USD/JPY Targets Key Resistance at 156.80 Amid Fed's 'High-for-Longer' Rate Stance; Technicals Suggest Upside Potential

USD/JPY experienced a slight increase, ending the North American session up by 0.27% at 156.60, within a daily trading range between 156.63 and 156.12. The U.S. dollar remained strong as U.S. Treasury yields edged higher following the release of the Federal Reserve minutes. These minutes indicated a cautious stance from the Fed, suggesting that disinflation might be progressing more slowly than previously anticipated, thereby supporting the notion of "higher for longer" interest rates. The Fed's current data-dependent approach and recent remarks by Goldman Sachs' CEO, asserting that rate cuts are unlikely this year, further reinforced the dollar's appeal. The persistent rate advantage in the U.S. keeps the USD/JPY dominated by bullish sentiments, with expectations that the USD will continue to be preferred by investors due to the Fed's position on maintaining current rates.

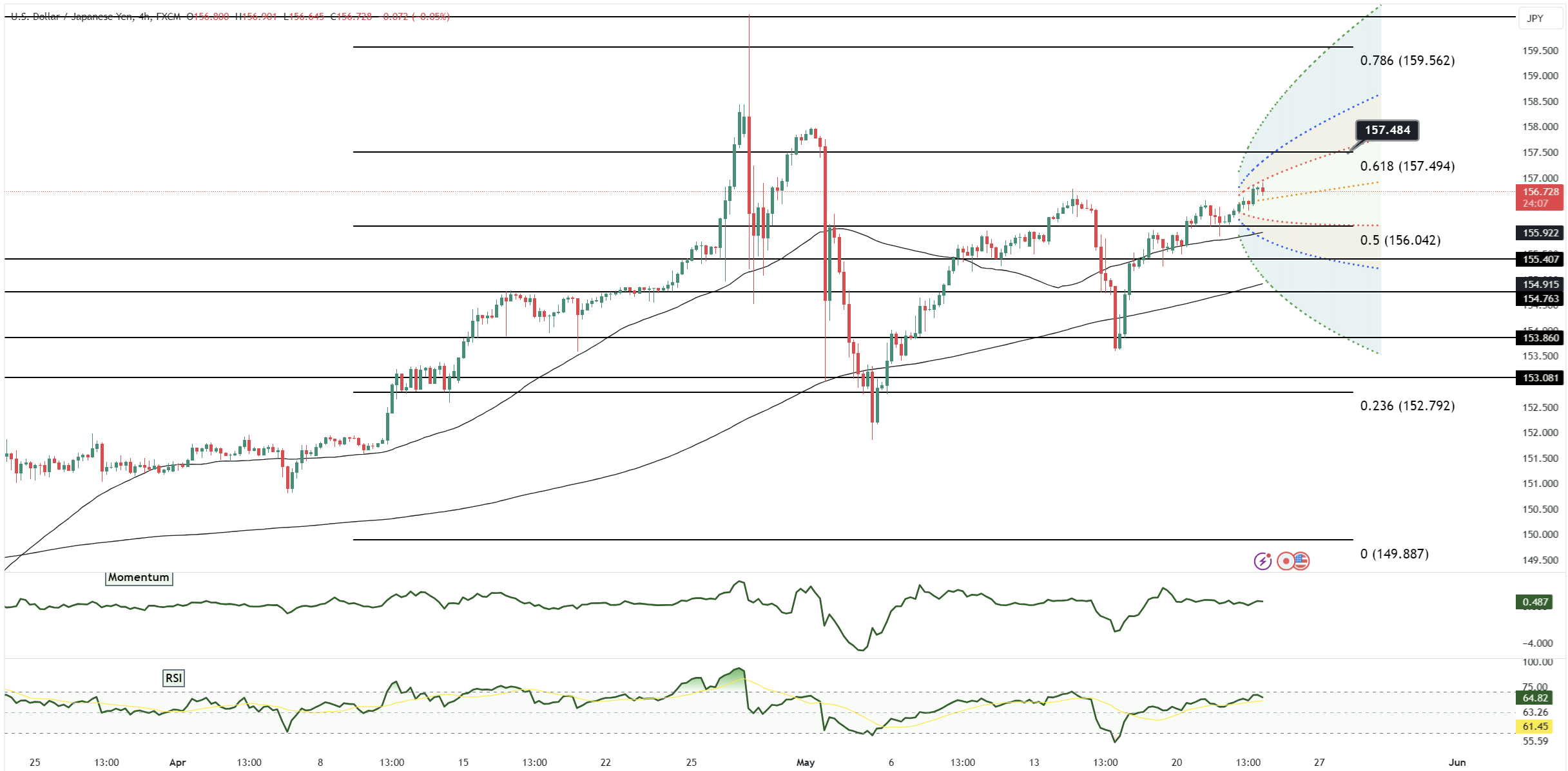

From a technical perspective, USD/JPY bulls appear to maintain a significant edge. The pair is currently eyeing the May 14 high of 156.80, with a break above this level potentially opening the path to 157.50, where previous interventions are suspected, and even further to the upper Bollinger Band at 158.00. On the downside, support is found at the low from Wednesday at 156.12, followed by the rising 10-day moving average (DMA) at 155.90 and a more robust support at the May 17 low of 155.25. These technical levels are crucial as they provide clear markers for traders to set their targets and stop losses. As USD/JPY approaches these key thresholds, the market's reaction will offer insights into the underlying momentum and trader sentiment, possibly leading to accelerated moves either upward or downward based on the interplay of U.S. monetary policy expectations and ongoing economic data releases.