Yen Bears Press USD/JPY Higher, but Clouds Loom Ahead of Key Resistance Levels

Technical Analysis:

USD/JPY posted meaningful gains on Friday, climbing steadily as U.S. Treasury yields surged following elevated U.S. inflation expectations and buoyant risk appetite driven by stronger equities and positive trade-related news flow. Notably, the University of Michigan survey’s inflation expectation increase to 7.3% for the coming year significantly boosted market sentiment, solidifying views that the Federal Reserve is unlikely to ease policy anytime soon. Concurrently, rising U.S. tech shares and oil prices further supported risk-on sentiment, pressuring the yen and providing fuel for the dollar's rally.

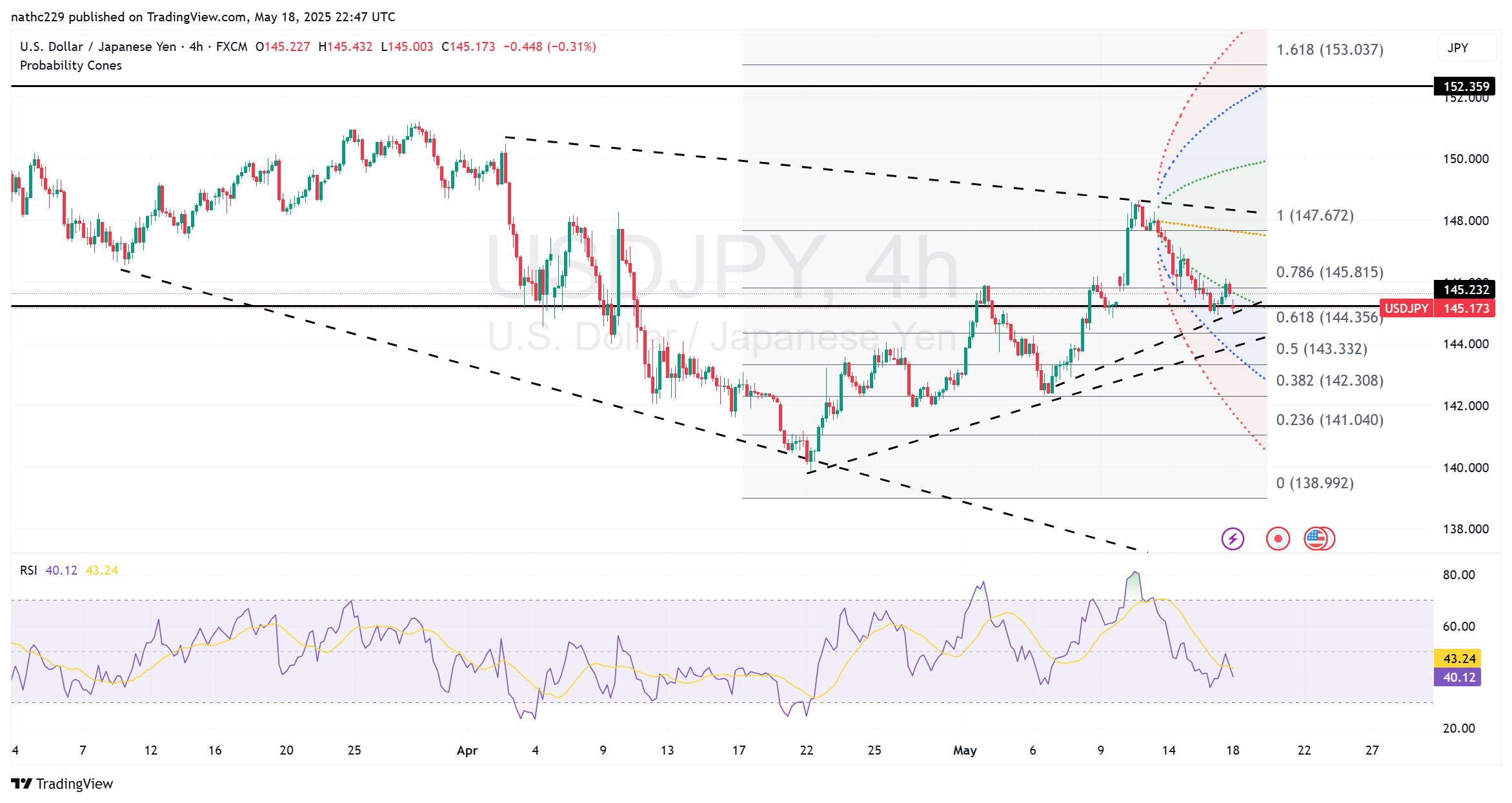

Technically, the pair established a bullish hammer candlestick formation just above the critical support at 145.00, positioning bulls favorably into next week. The immediate challenge lies at the Ichimoku cloud base at 146.45, a crucial resistance area that, if decisively broken, would signal a further bullish extension toward the May 15 peak at 147.67. Beyond this level, the daily Bollinger Band upper boundary at 148.17 acts as significant overhead resistance, likely capping short-term upside without additional bullish fundamental catalysts. Indicators such as the daily RSI are positively inclined but have yet to signal strongly overbought conditions, allowing some room for further near-term appreciation.

However, yen bulls retain several reasons for optimism. On the downside, initial strong support at 144.27—where the 21-day moving average and Ichimoku baseline converge—will be key. Below that, the May 7 high at 144.00 provides an additional robust layer of protection. Fundamentally, despite recent dovish comments from Bank of Japan board member Nakamura and weak Japanese Q1 GDP data, yen demand persists via repatriation flows amid ongoing global uncertainty. Additionally, elevated yen option demand ahead of the G7 finance minister and central banker meetings reflects investor caution and risk aversion. With futures open interest hovering near three-week lows, bullish USD/JPY positioning appears cautious, indicating potential vulnerability to rapid sentiment reversals, especially if G7 outcomes signal coordinated policy tightening or increased global economic uncertainty.