USD/JPY Rebounds to 155.70 on Strong Japanese Importer Demand Despite Weakening Japan Economic Indicators

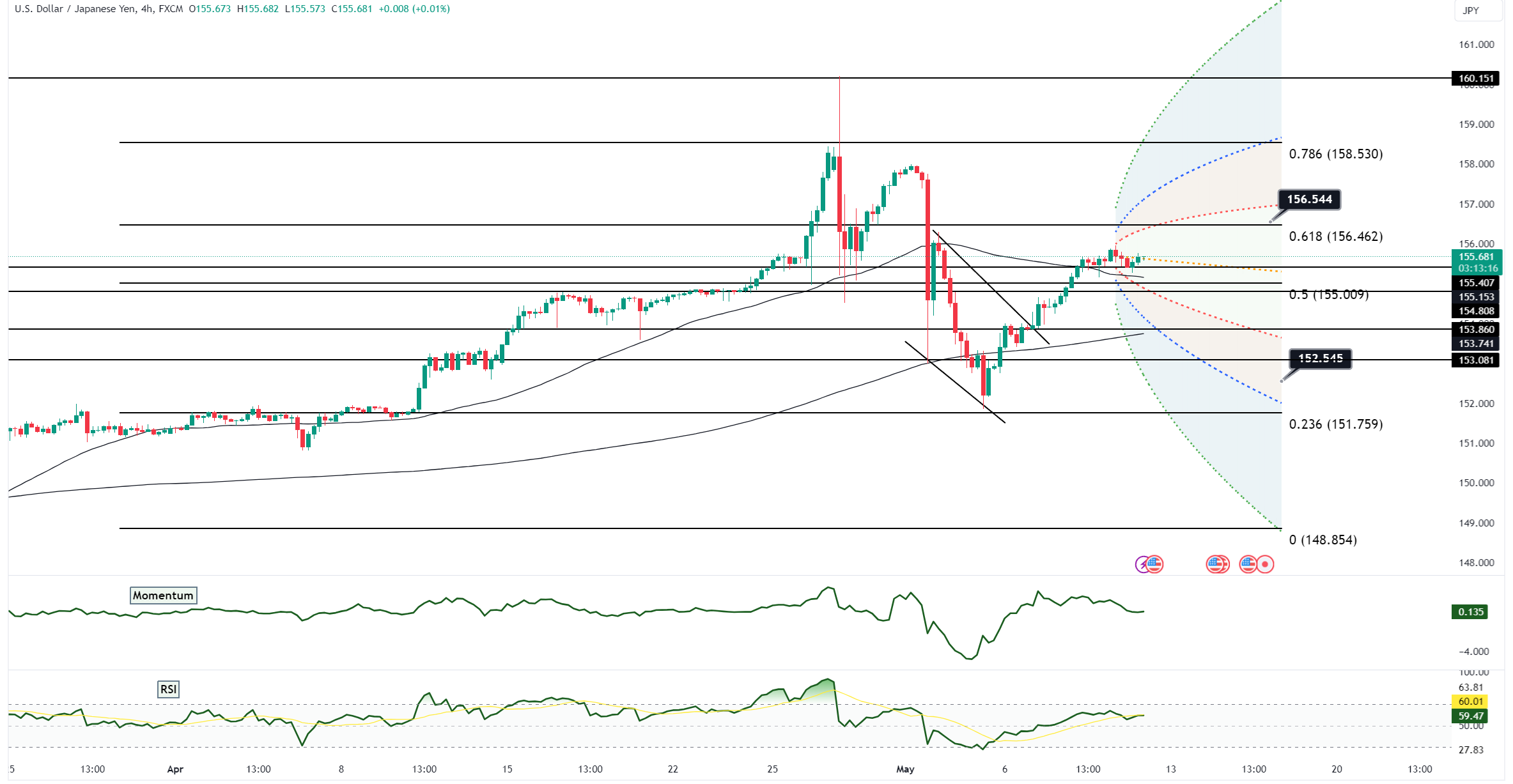

USD/JPY Initial Dip to 155.20 in Early Asia: This indicates that initially, in the Asian trading session, the exchange rate for the US dollar (USD) against the Japanese yen (JPY) dropped to 155.20. The reason cited for this decline is lower yields on US bonds. When yields on US Treasury bonds decrease, it can lead to a decreased demand for the US dollar, thereby causing its value t decline against other currencies like the Japanese yen.

Rebound to 155.70 Driven by Strong Demand from Japanese Importers: Following the initial dip, there was a rebound in the USD/JPY exchange rate to 155.70. This upward movement was attributed to strong demand from Japanese importers. Importers needing to purchase goods or services denominated in US dollars would require exchanging their Japanese yen for US dollars, leading to increased demand for the US dollar and thus, causing its value to rise against the Japanese yen.

Market Response to MOF Commentary Remained Relatively Orderly: The Ministry of Finance (MOF) likely made some comments or announcements regarding economic policies or developments that could impact the currency markets. The notable aspect here is that despite these comments, the market response was described as orderly. This suggests that the market participants did not react in a volatile or erratic manner to the MOF commentary, which could indicate that the commentary did not contain any unexpected or alarming information.

Weakness in Japan's Spending Data and Current Account Surplus Overlooked: Despite the weaknesses in Japan's spending data and current account surplus, the market seemed to overlook these factors. This indicates that the market focus may have been more influenced by other factors, such as US yields, import demand, and options expiries, rather than the fundamental economic indicators from Japan. Weakness in spending data suggests potential challenges in domestic consumption, while a decline in the current account surplus could indicate various economic imbalances or external trade pressures.

In summary, the dynamics driving the USD/JPY exchange rate in this scenario include movements in US yields, import demand from Japan, market reactions to MOF commentary, significant options expiries, and the market's relative disregard for weak economic indicators from Japan. Each of these factors contributes to the overall understanding of how the currency pair is behaving within the given context.