USD/JPY Bulls Cautiously Target March Highs; BOJ Tightening Risks Could Stall Gains

Technical Analysis:

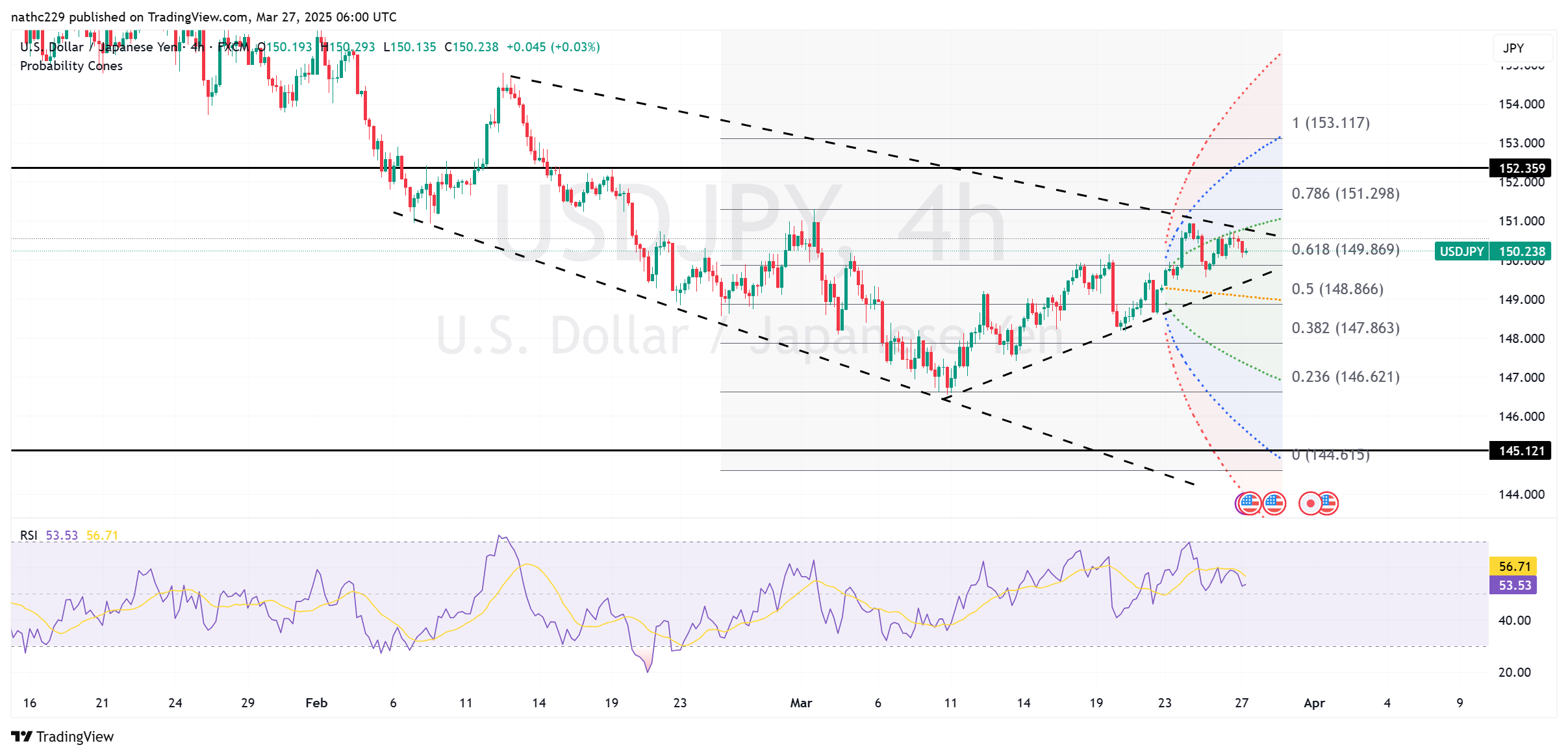

USD/JPY strengthened and closed firmly above the key psychological 150.00 mark on Tuesday, supported by increased U.S. dollar demand amid fresh tariff concerns, notably involving potential U.S. auto tariffs. The pair climbed to a session high of 150.75 but notably struggled to surpass this level convincingly, indicating technical resistance remains significant at this juncture. Immediate upside barriers include the February 7 low and current intraday high at 150.93-95, followed closely by the more pivotal March high at 151.30. A decisive break above these levels would open the path toward a critical longer-term resistance at the 200-day moving average, located around 151.70.

Short-term technical indicators remain supportive of USD/JPY bulls, with higher lows formed consistently since last week’s dip to around 149.10. The 9-day exponential moving average (EMA) at 149.60-55 currently provides immediate support and is critical for maintaining the bullish bias. A daily close below this moving average could indicate weakening bullish momentum, triggering a deeper corrective move toward the recent March 18 low at 149.10, and potentially lower toward stronger support levels around 148.50-60.

Nevertheless, bullish momentum faces significant fundamental headwinds from growing speculation that the Bank of Japan might quicken its tightening pace amid rising inflation concerns domestically. Recent statements from BOJ officials suggest heightened vigilance regarding inflation and indicate a growing likelihood of earlier rate hikes. Current market pricing assigns roughly a 28% chance of a BOJ hike as early as May. Should these expectations strengthen, USD/JPY would likely face increased selling pressure near major resistances, potentially limiting or reversing recent gains. Therefore, while technical indicators favor further short-term upside, USD/JPY bulls should approach the pair cautiously and closely monitor BOJ signals and market positioning for early signs of reversal.