USD/JPY Bears Maintain Control as Hedgers Boost Yen Demand

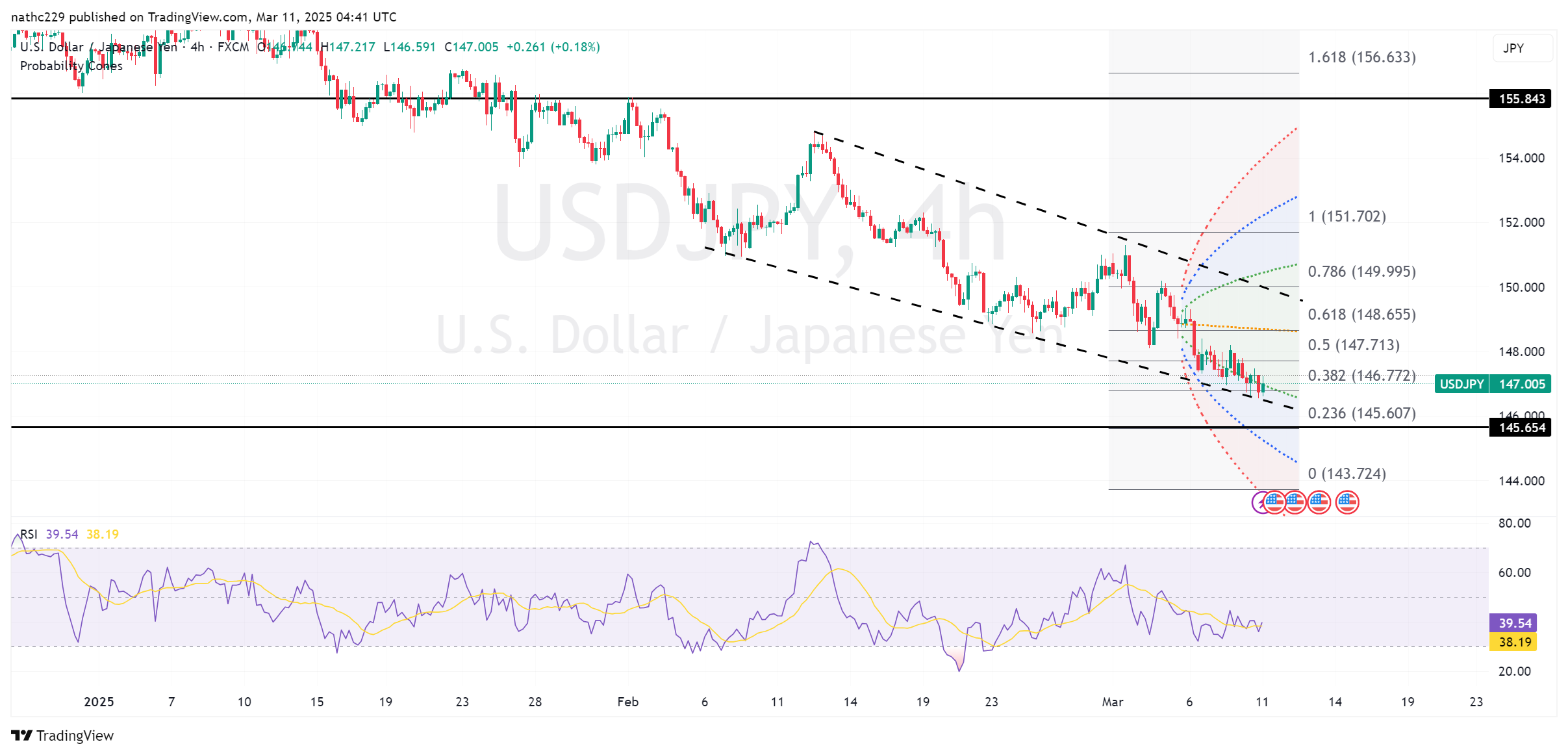

USD/JPY continues to drift lower, pressured by declining U.S. Treasury yields and weak risk sentiment tied to global growth worries and ongoing tariff threats. The pair faces immediate downside support near the lower Bollinger band at 146.75, closely followed by the key October 2 high at 146.52. A sustained break below these supports would trigger further bearish momentum toward 145.00.

Technically, the bearish outlook is reinforced by short-term resistance at 148.20 (Friday’s high), then at 148.56 (February 25 low) and the 9-day EMA at 148.20. The record-high yen positioning, particularly driven by hedgers rather than speculative traders, adds credibility to the yen’s bullish outlook, suggesting limited potential for a significant short-covering rally.

Looking ahead, USD/JPY’s bearish trajectory hinges on upcoming U.S. economic data and geopolitical developments. Weakness in non-farm payrolls or CPI could further weigh on U.S. yields and reinforce the yen’s safe-haven appeal. Conversely, stronger-than-expected U.S. data or improving market sentiment might trigger a limited rebound toward the 148.20-148.56 resistance zone. For now, however, the bias clearly favors further yen appreciation.