Yen Bulls Under Pressure as USD/JPY Rebounds; Technical Indicators Suggest Further Gains

Technical Analysis:

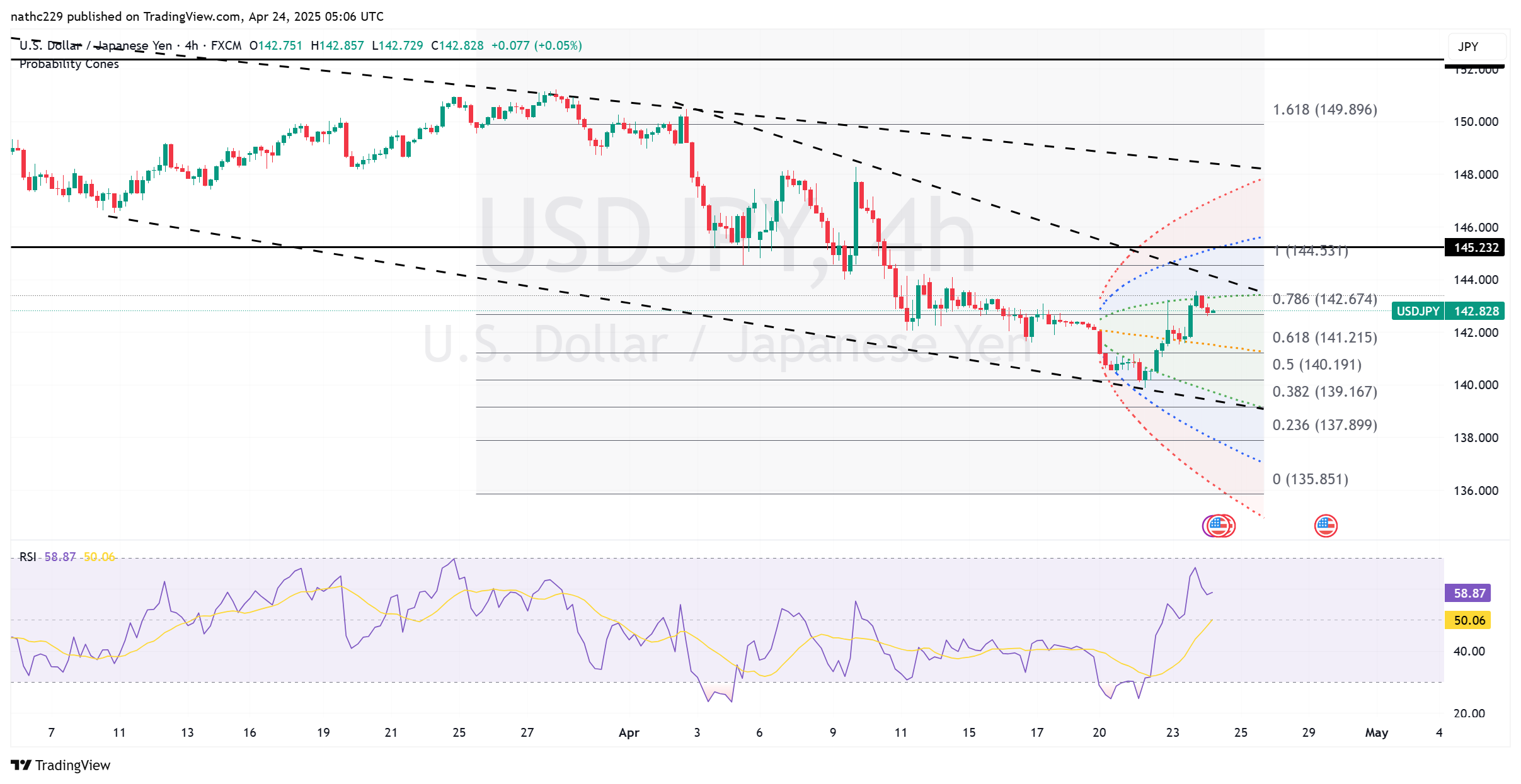

USD/JPY staged a notable rebound to reach fresh session highs at 143.35 amid strengthening U.S. Treasury yields and a positive turn in global risk sentiment following supportive comments from U.S. Treasury Secretary Bessent regarding a robust dollar and moderated tariff concerns. The pair’s ability to regain the 200-hour moving average at 142.26 represents a significant technical development, suggesting that bullish momentum may be gaining traction, particularly as stochastics turn upward after the previous sequence of lower highs was decisively broken.

For bulls, the immediate challenge now lies at key resistance near 143.99-144.00, the lows from April 9-10. A decisive break above this area would significantly boost bullish confidence and likely spur additional short-covering toward the next critical resistance at 144.55, established on April 4. Clearing these levels could challenge a substantial volume of existing yen long positions, leading to accelerated upside moves toward the psychologically important 145.00 area and possibly beyond, contingent on broader dollar sentiment and equity market stability.

However, technical caution remains warranted, given persistent structural headwinds and the record-long yen positioning indicated by recent CFTC data. Downside support at the April 21 low of 140.48 must hold to prevent a renewed bearish impulse. If this key support gives way, it would expose the 2025 year-to-date low of 139.89 and subsequently deeper structural support at 139.58 (September 16 low). Traders will remain sensitive to upcoming headline risks, including potential outcomes from impending U.S.-Japan trade talks and the Bank of Japan’s policy meeting next week, both of which have potential to significantly influence short-term direction.