open an account today to unlock the benefits of trading with CMS Financial