USD/JPY Pressured by Tariff Concerns, Key Support at 148.50

USD/JPY briefly rose above 150 after President Trump's tariff announcements but quickly retreated as yen strength prevailed amid heightened market uncertainty. Persistent tariff threats targeting Mexico, Canada, and China have dampened risk sentiment, reinforcing yen buying and driving AUD/JPY to its lowest close since early August. Although short-covering and algorithmic trading temporarily supported USD/JPY near 150, bearish pressures remain dominant as markets await further economic signals.

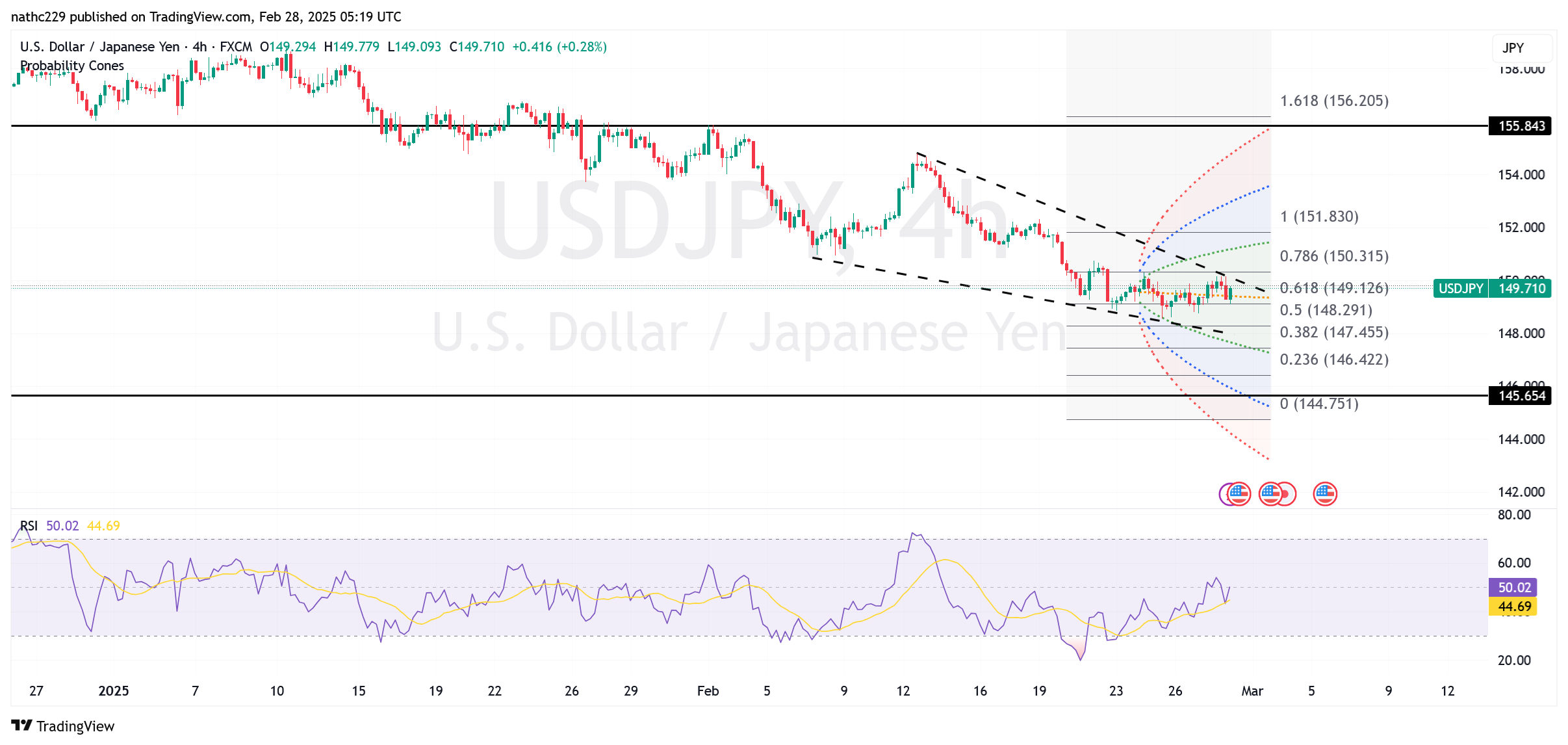

Technically, USD/JPY faces immediate resistance at the 9-day EMA near 150.20, followed by key barriers at 150.93 and the weekly cloud base at 151.11. On the downside, crucial support at 148.55 (100-week MA) and the February 25 low at 148.56 will determine whether further losses materialize. A breakdown here could lead to deeper declines toward the September 3 high at 147.20, especially if risk aversion persists.

Looking ahead, U.S. economic data and Tokyo CPI will significantly influence USD/JPY’s direction. Weak economic readings or renewed equity market declines could trigger fresh yen demand, pushing USD/JPY decisively below key support. Conversely, a stabilizing equity market or easing tariff concerns could temporarily ease bearish pressures. For now, the bias remains tilted to the downside while USD/JPY trades below 151.