USD/JPY Struggles as BOJ Tightening Bets Strengthen

USD/JPY is facing renewed selling pressure as expectations for a BOJ rate hike gain traction. Rising JGB yields and strong yen demand from asset managers suggest that the pair could remain on a downward path in the coming weeks. The probability of a 25-basis-point hike in June stands at roughly 50%, with traders awaiting BOJ board member Hajime Takata’s speech on Wednesday for further policy signals. While a potential Ukraine ceasefire and softer U.S. yields add to yen strength, risks remain, including the possibility of weaker Japanese inflation data or a renewed push for USD demand due to U.S. trade policies.

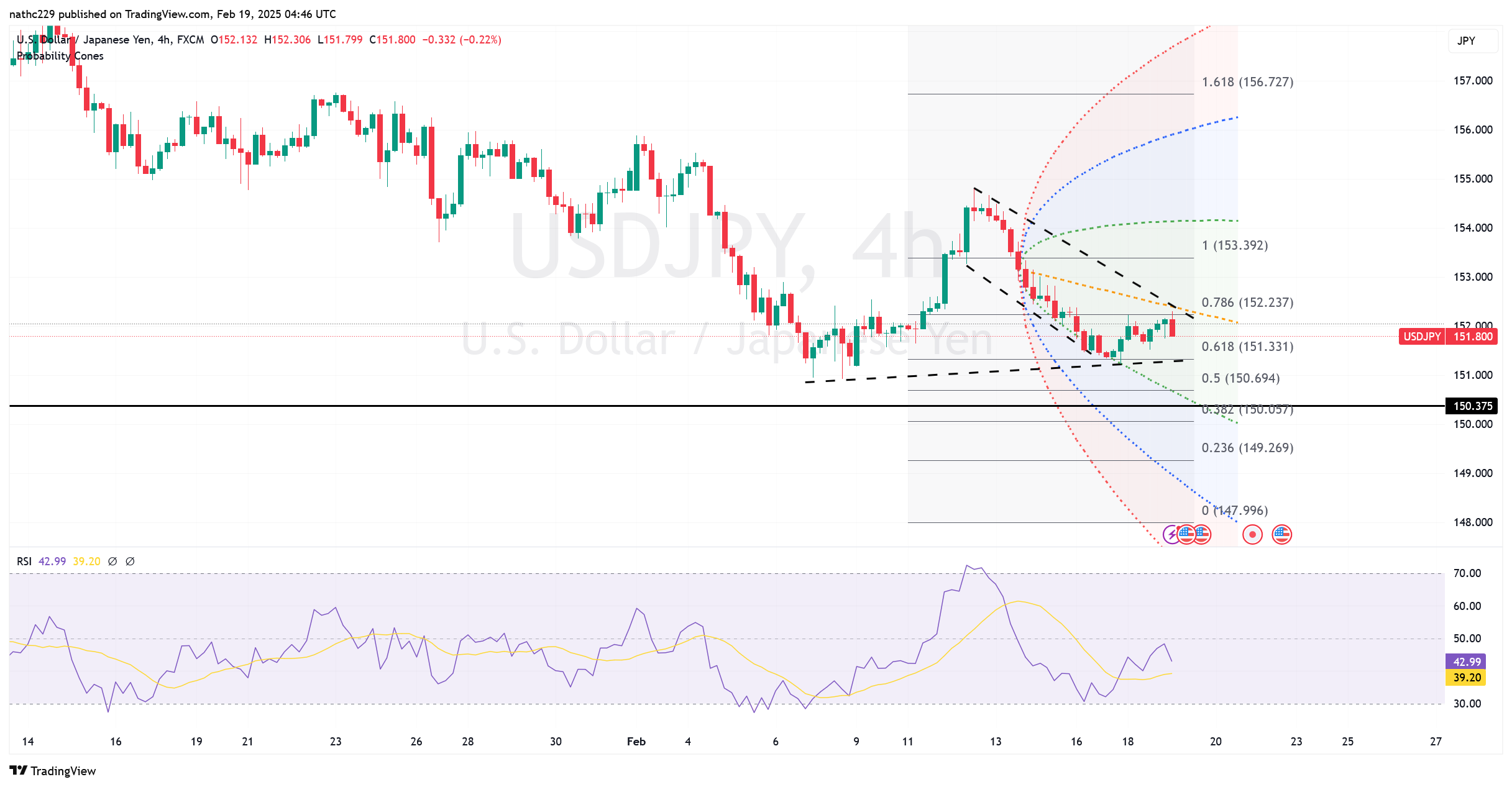

Technically, USD/JPY remains in a tight range between 150.93 and 152.22, with key resistance at 152.57 (9-day EMA), 153.35 (100-DMA), and 153.77 (daily cloud bottom). A break above these levels could open the door to 155.00, though fundamental factors favor further downside. Support lies at 151.20 and the February 7 YTD low of 150.93. A break below 150.93 would likely accelerate bearish momentum, targeting the December 3 high of 150.25. FX volatility remains low, suggesting that a clear catalyst—such as stronger BOJ tightening signals—will be needed to push USD/JPY decisively lower.

Market participants will be closely watching Japan’s inflation data and BOJ commentary in the coming days. A stronger inflation print could reinforce the case for a rate hike, boosting the yen and pushing USD/JPY toward the 150 handle. On the other hand, softer data could delay BOJ action, allowing USD/JPY to consolidate or retest resistance. As long as the pair remains below 152.68 (200-DMA), the bias remains bearish, with downside targets at 150.93 and 150.25 in the near term.