USD/JPY Near Range Highs, Eyes on Treasury Yields and BOJ Policy Shifts

USD/JPY has rebounded towards the upper end of its daily trading range, supported by strength in U.S. equity markets and a steepening U.S. Treasury yield curve. The pair's movement reflects a supportive backdrop for the dollar, as robust U.S. stock performance and rising yields have encouraged investors to favor dollar-denominated assets. Trading activity has been relatively muted, with USD/JPY holding below the 20-day upper Bollinger Band at 148.83, indicating a cautious market tone. Meanwhile, declining implied volatility across tenors, alongside lower skews, suggests reduced expectations for significant near-term price swings. However, the recent 4% decline in oil prices could offer support to the yen by alleviating pressure on Japan's trade balance.

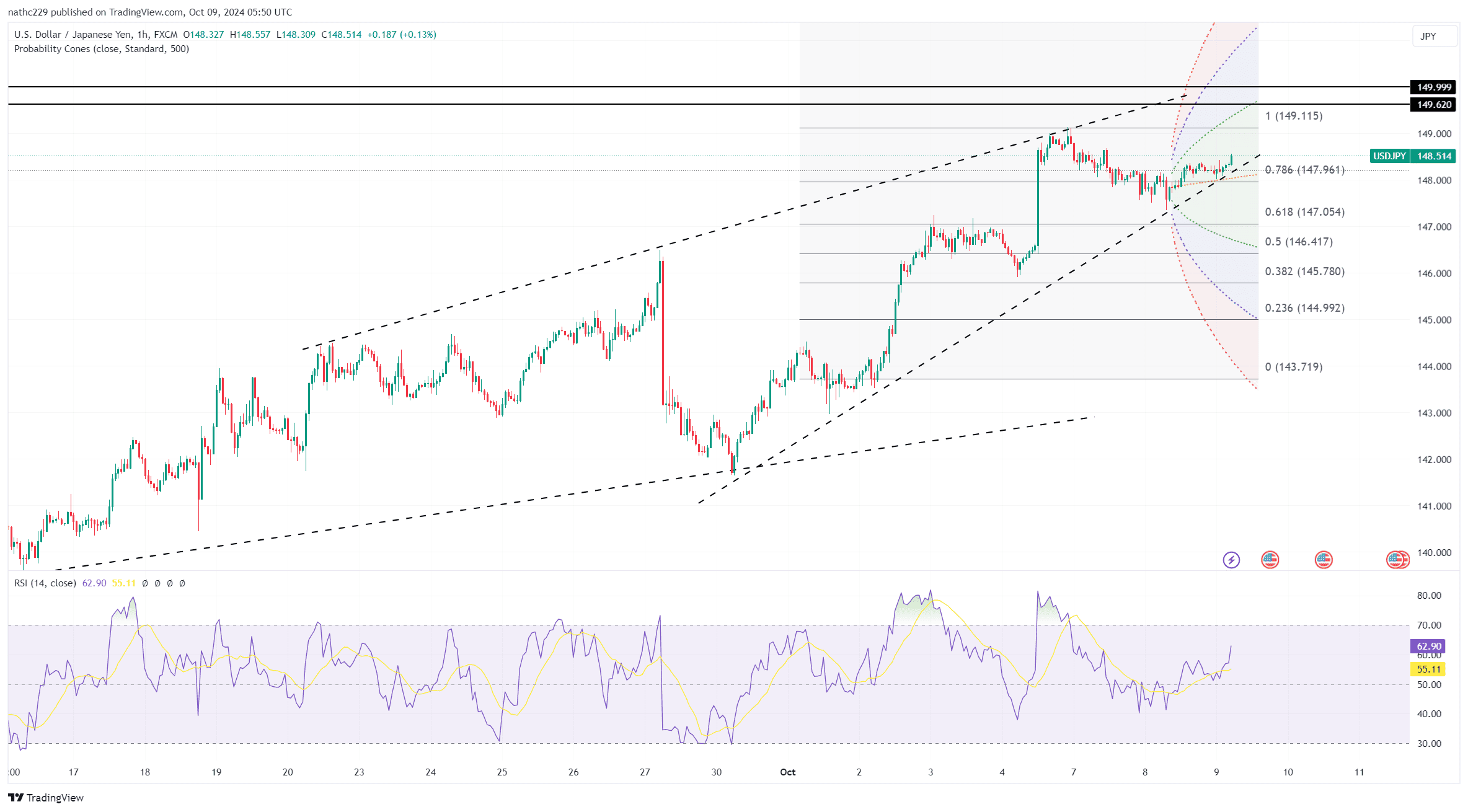

Technical indicators point to a range-bound outlook for USD/JPY, with resistance near 149.40, the high reached in mid-August, and support at the Ichimoku cloud bottom around 146.89. The broader trading band between 140 and 150 remains intact, with the pair’s proximity to the upper range suggesting that any upside movement could face resistance. A break above 148.83 would open the door for a test of the 149.40 resistance, while a decline back towards the Ichimoku cloud support could signal a shift in momentum. Traders are eyeing upcoming comments from Fed officials, which could trigger movements in Treasury yields and influence USD/JPY’s direction.

The potential for policy shifts in Japan adds another layer of uncertainty for USD/JPY. While the market currently expects the BOJ to maintain a cautious approach, the possibility of a rate hike at the December 19 meeting has increased, with LSEG's IRPR page indicating a 60% probability for a 25 basis point increase. Any rise in these odds could weigh on USD/JPY, as the prospect of tighter monetary policy in Japan would bolster the yen. If market sentiment shifts towards a more hawkish BOJ, USD/JPY could break below the Ichimoku cloud support at 146.89 and potentially test the 145 level, challenging the recent upward momentum in the pair.