USD/JPY Advances Amid Robust Dollar Strength, Limited Downside Risks

The USD/JPY pair surged to a new high of 155.625 on Wednesday, driven by strong dollar momentum and resilient U.S. yields. Following hawkish comments from Dallas Fed President Lorie Logan, who highlighted economic resilience and ongoing inflation concerns, the market now sees the Fed funds rate potentially near neutral. These remarks follow similar optimism from Fed Chair Jerome Powell, underscoring a “Goldilocks” scenario for the U.S. economy, where growth and inflation are balanced, supporting Treasury yields and risk sentiment. As a result, USD/JPY has moved decisively upward, with minimal risk of intervention from Japanese authorities as the pair nears the 155 level.

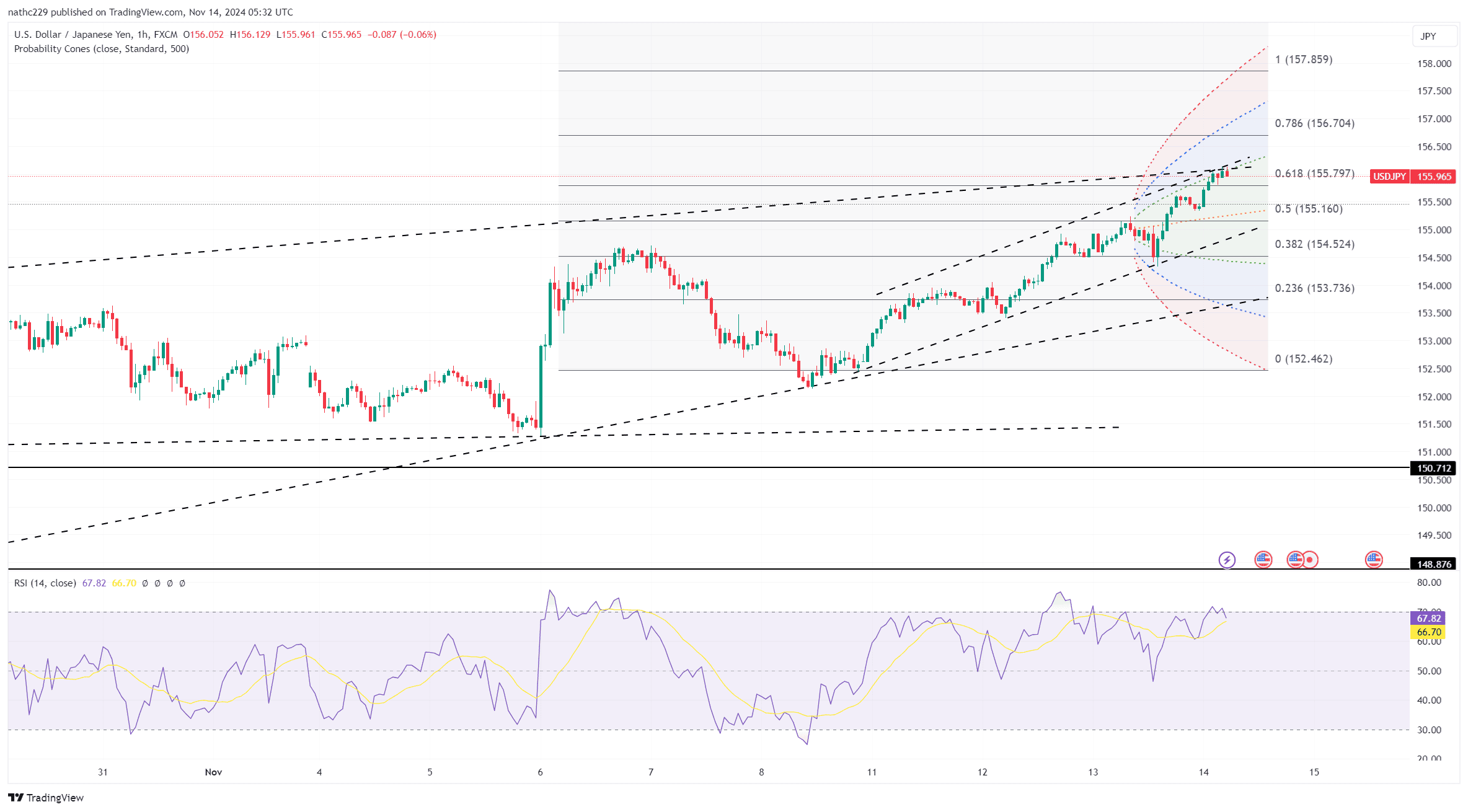

Technically, USD/JPY remains bullish, with a close above the upper Bollinger Band at 155.52 suggesting room for further gains. Support levels include the Nov. 6 high of 154.70 and the Oct. 28 high of 153.88. Despite the dollar’s strength, USD/JPY is stretched compared to its Ichimoku cloud top at 147.40, though a drop to that level appears unlikely without a significant shift in dollar momentum. A key support level for a potential reversal would be the 200-day moving average at 151.78, below which the bullish trend would be challenged.

As the week continues, further Fed commentary and jobless claims data could influence USD/JPY, especially if they reinforce current U.S. economic resilience and support dollar gains. For now, the combination of hawkish Fed signals and a strong dollar leaves USD/JPY with a bullish outlook, though further gains may be more gradual if overbought technical indicators begin to weigh on the pair.