USD/JPY Eyes 162 as Yen Weakens; Focus on U.S. CPI and BoJ Meeting

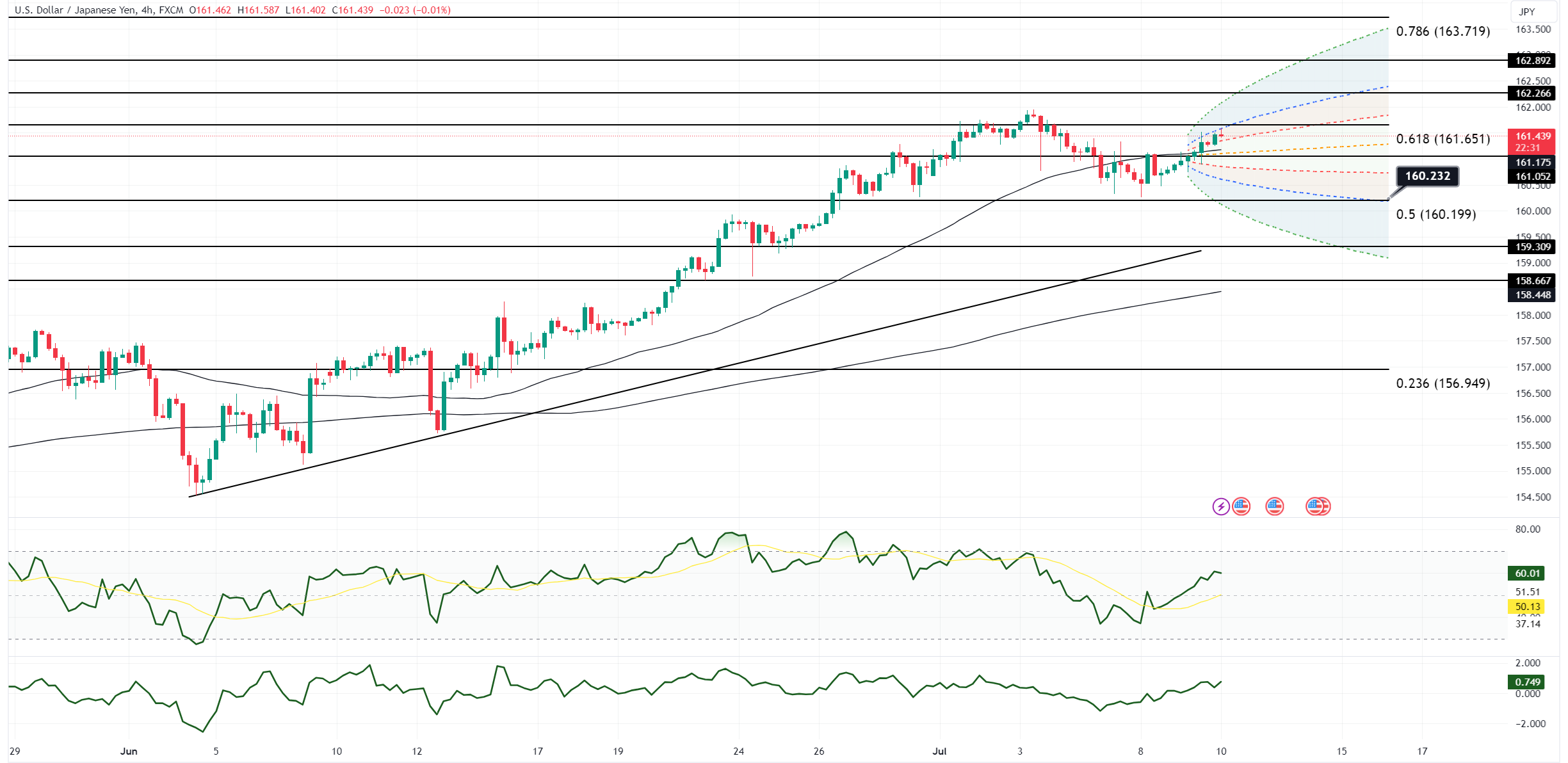

After its recent brief recovery, the Japanese yen is once again losing ground against the dollar. USD/JPY is now targeting the 162 level after holding support at 160.25, its pre-intervention peak. As long as market volatility remains low, yen-funded carry trades continue to be attractive. There's potential for USD/JPY to climb higher, given the reduced threat of intervention, although a sharp move to 165 could change this scenario.

Ahead of the Bank of Japan's July meeting, some bond market participants have suggested reducing monthly bond purchases to around 2-3 trillion yen from the current 6 trillion yen pledge. While this significant tapering is widely anticipated, its impact on the yen is expected to be minimal, leaving the currency's downtrend intact.

Federal Reserve Chair Jerome Powell recently provided no new insights into the monetary policy outlook, reiterating that more positive data is needed to support a rate cut. This was somewhat disappointing for those hoping for a clearer easing signal, especially following a spate of soft U.S. economic data. Consequently, both U.S. Treasury yields and USD/JPY have drifted higher, though a breakout from current ranges is unlikely before the U.S. inflation data release on July 11.

USD/JPY is currently up 0.3%, with bulls aiming for the 162 mark. Powell's comments were in line with expectations, disappointing those looking for a dovish shift. The upcoming CPI report will play a crucial role in influencing market pricing. The pair is set to close above the 200-hour moving average (161.13), providing support for long positions. However, resistance is expected at 161.90-162 ahead of the CPI release, while support at 160.25 should hold in the near term. The low-volatility environment continues to support interest in yen-funded carry trades.

Open an account today to unlock the benefits of trading with CMS Financial