USD/JPY Nears Critical Resistance as Intervention Fears and Profit-Taking Cap Gains

USD/JPY's bullish momentum has slowed near the 150 level, as traders begin to lock in profits and heed warnings from Japanese officials regarding yen volatility. The pair saw its range widen between 149.51 and 150.28 on Friday, with a brief risk-off move sending the pair to fresh lows. Japan’s Ministry of Finance (MoF) warned that markets have become “somewhat one-sided,” with Atsushi Mimura signaling that intervention may be possible if volatility increases. Despite these warnings, speculative accounts continue to build long USD/JPY positions, betting on further yen weakness, especially as U.S.-Japan yield differentials continue to favor the dollar.

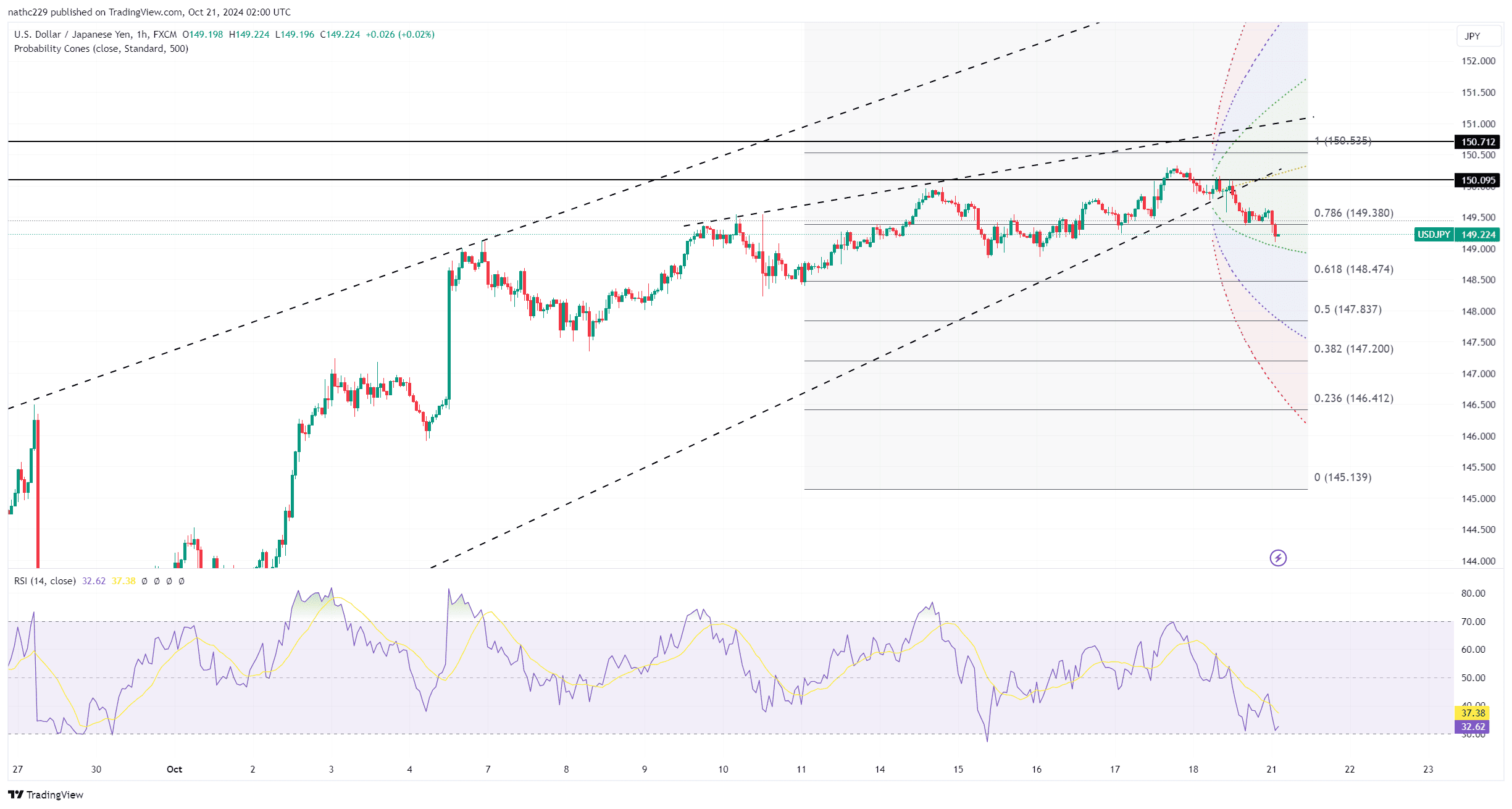

From a technical perspective, USD/JPY is approaching key resistance levels, including the 100-day moving average (DMA) at 150.83 and the Ichimoku cloud top at 151.04. These levels, along with the 200-DMA at 151.37, are likely to pose significant challenges to further upside. On the downside, the 9-day exponential moving average (EMA) at 149.03 and the conversion line at 148.83 offer immediate support. Should the pair break below the October 8 doji close at 148.20, a more bearish tone could emerge, leading to a potential correction toward 147. This bearish shift could be triggered by comments from BOJ Governor Ueda during his upcoming speech at the IMF's "Governors Talk" session, particularly if he signals a more hawkish stance on monetary policy.

Looking forward, USD/JPY remains at a critical juncture as traders weigh the risk of BOJ intervention against broader dollar strength. Speculative accounts are increasingly focused on the U.S. elections and geopolitical factors that could support the dollar, but any signs of a hawkish shift from the BOJ could quickly reverse sentiment. Traders are likely to continue buying dips until key support levels are breached, but a sustained break above 152 would likely heighten concerns over yen volatility and could prompt more direct intervention from Japanese officials. In the near term, the market will remain jittery, with positioning and headlines driving volatility in USD/JPY.