USD/JPY Poised to Break 160.00 Amid Volatility, Intervention Concerns Persist

Overview and Recent Movements: The USD/JPY pair has recently experienced significant volatility, moving above the 10-hour moving average to reach 159.60 in the New York afternoon. During the session, it fluctuated between a high of 159.94 in Asia and a low of 158.75 in Europe, before stabilizing at 159.87 in New York. The peak at 159.94 triggered verbal intervention from Japanese authorities, highlighting market caution.

Market Dynamics and Key Drivers:

Interest Rate Differentials: The primary driver for USD/JPY remains the interest rate differential between the U.S. and Japan. The yen's vulnerability to higher U.S. yields continues to support the dollar. As long as U.S. yields remain elevated, the yen will likely weaken, making it sensitive to interest rate movements.

Bank of Japan's Policy: The Bank of Japan's recent decision to delay reducing its bond-buying program has further weakened the yen. This dovish stance contrasts sharply with the Federal Reserve's policies, which are geared towards higher interest rates.

Intervention and Market Sentiment: Despite verbal interventions by Japanese authorities, including warnings from currency diplomat Kanda about taking appropriate measures if forex movements become excessive, these interventions tend to have only short-lived effects. The market remains poised to test the Bank of Japan's resolve, as evidenced by the previous actual intervention of nearly 10 trillion yen earlier this year, which saw USD/JPY drop from 160.24 to 154.40 before recovering.

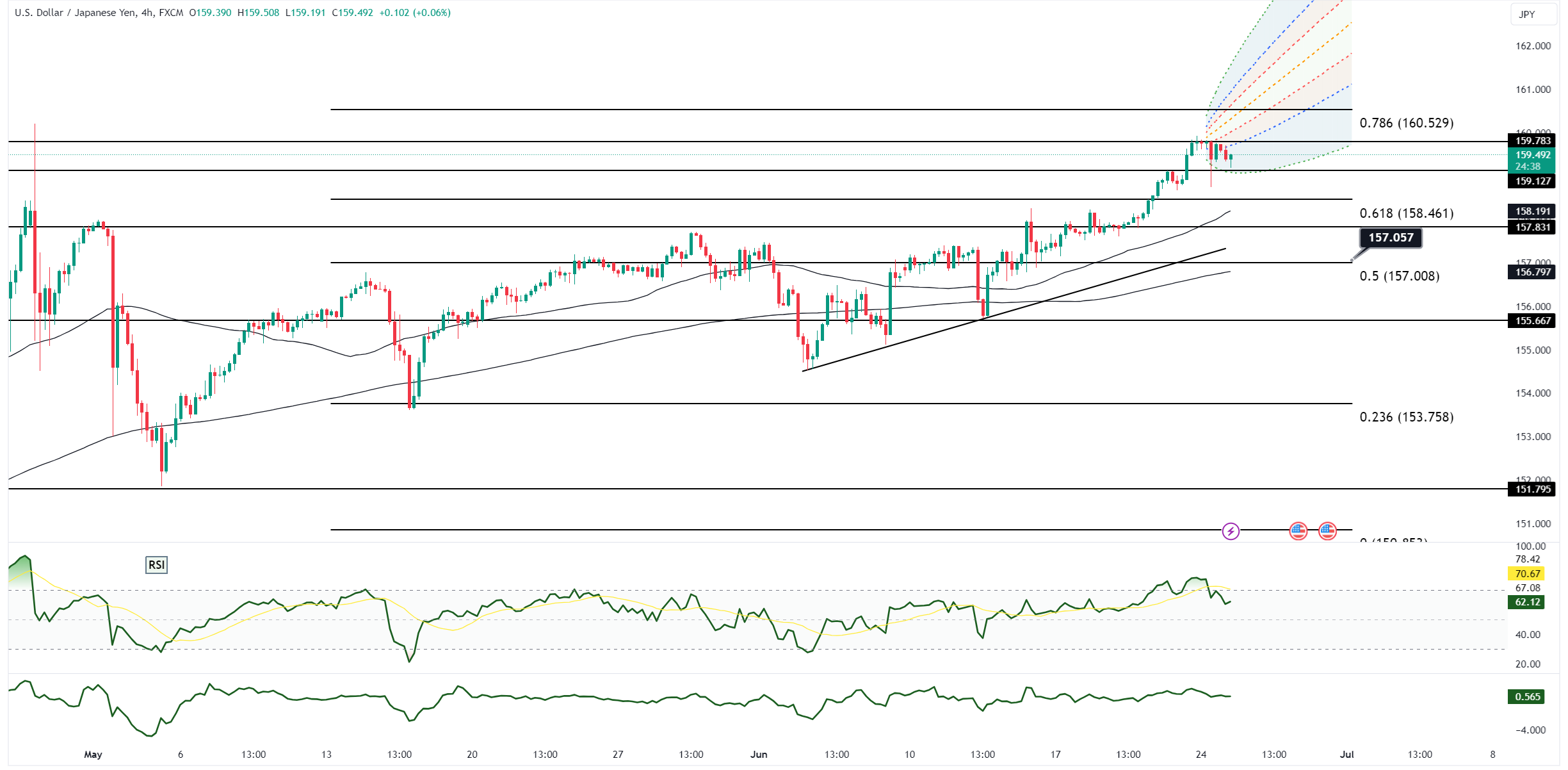

Technical Analysis:

Support and Resistance Levels: Key levels to watch include the 10-day moving average at 158.02 and the April 29 high of 160.24. The pair’s ability to break and sustain above these levels will be crucial in determining its short-term direction.

Recent Volatility: Monday's session highlighted the market's anxiety about potential intervention, with significant moves both upwards and downwards. The recovery to 159.44 from a European session low of 158.75 indicates a persistent bullish sentiment, driven by fundamental factors.

Market Positioning: Traders are likely to remain cautious of official intervention while simultaneously testing the upper limits of USD/JPY. The high from Asia at 159.94 and subsequent pullbacks suggest that while the market is ready to push towards 160.00, it is also wary of potential government actions.

Outlook: The USD/JPY appears primed to test the 160.00 level, supported by both fundamental and technical factors. However, the potential for Japanese intervention remains a significant risk. As long as the interest rate differential between the U.S. and Japan persists, the dollar is likely to maintain its strength against the yen. Traders should watch for movements in U.S. yields and any signs of intervention from Japanese authorities, as these will be critical in determining the pair’s trajectory.

In conclusion, while the market dynamics favor a move above 160.00, caution is warranted due to the possibility of intervention. The yen’s sensitivity to U.S. yield movements and the ongoing divergence in monetary policy between the U.S. and Japan will continue to be key drivers in the USD/JPY pair.

Open an account today to unlock the benefits of trading with CMS Financial