USD/JPY Eyes 158 on Strong NFP and Anticipated CPI, Fed Decisions

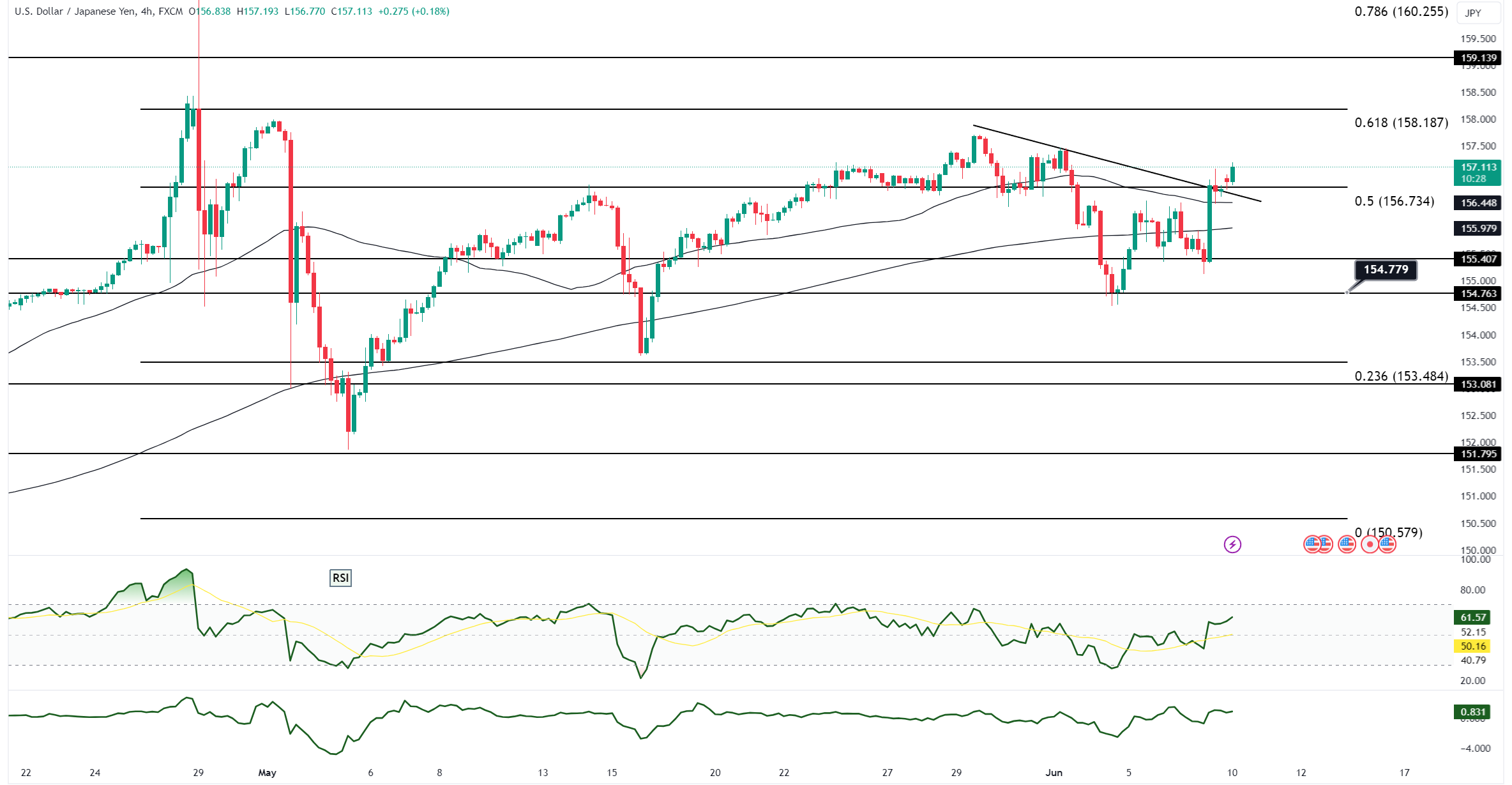

The USD/JPY currency pair recently ended its series of lower highs following a bullish Non-Farm Payroll (NFP) report. This positive report led to a significant surge in Treasury yields, which rose by approximately 15 basis points from key support levels. A similar gain was observed in the Treasury-Japanese Government Bond (JGB) yield spread. As a result, market participants are now eyeing the May 29 and May 1 highs at 157.71 and 157.99, respectively, particularly if the U.S. Consumer Price Index (CPI) data, scheduled for release on Wednesday, comes in firm.

These levels are significant as they mark the highs reached before and after the last intervention by the Bank of Japan (BoJ). The May high of 157.99 is also a key level. The Federal Reserve's meeting, which concludes on Wednesday, coincides with the release of the CPI data, adding further significance to this event after the hawkish jobs report.

On Friday, USD/JPY surged from 155.125, creating a bullish engulfing daily candle. The pair also appears set to close back above the 10-day moving average at 156.52. This week's low of 154.55 was caught by the rising 55-day moving average, which also supported May's lows. The weekly candlestick shows a substantial tail, indicating that bulls remain in control.

The recent rally in USD/JPY was bolstered by the rise in U.S. Treasury yields following the better-than-expected jobs data, bringing the 157.71/99 levels into play if the U.S. CPI data exceeds forecasts next Wednesday. These levels were significant during the last Japanese intervention. The rise in two- and ten-year Treasury yields by roughly 14 basis points from crucial support levels after the payrolls report also contributed to the surge in USD/JPY. The pair moved above the 10-day moving average and closer to this week's high of 157.48, supported by diminished expectations of Fed rate cuts following the data.

However, the unexpected rise in the jobless rate from 3.9% to 4.0%, due to a weak household survey showing a decline in employment by 408,000, might deter USD/JPY somewhat. Nevertheless, the focus now shifts to Wednesday's U.S. CPI report and the conclusion of the FOMC meeting. The Reuters consensus forecast projects a monthly inflation rate of 0.1% overall and 0.3% for the core rate. The annual core rate is expected to have decreased slightly to 3.5% from 3.6%. Above-forecast numbers could make the Fed less likely to signal the possibility of rate cuts, with some policymakers possibly advocating for keeping hikes on the table. If this scenario unfolds, USD/JPY might rise toward 158, potentially testing Japan's patience with yen weakness.

Open an account today to unlock the benefits of trading with CMS Financial