USD/JPY Stays Range-Bound as LDP Leadership Election Looms, Volatility Expected

USD/JPY has settled into a consolidation phase, trading between 144.11 and 145.20, as markets await key events, including the LDP leadership election and Friday’s U.S. PCE data. U.S. Treasury yields have firmed in recent days, supported by hawkish comments from Fed officials and better-than-expected U.S. data, such as lower jobless claims, which bolstered the dollar. Despite the firm U.S. dollar, bearish sentiment toward the yen linked to a potential Takaichi win in the LDP race has eased somewhat, with markets speculating that other candidates like Koizumi or Ishiba may emerge victorious. Overnight volatility has remained firm at around 23%, reflecting the anticipation of significant spot moves after the election and Friday’s data releases.

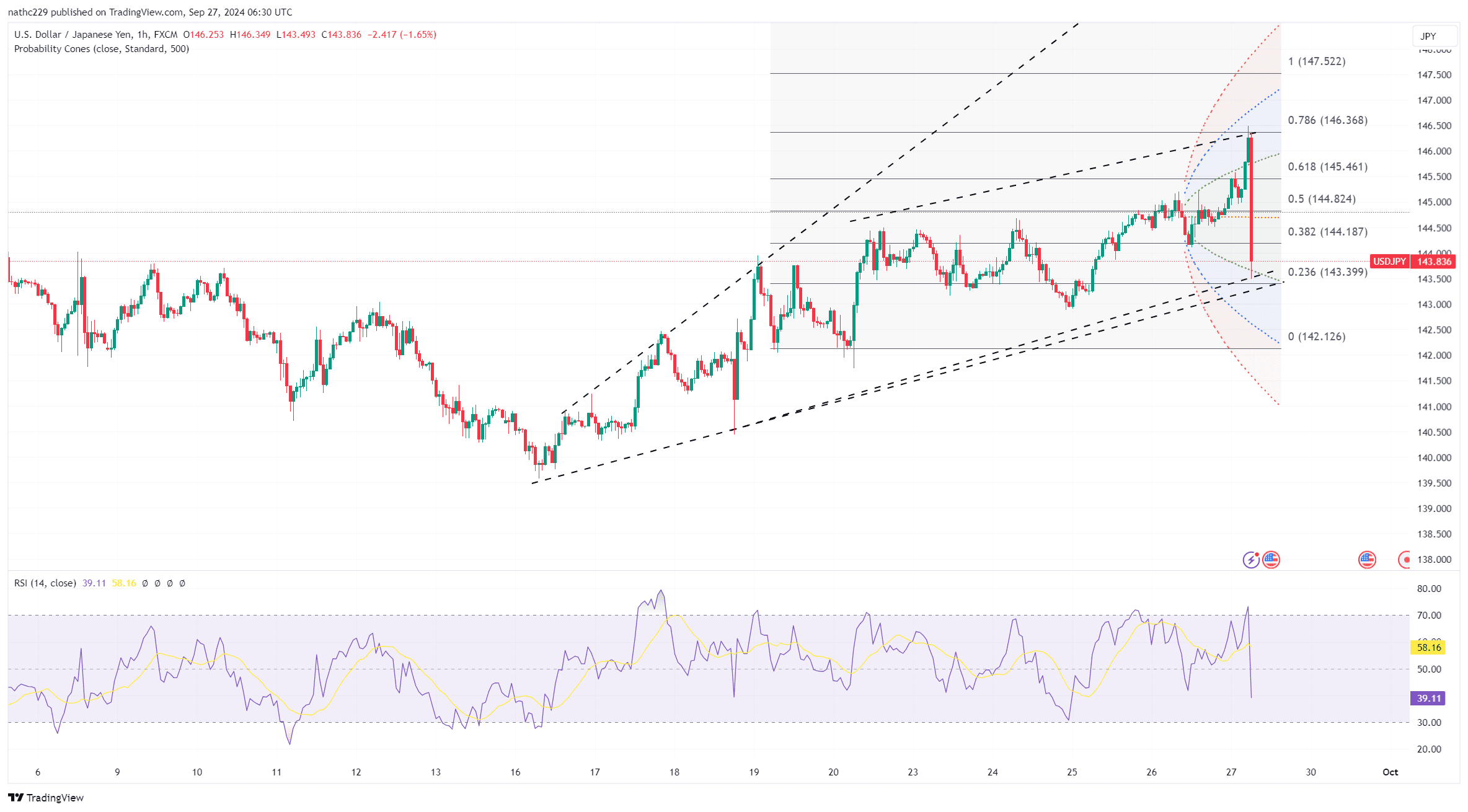

From a technical perspective, USD/JPY faces critical resistance at 145.25, the Aug. 21 doji level, which if broken, could signal further upside for dollar bulls. On the downside, key support lies at 144.20-22, which includes the post-U.S. payrolls high and the Aug. 5 close. A break below this level could see the pair testing the 21-EMA at 143.80 and the Ichimoku base line at 143.39. If the pair continues to decline, the next significant level would be the Sept. 24 low at 143.11. Meanwhile, external factors such as China’s stimulus measures and the SNB’s rate cut have provided support for risk sentiment, sending yen crosses like AUD/JPY and GBP/JPY to fresh monthly highs. However, a broadly weaker U.S. dollar and declining oil prices have capped the yen’s losses for now.

As the LDP election unfolds, USD/JPY traders will be closely watching for the outcome. A victory for Takaichi, a known advocate for more stimulus, could fuel further yen weakness, especially if global risk sentiment continues to improve. On the other hand, if either Ishiba or Koizumi wins, the yen could strengthen, particularly if Tokyo CPI data surprises to the upside, indicating higher inflation and prompting a more cautious stance from the BOJ. Friday’s U.S. PCE data will also be critical, as weaker-than-expected inflation numbers could lead to renewed speculation about Fed rate cuts, potentially boosting the yen against the dollar.