USD/JPY Near Key Levels as Traders Balance Risk with Policy Uncertainty

USD/JPY has remained near the top of its daily trading range, testing significant resistance at 149.08, as U.S. yields rise on solid economic data. The passing of the U.S. presidential election is expected to ease market uncertainty, potentially driving further risk-taking into the year-end. This optimism has fueled demand for the dollar, with speculative accounts increasing long positions following the break above 147. However, Japanese officials are cautious about the yen’s decline, mindful of the negative impact that excessive carry trade activity could have on consumer sentiment and import costs. Economy Minister Ryosei Akazawa’s recent comments tempering the prime minister’s accommodative policy stance underscore the policy risks involved.

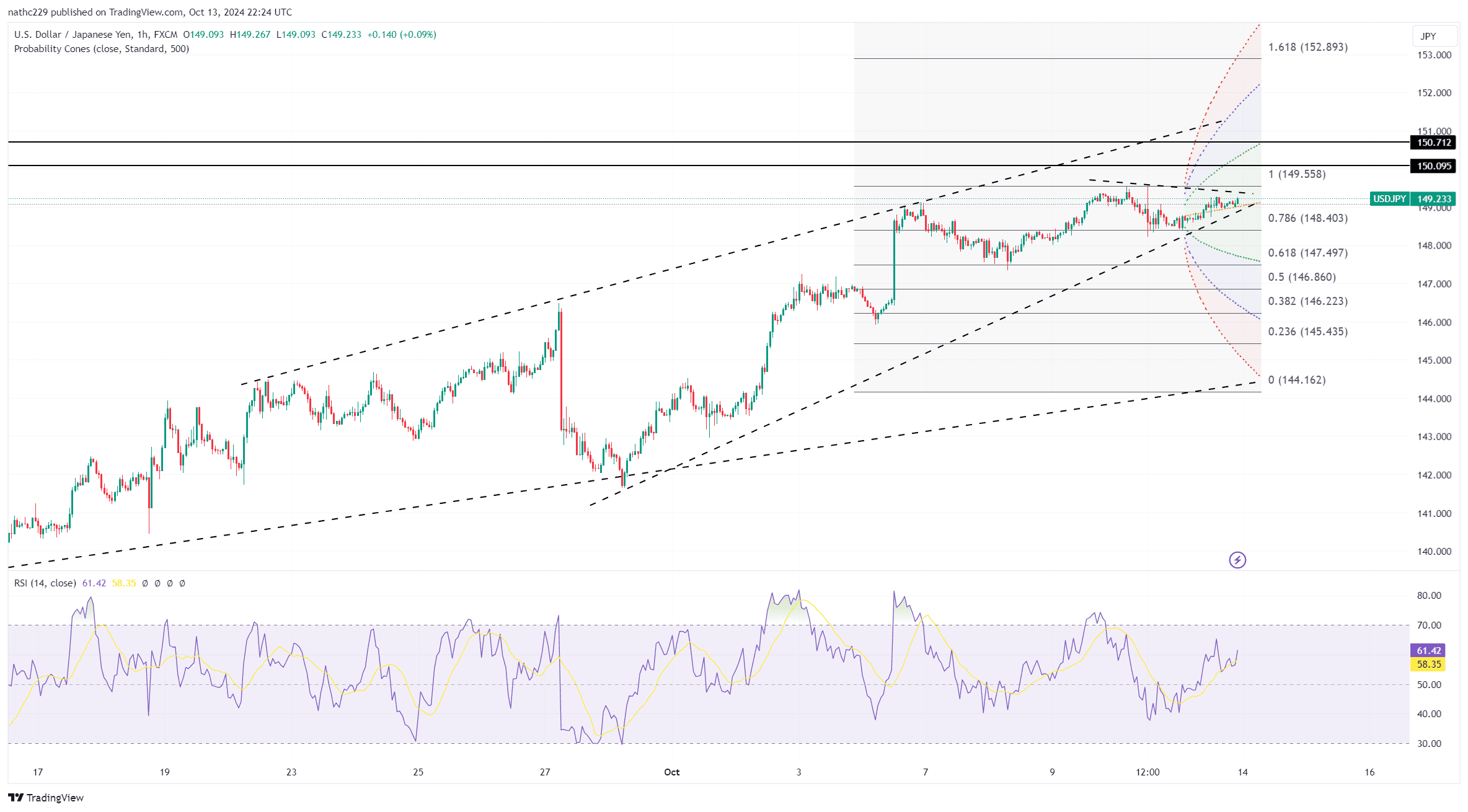

From a technical standpoint, USD/JPY faces resistance at the top of the rising weekly Ichimoku cloud at 149.08, followed by the 149.58 weekly peak and the critical psychological level of 150.00, where options are positioned. A break above 150.00 could signal further upside, but policy risks and BOJ concerns about the yen’s decline may limit gains. On the downside, key support lies at the October 8 doji close of 148.20, with additional support at the 9-day EMA of 147.67 and the October 2 high at 146.52. USD/JPY’s rolling 20-day correlation with the DXY index is near its highest level this year, emphasizing the pair’s sensitivity to broader dollar trends.

Looking ahead, the focus will be on Japan’s CPI report and BOJ Deputy Governor Himino’s remarks, which could provide clues about the central bank’s policy stance. If the CPI report shows signs of growth, it could trigger a response from policymakers aimed at slowing the yen’s decline. The market remains wary of intervention risks, particularly if USD/JPY approaches the 150.00 level, which could prompt action from Japanese officials. For now, traders are balancing expectations of a Fed pause with the possibility of BOJ tightening, creating an environment where the pair could remain volatile around key resistance levels.