USD/JPY Bears Target Critical 141.62 Support as Dollar Weakness Persists

Technical Analysis:

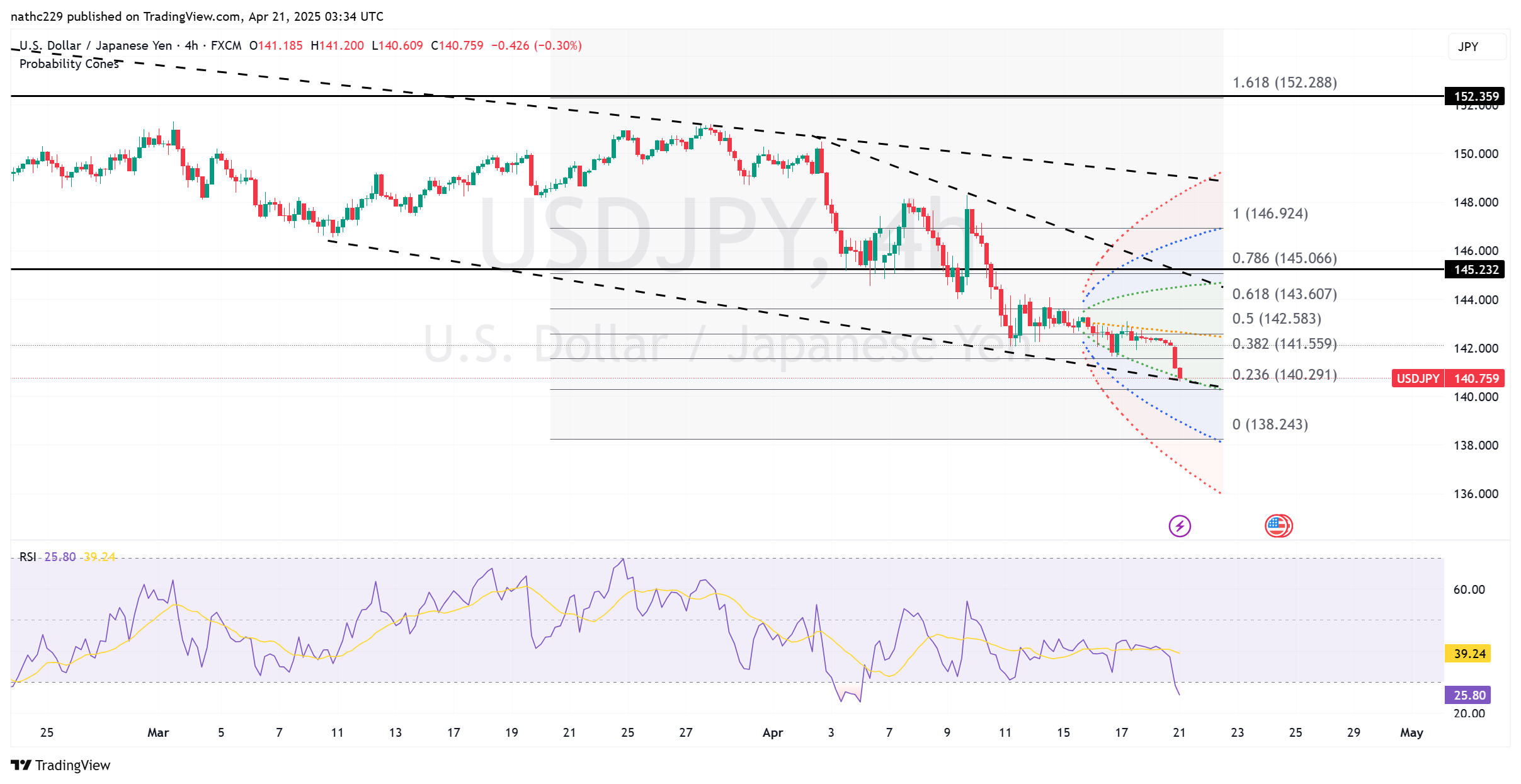

USD/JPY remained under distinct bearish pressure Friday, sliding gradually to the session’s low end of a tight 142.13-142.52 trading range amid ongoing weakness in the U.S. dollar and limited market participation. The technical landscape clearly favors bearish sentiment, evidenced by a consistent pattern of lower daily highs established over recent trading sessions. This persistent downward trajectory suggests that bullish traders continue to face significant headwinds, exacerbated by stalled upside momentum and formidable technical resistances above current levels.

Short-term technical indicators further reinforce bearish sentiment. Immediate support sits near the pivotal weekly low of 141.62; a sustained break below this critical level would significantly deteriorate the short-term technical outlook, opening the door for further declines. Should bearish momentum accelerate, the pair could quickly target deeper downside objectives, including the lower Bollinger band support at 140.65. Continued downward pressure, driven by persistent dollar weakness and cautious market sentiment ahead of important macroeconomic events, could extend losses toward the psychologically key 140.00 support.

Conversely, initial resistance for USD/JPY is observed near Thursday’s session high at 143.11, with more substantial technical resistance at the 9-day EMA around 143.76. The subsequent key pivot lies at 144.00, the April 10 low, representing a crucial threshold for bulls aiming to stabilize sentiment. A decisive daily close above this level would be needed to counteract bearish momentum and potentially initiate a corrective rebound toward higher resistance levels near 145.00. Traders will closely monitor next week's U.S.-Japan trade discussions, alongside Fed commentary and Japanese economic data releases, as these factors could provide fresh directional catalysts in an otherwise technically bearish environment.