USD/JPY Surges Past 156.05 on Inflation Concerns; Eyes 158.28 as Key Technical Pivot Amid US Data and BoJ Rate Hike Expectations

The USD/JPY pair has gained 0.28%, surpassing 156.05, marking a significant 50% retracement of its recent plunge. This modest breakout was triggered by the NY Fed survey's indication of higher inflation expectations. Market attention now shifts to key US economic data, with the Producer Price Index (PPI) scheduled for Tuesday, followed by the Consumer Price Index (CPI) and retail sales data on Wednesday. The last year-over-year CPI was at a low of 3.0% in June 2023, with the April forecast at 3.4% compared to 3.5%. Despite this, the Federal Reserve is still anticipated to cut rates by September, with a projected 43 basis point reduction by the end of the year. Meanwhile, Bank of Japan (BoJ) swaps suggest a 10 basis point hike in July and a 23 basis point increase by year-end, following adjustments after Monday's quantitative easing cut. Japanese Government Bond (JGB) yields have shown a gradual rise as the market's pricing for Fed rate cuts fluctuates.

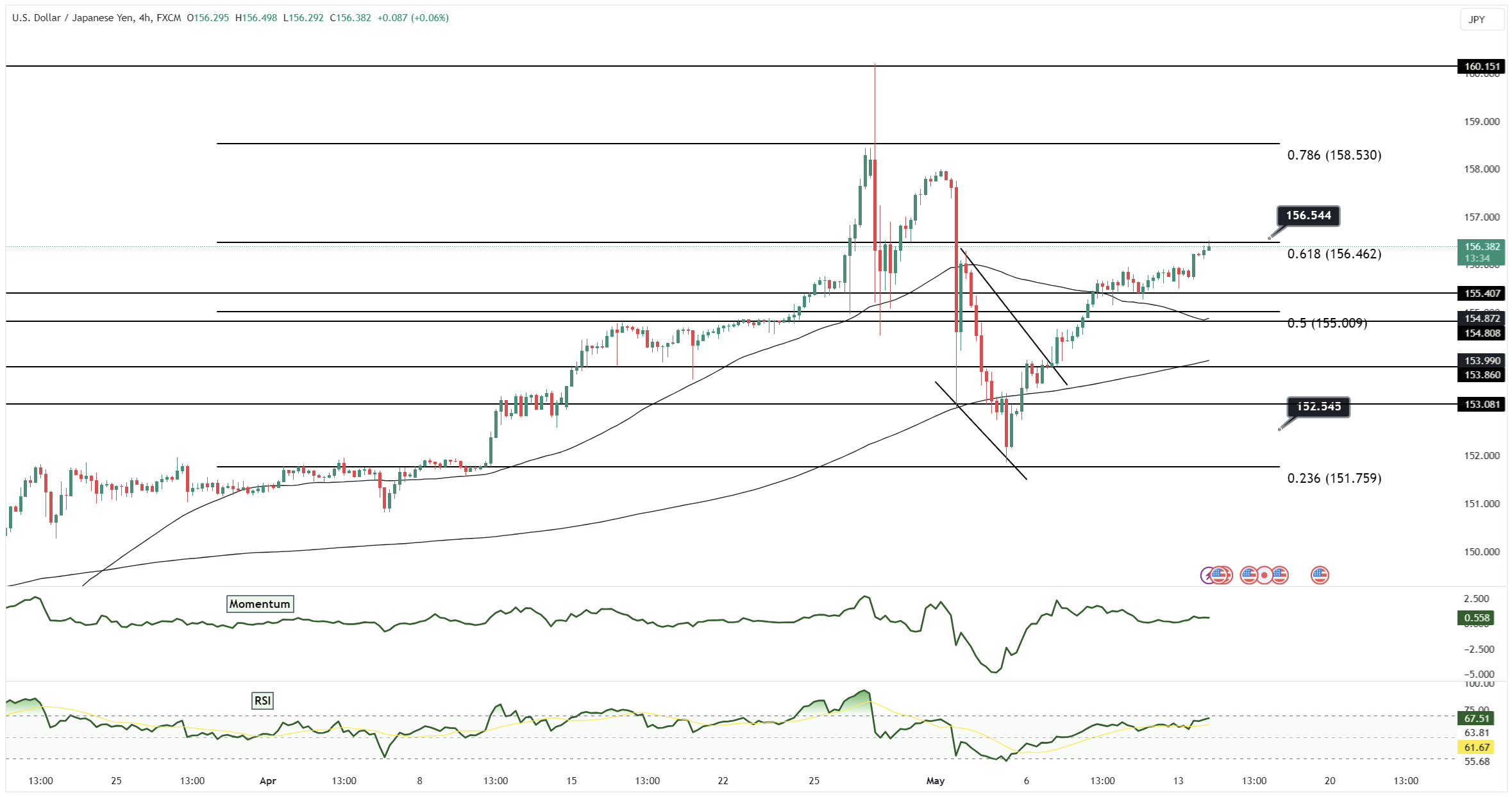

From a technical analysis perspective, a bullish scenario for USD/JPY would be a close above the May 2 high of 158.28, targeting the 61.8% retracement level at 157.04. The May 1 high of 158 serves as the next pivot point, contingent on supportive US economic data. Conversely, dovish US data could see support levels at 155.50 and around 150. Additionally, the Ministry of Finance (MoF) may intervene if the rapid rise in the pair approaches the peaks seen in 2024 and 1990.