Sterling Slips Toward 1.20 as UK Bond Market Turmoil Deepens

GBP/USD dropped to a 14-month low of 1.2239 Thursday, pressured by surging UK bond yields and growing fiscal concerns. A slight recovery to 1.23 was driven by short-covering ahead of a speech by BoE Deputy Governor Sarah Breeden, though her comments on inflation and monetary policy did little to ease market fears. Rising UK funding costs, coupled with a stagnating economy and steady inflation above target, are placing the BoE in a precarious position. The central bank appears hesitant to cut rates, fearing inflationary risks, while the pound remains weighed down by fiscal uncertainties and U.S. dollar strength.

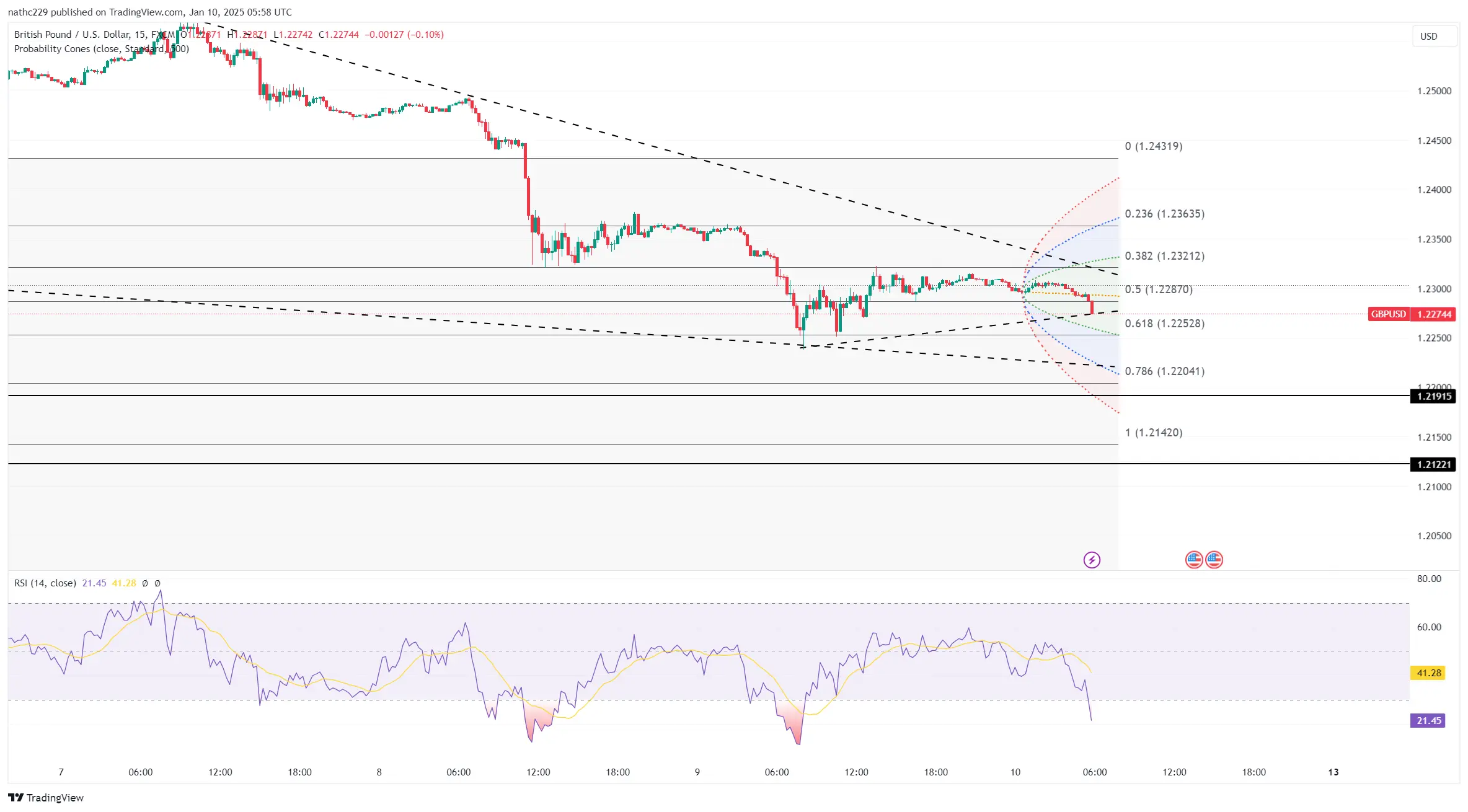

Technicals paint a challenging picture for GBP/USD. Immediate resistance lies at 1.2326 (30-hour moving average) and 1.2363 (Thursday’s high), with stronger resistance at the 10-day moving average near 1.2463. On the downside, support is seen at 1.2263 (lower 30-day Bollinger Band), followed by the 14-month low at 1.2239 and the November 2023 weekly low of 1.2187. A break below 1.2187 could pave the way for a move toward 1.20, a key psychological level that could trigger further selling.

The bearish outlook for sterling persists, as the UK faces both fiscal and monetary challenges. Rising gilt yields are limiting the BoE’s options, and markets remain focused on the economic toll of higher funding costs. In contrast, the U.S. dollar continues to benefit from economic resilience and steady yields. With no immediate relief in sight, GBP/USD is likely to remain on a downward trajectory, with a test of 1.20 increasingly probable if current trends persist.