USD/JPY Bears Remain in Control as Economic Risks Mount

USD/JPY remains bearish after setting a fresh 2025 low at 147.31, pressured by falling Treasury yields amid rising economic uncertainties and weak U.S. data. Thursday’s surge in layoffs and cautious Fed rhetoric heightened market expectations for a potential May rate cut, further weighing on the dollar. Although the pair rebounded slightly from lows, broader bearish sentiment continues to dominate.

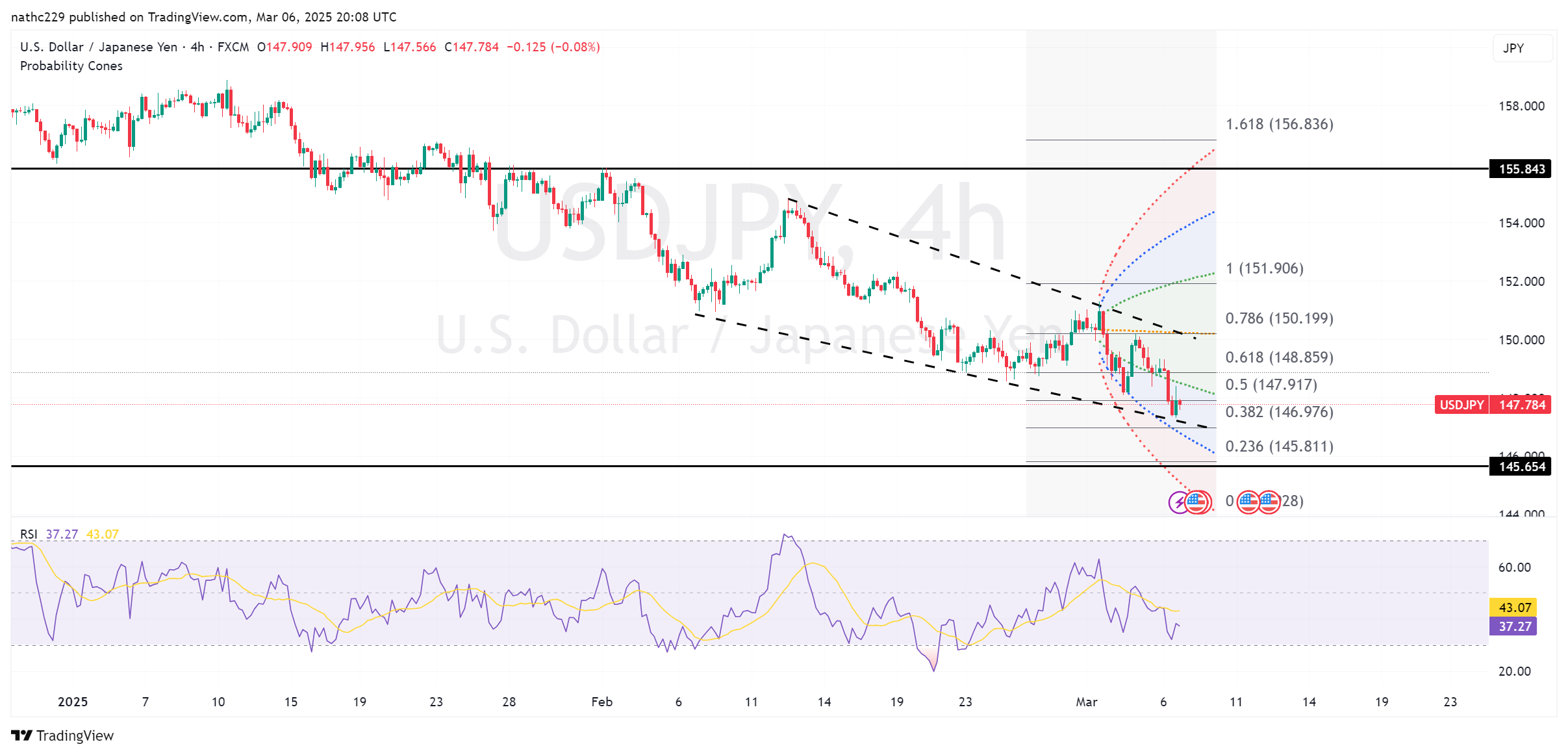

Technically, USD/JPY is testing critical support around 147.20-147.49, with a break below this area exposing deeper losses toward 146.52, the October low. Immediate resistance lies at 149.12 and the 9-day EMA at 149.42, which need to be reclaimed to ease bearish pressure. Expanding Bollinger Bands and downward-sloping momentum indicators support a continuation of the bearish trend.

Looking ahead, Friday’s U.S. non-farm payrolls report will be pivotal. Weaker-than-expected employment figures could accelerate downside momentum, potentially driving USD/JPY below 147. Conversely, a strong print might offer temporary support, though gains will likely remain capped below 149.50 amid ongoing trade concerns and rising yen attractiveness driven by higher JGB yields.