USD/JPY Under Pressure as Risk-Off Sentiment Strengthens

USD/JPY has extended its decline to a new year-to-date low, breaking below the December low of 148.65 as lower Treasury yields and weaker risk sentiment continue to drive demand for the yen. The drop in U.S. consumer confidence, coupled with looming government budget cuts and tariffs, has reinforced expectations of a possible Fed rate cut in May, keeping pressure on the dollar. Meanwhile, Japan’s inflation breakevens remain elevated, contrasting with the U.S. and European inflation outlooks, further supporting yen strength.

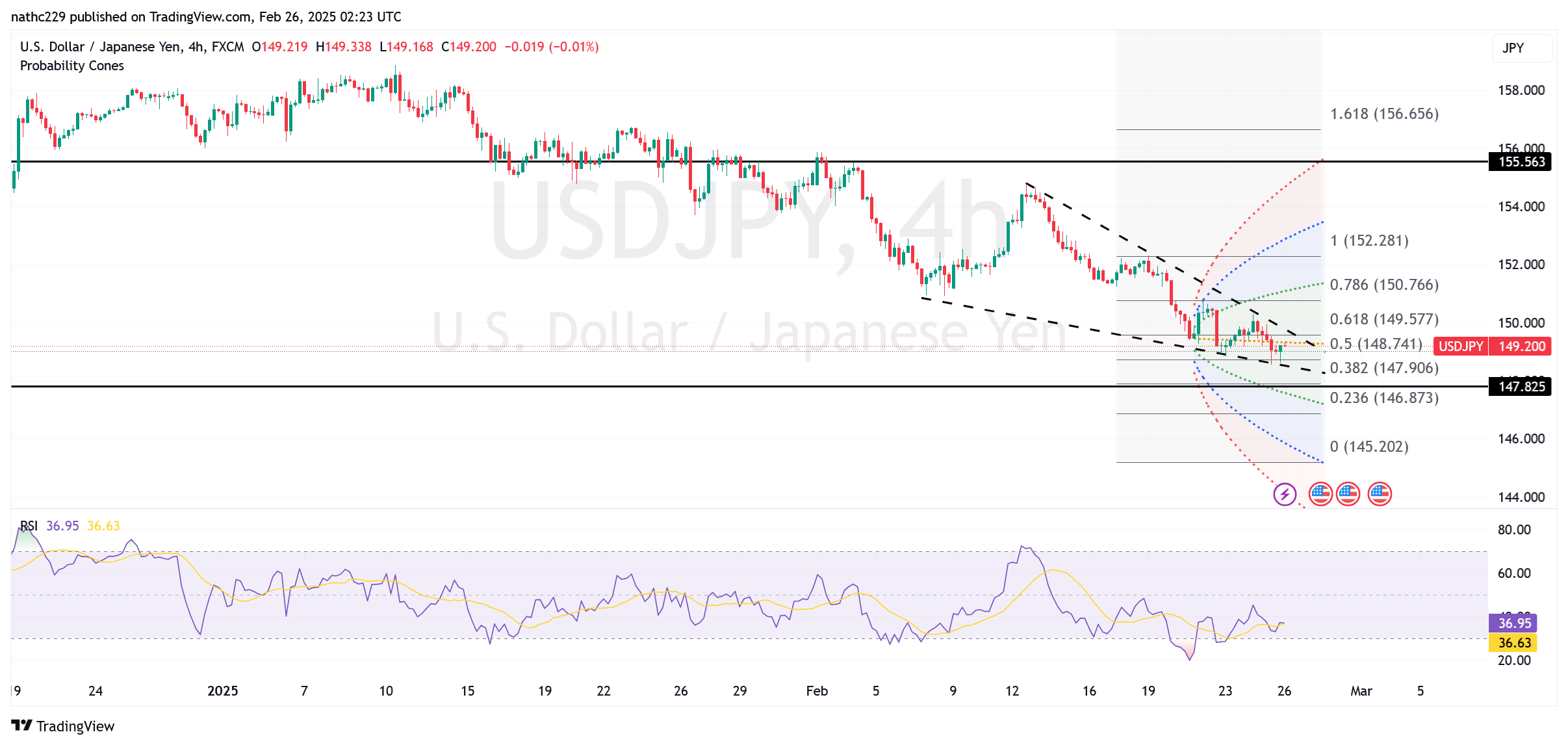

Technically, USD/JPY is approaching major support at 148.55 (100-week MA) and 148.42 (lower Bollinger Band), with a potential downside target at 147.20 (September 3 high). The pair remains bearish as long as it holds below 150.93 (February 7 low) and 151.11 (weekly cloud bottom). However, as the pair nears oversold conditions, downside momentum may slow, leading to potential consolidation around current levels.

Looking ahead, risk sentiment and U.S. rate expectations will dictate USD/JPY’s next move. If Treasury yields continue their decline and risk-off flows persist, further downside is likely. However, key support at 148.42-147.20 may trigger a corrective bounce if selling pressure eases. For now, the bias remains bearish unless USD/JPY reclaims resistance levels above 150.93.