Sterling Rally Stalls Near YTD High; Technical Resistance at 1.3200 Holds Ahead of Key UK Data

Technical Analysis:

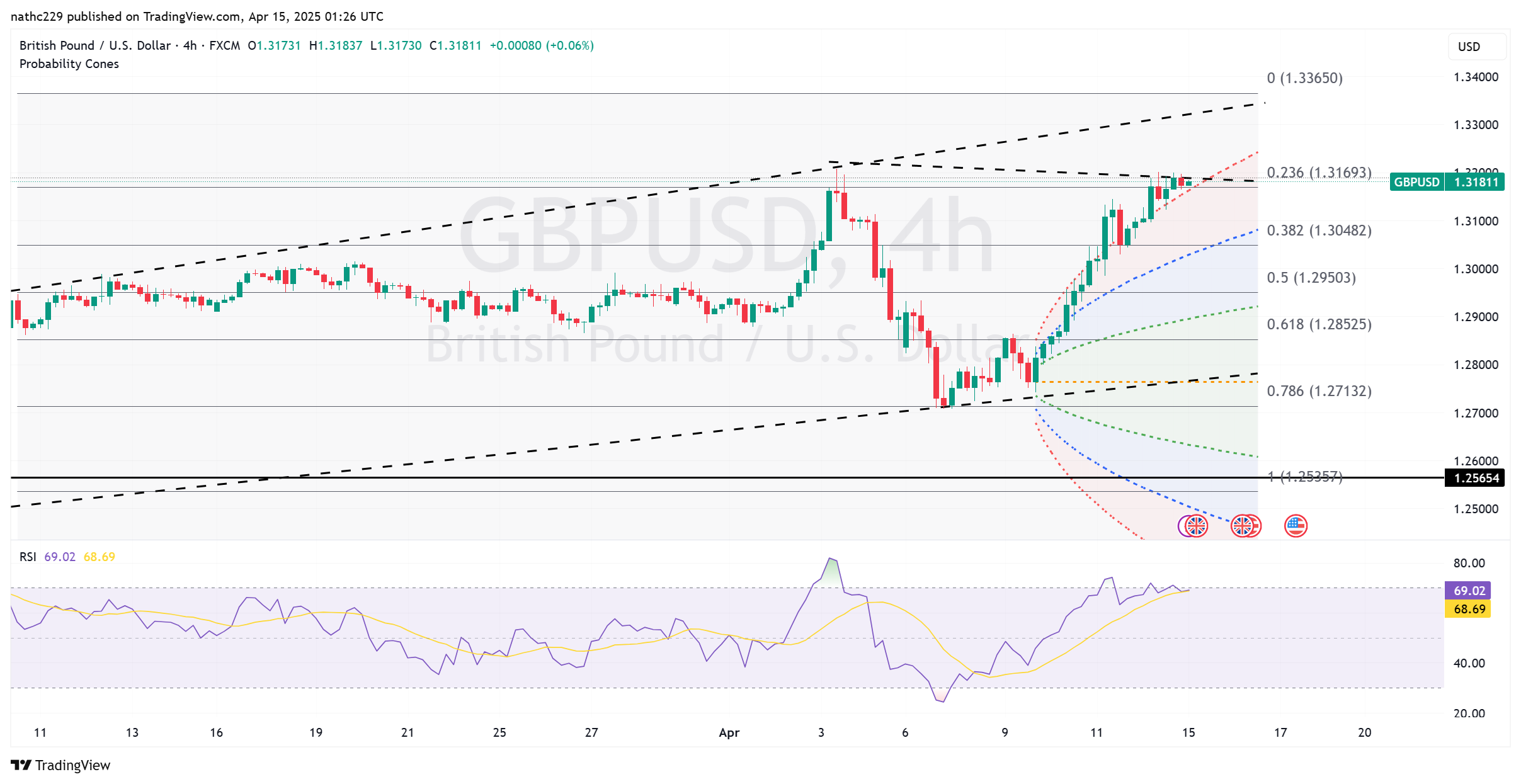

GBP/USD’s upward momentum faced significant headwinds on Monday as the pair tested and subsequently stalled precisely at key year-to-date resistance near 1.3200. The pair closed with a robust daily gain of 0.8%, reflecting bullish sentiment driven primarily by persistent EUR/GBP cross-related selling and the broader lack of appetite for U.S. dollar assets. However, the inability of sterling to break clearly above the psychological and technical resistance at 1.3200 suggests that the current rally may require additional catalysts to advance meaningfully beyond current levels.

Technically, the 1.3200 level represents an important threshold for GBP/USD bulls, as a sustained daily close above this barrier would signify an important bullish continuation signal. Above this level, the next critical resistance lies at the 2024 peak of 1.3434, suggesting that successful clearance of 1.3200 could trigger substantial follow-through gains. Momentum studies, including both daily and monthly RSI indicators, remain supportive of continued upside, though the immediate rejection at 1.3200 points to caution in the near term.

On the downside, clearly identifiable support levels provide reference points for managing risk. The initial key support resides at the 200-day moving average at 1.2818, which, if broken, could signal a deeper correction toward the 55-day moving average support at 1.2754. Market participants will closely scrutinize the upcoming UK labour market and inflation data releases this week. A downside surprise—particularly in wage growth or services CPI—could prompt a repricing of expectations for Bank of England rate cuts, potentially testing the durability of GBP/USD’s recent bullish momentum and putting these key technical supports into focus.