USD/JPY Slips Below 150 as Risk-Off Sentiment Dominates

USD/JPY has retreated toward recent lows around 149.94 as weaker U.S. economic data, falling Treasury yields, and tariff uncertainty fuel demand for the yen as a safe haven. While the bearish momentum remains intact, strong support around the February 24 high at 149.86 and the 100-week moving average at 148.55 could limit deeper declines in the short term. With net long yen positions already at record highs, further yen gains may face resistance unless new catalysts emerge.

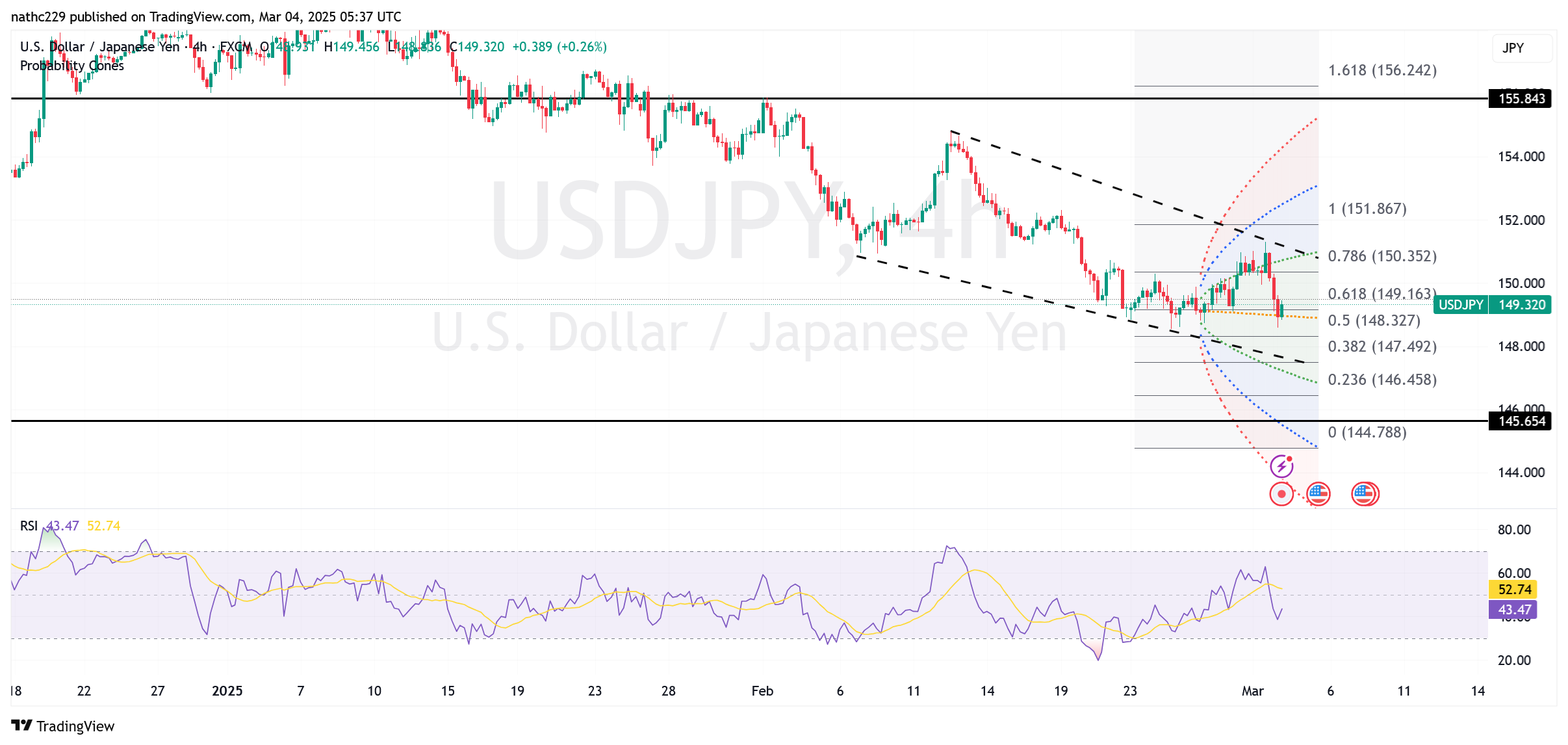

Technically, USD/JPY faces immediate downside support at 149.86, followed closely by key technical levels at 148.55 and 147.20. Short-term resistance is at 151.11 (weekly Ichimoku cloud base), and 151.30 (intraday high). A clear move above these levels would signal stabilization, potentially reducing near-term bearish pressure. However, given the broader bearish bias and elevated positioning in yen longs, downside risks continue to dominate.

Looking ahead, market participants will closely watch upcoming U.S. economic releases, particularly non-farm payrolls and ISM data, as well as BOJ comments, to gauge the next directional move. The yen’s recent strength may slow if risk sentiment stabilizes, but with trade uncertainties and growth concerns lingering, the overall bias remains tilted towards yen appreciation, targeting further downside toward the 147.20 support zone if the 149.86 level decisively breaks.