USD/JPY and JPY Crosses Seek Direction Post-BOJ Hike

USD/JPY and JPY Crosses Seek Direction Post-BOJ Hike

The market remains uncertain about the direction of USD/JPY and JPY crosses following the Bank of Japan’s (BOJ) recent interest rate hike. Overnight "leaks" revealed that the BOJ raised its short-term rate target to 0.25% and announced a tapering schedule for its Japanese Government Bond (JGB) purchases. Additionally, the BOJ tweaked its economic and price outlooks to focus more on positives and inflation. Despite these moves, there are concerns that the BOJ might have succumbed to government pressure to hike rates.

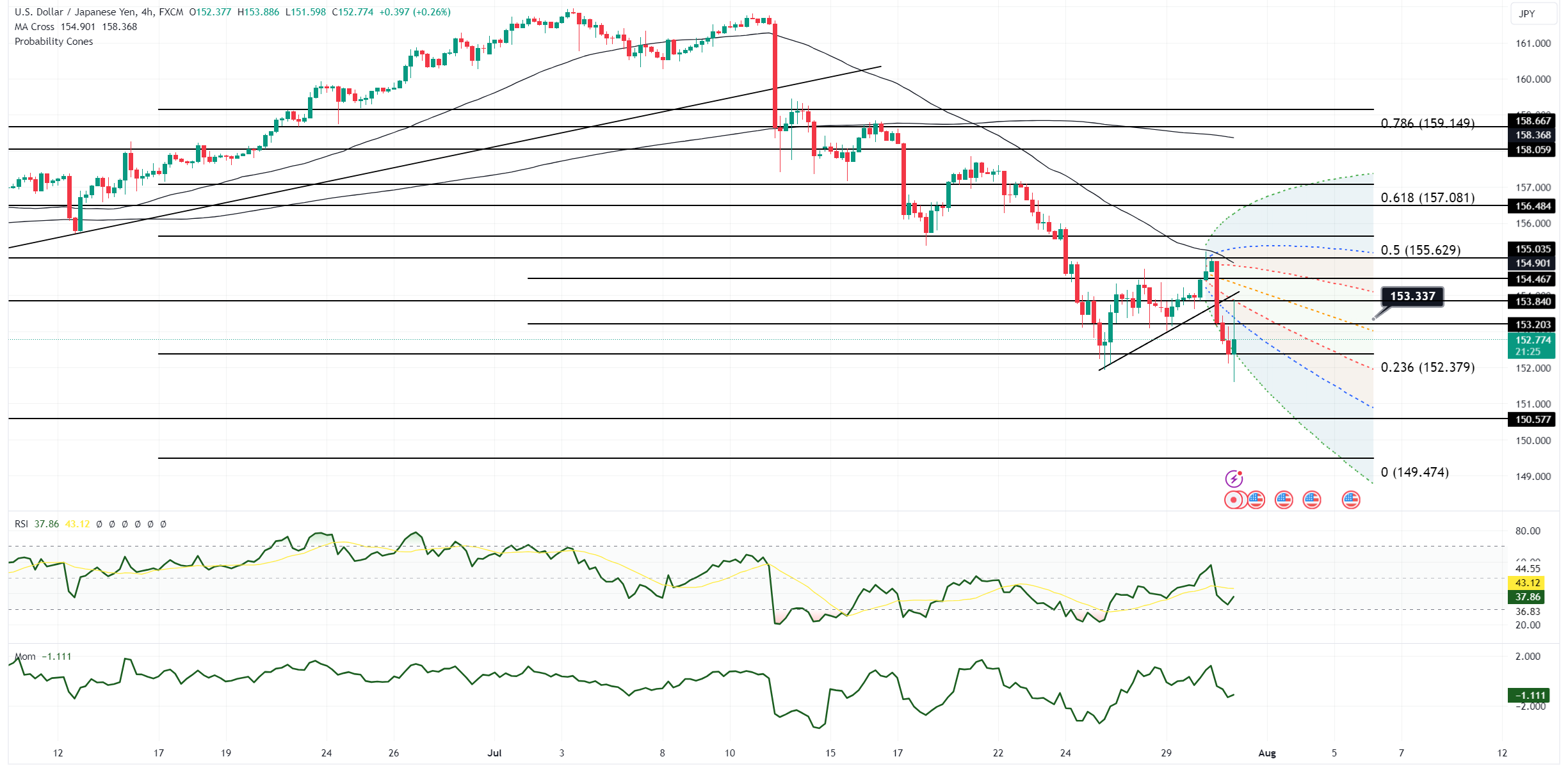

USD/JPY experienced volatility post-BOJ, trading between 151.55 and 153.92, and has since come off its highs. The initial reaction saw sales on the surprise hike, followed by after-the-fact buybacks. The BOJ’s move and its hawkish stance are likely to cap the upside for USD/JPY and JPY crosses. Key support for USD/JPY is at the session low and where the 200-day moving average (DMA) comes in. A decisive break below this could lead to moves towards the 150.75 low from April 5 and the 150.25 low.

EUR/JPY traded between 164.10 and 166.45, holding above 164.00 and the ascending 200-DMA. GBP/JPY ranged from 195.25 to 197.32, and AUD/JPY traded between 98.60 and 100.15, with AUD/JPY being the weakest, suggesting a potential end to carry trade viability. Option expiries today include USD/JPY at 152 and EUR/JPY at 167.00, totaling 626 million euros.

Japanese yields jumped pre-BOJ on expectations of a hike and remained high post-BOJ, with JGB 2-year yields at 0.442% and 10-year yields at 1.023%. U.S. yields softened, with 2-year yields at 4.350% and 10-year yields at 4.134%. The Nikkei took the BOJ move in stride, recovering from earlier lows to 38,610, up 0.2% for the day. The market is also digesting comments from MOF Mimura on potential FX action.

Brief Market Highlights:

- The BOJ raised interest rates and outlined a bond taper plan, setting the short-term rate target at 0.25%.

- The BOJ announced several cuts to bond purchases as part of its plan to exit easy monetary policies.

- Japanese government bond yields jumped pre-BOJ on the view that the BOJ may hike, and remained high post-BOJ.

- Japanese banks led the Nikkei higher after the BOJ raised rates.

- Japan’s June Industrial Output fell by 3.6% month-on-month against a forecast of -4.8% and a previous reading of 3.6%; year-on-year it declined by 4.2% compared to a previous increase of 0.3%.

- Japan’s June Retail Sales rose by 3.7% year-on-year, exceeding the forecast of 3.2% and the previous figure of 2.8%.

Open an account today to unlock the benefits of trading with CMS Financial