USD/JPY Stabilizes Near Lows; Yen Rally Pauses as Volatility Eases

USD/JPY steadied near recent lows around 147.00, as stretched yen positioning and subdued volatility limit further downside momentum despite ongoing tariff threats and soft U.S. data. BOJ tightening expectations remain supportive of yen strength, yet rising commodity prices and potential resistance from Japanese authorities against excessive yen gains have stalled additional bearish moves.

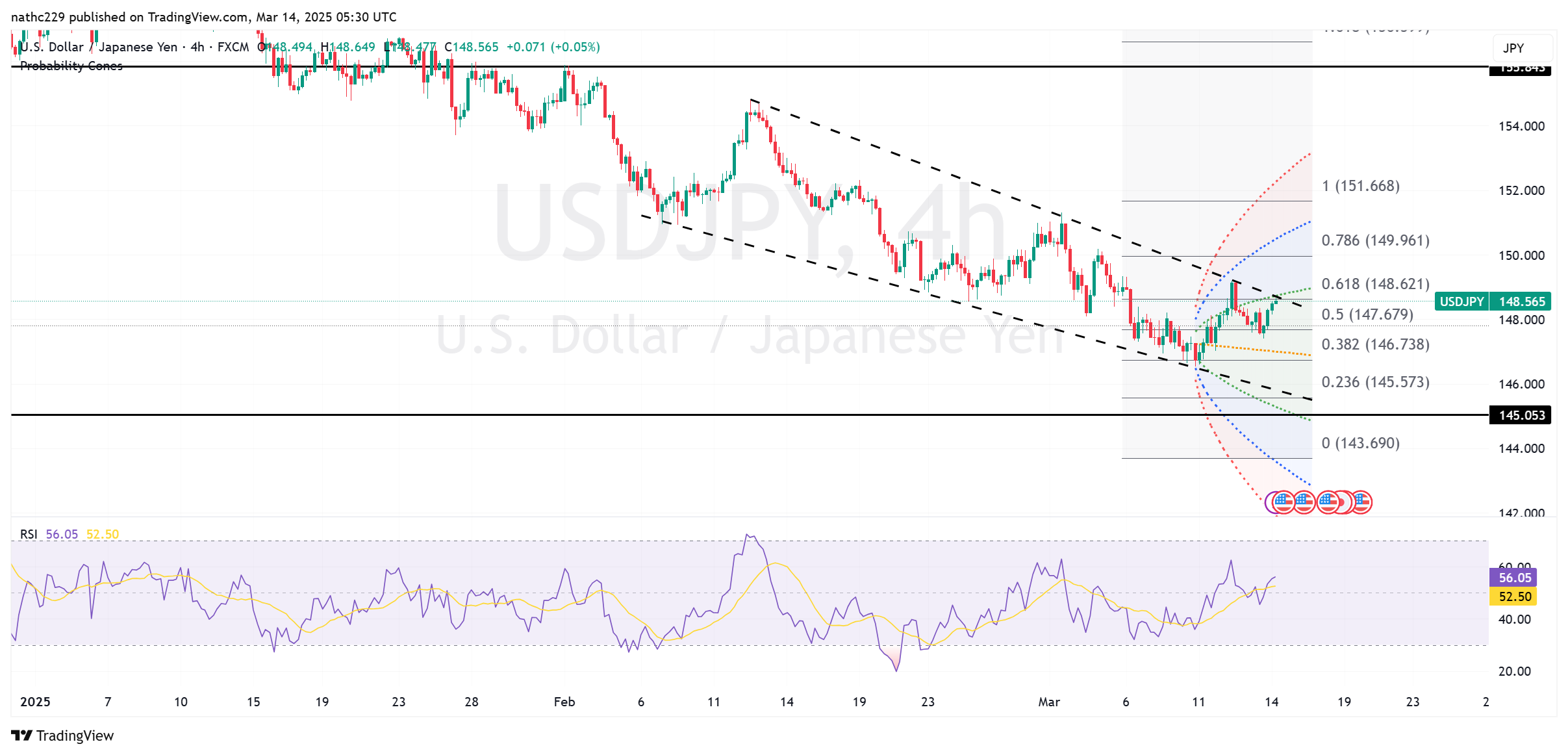

From a technical standpoint, immediate resistance lies near 147.50 (descending trendline resistance), with stronger resistance at 149.12 (Feb 25 close). Support remains firm at 146.75 (lower Bollinger Band) and 146.52 (October 2 high). Declining volatility across USD/JPY options indicates the market expects limited near-term movement ahead of next week’s BOJ meeting.

Looking forward, USD/JPY direction will be heavily influenced by central bank decisions and geopolitical developments. A hawkish BOJ stance or escalating tariff tensions could drive yen gains, pushing the pair toward support around 145. Conversely, signs of improved risk appetite or easing trade tensions may trigger short-covering rallies toward 149.00. For now, cautious sentiment prevails, keeping USD/JPY anchored in a tight range.