Sterling Pulls Back from Nine-Week High Ahead of Key U.S. Inflation Data, GBP/USD Outlook Remains Positive

The GBP/USD retreated from Tuesday's nine-week high of 1.2801 but maintains a positive outlook, staying close to the March 8 high of 1.2894. Symmetrical rate expectations from the BoE and Fed have eliminated any yield advantage for the dollar. Sterling's rise is evident in the longer-term daily moving averages, with spot rates significantly above the 100-DMA at 1.2635 and the 200-DMA at 1.2541, indicating a decrease in dovish outlooks from both central banks. However, sterling's recent gains, following stronger-than-expected UK CPI data, face a challenge on Friday with the release of the U.S. April PCE index data. This data will provide insight into the Fed's progress in reducing U.S. inflation. If the data meets forecasts, markets may delay Fed rate cut expectations, keeping GBP/USD near current levels. Conversely, higher-than-expected data could increase Fed rate hike expectations, pressuring GBP/USD, while a softer print might revive bets on quicker U.S. rate cuts, potentially pushing the pound toward the 2024 high of 1.2894.

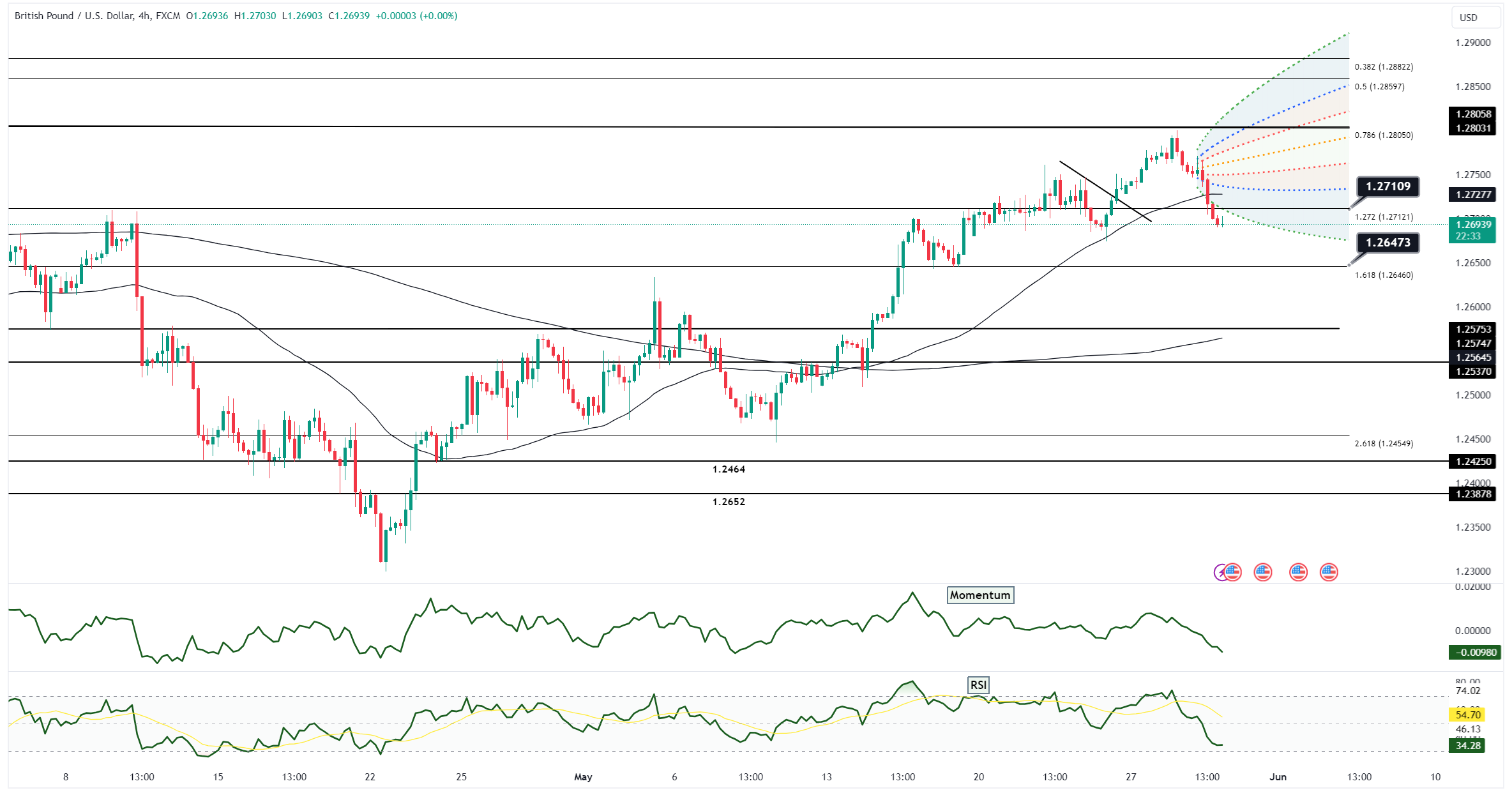

Sterling has softened in the North American afternoon session, trading at -0.42% at 1.2708, within the Wednesday range of 1.2772-1.2706. The dollar remains broadly firm as U.S. Treasury yields rise, despite larger UK rate hikes. Sterling's slip from Tuesday's high is attributed to anticipation of inflation data and rate guidance. Recent GBP gains have been tempered ahead of key eurozone and U.S. inflation data expected on Friday. The policy paths for the U.S. and UK in 2024 are similar, with nearly 50% odds for the first rate cut and a 30 basis point reduction by the end of the year. Momentum favors GBP bulls above 1.2596, the 50% Fibonacci retracement of the 1.2894-1.2299 move, with support at Wednesday's low of 1.2706, the May 24 daily low of 1.2676, and the 100-DMA at 1.2635. Resistance is noted at the 50% retracement of 1.2801-1.2706 at 1.2754, Wednesday's high at 1.2772, and the upper 30-day Bollinger Band at 1.2812.

Open an account today to unlock the benefits of trading with CMS Financial