USD/JPY Bulls Seize Control; Break into Ichimoku Cloud Sets Stage for Test of 200-DMA

Technical Analysis:

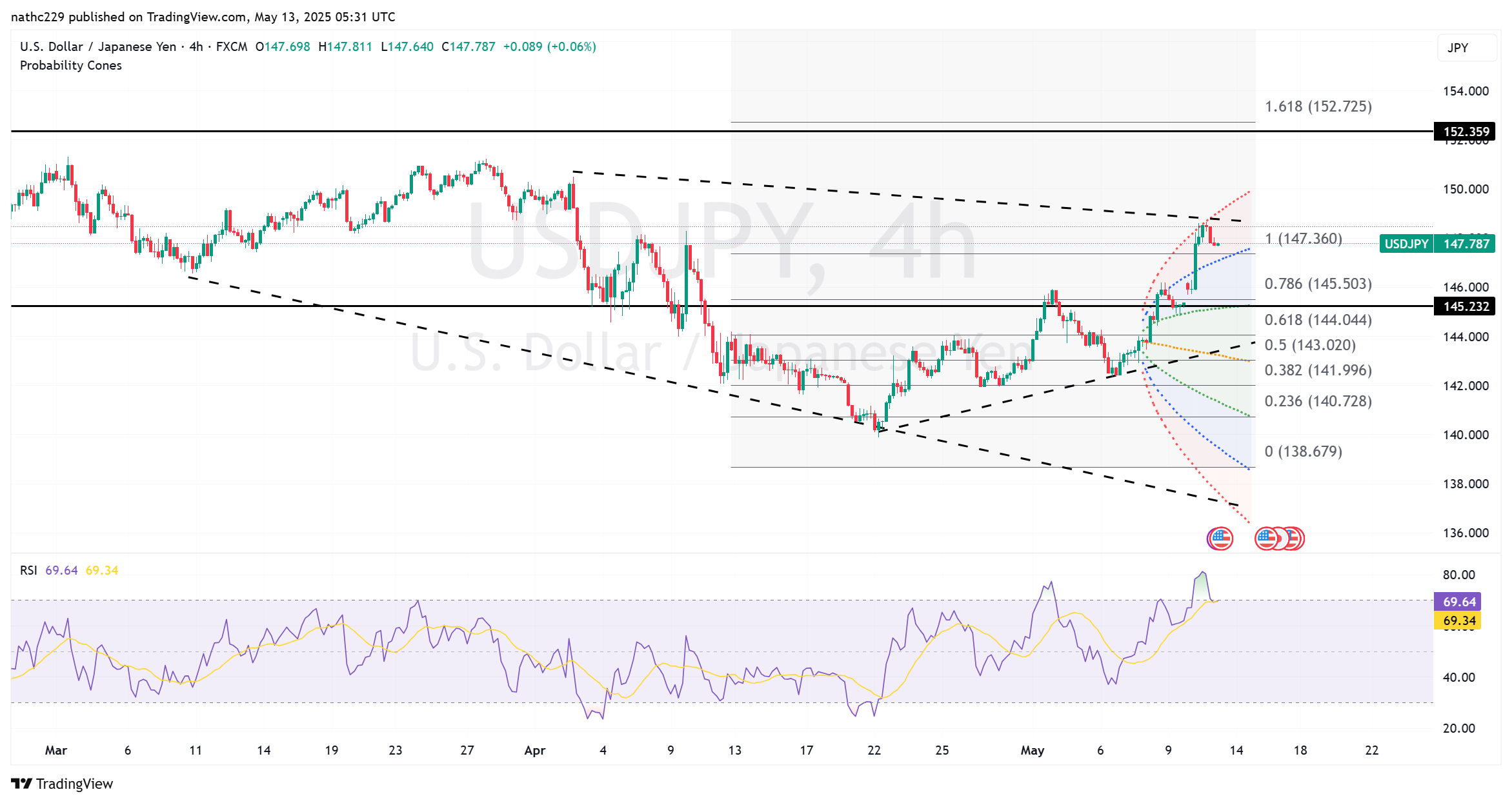

USD/JPY delivered a remarkable rally on Monday, powering sharply higher to a new intraday peak at 148.64 and positioning itself for the largest single-day gain in over five years. This rally has been supported primarily by a buoyant global risk environment following a crucial U.S.-China tariff compromise and comments from Fed Governor Kugler, which reduced the likelihood of aggressive U.S. interest rate cuts. This favorable backdrop saw U.S. 2-year Treasury yields spike upward by 12 basis points, causing bears to swiftly exit positions, intensifying the pair's upward momentum.

Technically, the pair’s strong upward thrust has decisively breached significant resistance, clearly entering the daily Ichimoku cloud and maintaining trade above the upper 21-day Bollinger Band, currently near 146.93. Such a breakout strongly validates a bullish technical shift, likely prompting further upside momentum. Immediate technical resistance is now situated at the pivotal 148.65-70 level, representing lows from December and March. Beyond this zone, bulls would target a swift test of the April 3 high at 149.25. Continued bullish sentiment could extend the rally further, potentially challenging the crucial 200-day moving average at 149.70, which would represent a major technical milestone for the pair.

On the downside, technical levels remain clearly defined, serving as reliable guideposts for short-term traders. Initial support is marked by the Ichimoku cloud base at 147.88, while more substantial support comes into play around the overlapping 55-day moving average and upper Bollinger band in the 146.62-146.93 area. Additionally, the May 8 intraday high at 146.20 serves as critical structural support. Given the recent rapid ascent, short-term momentum indicators such as the RSI are now approaching overbought territory, cautioning against potential corrective retracements. Nonetheless, with bearish USD/JPY option positions easing across multiple tenors and the possibility of further Japanese fiscal stimulus, downside corrections are likely to be short-lived, providing fresh opportunities for bullish positioning.