Sterling Extends Gains on Diverging UK-U.S. Rate Expectations, Eyes February 2022 High

GBP/USD rose to a new 2024 high of 1.3391 on Tuesday, as the pair capitalized on dovish global rate expectations and fresh stimulus measures from China’s central bank. The People’s Bank of China’s announcement of significant stimulus injected optimism into the broader markets, which in turn lifted sterling, particularly as traders expect the Bank of England (BoE) to maintain a more cautious stance compared to the Federal Reserve. UK inflation remains elevated, especially in core CPI readings, giving the BoE less room to maneuver in terms of rate cuts, while the Fed has shifted its focus from inflation to employment. This divergence in monetary policy outlooks between the two central banks continues to bolster GBP/USD, as traders foresee more limited cuts from the BoE relative to the Fed.

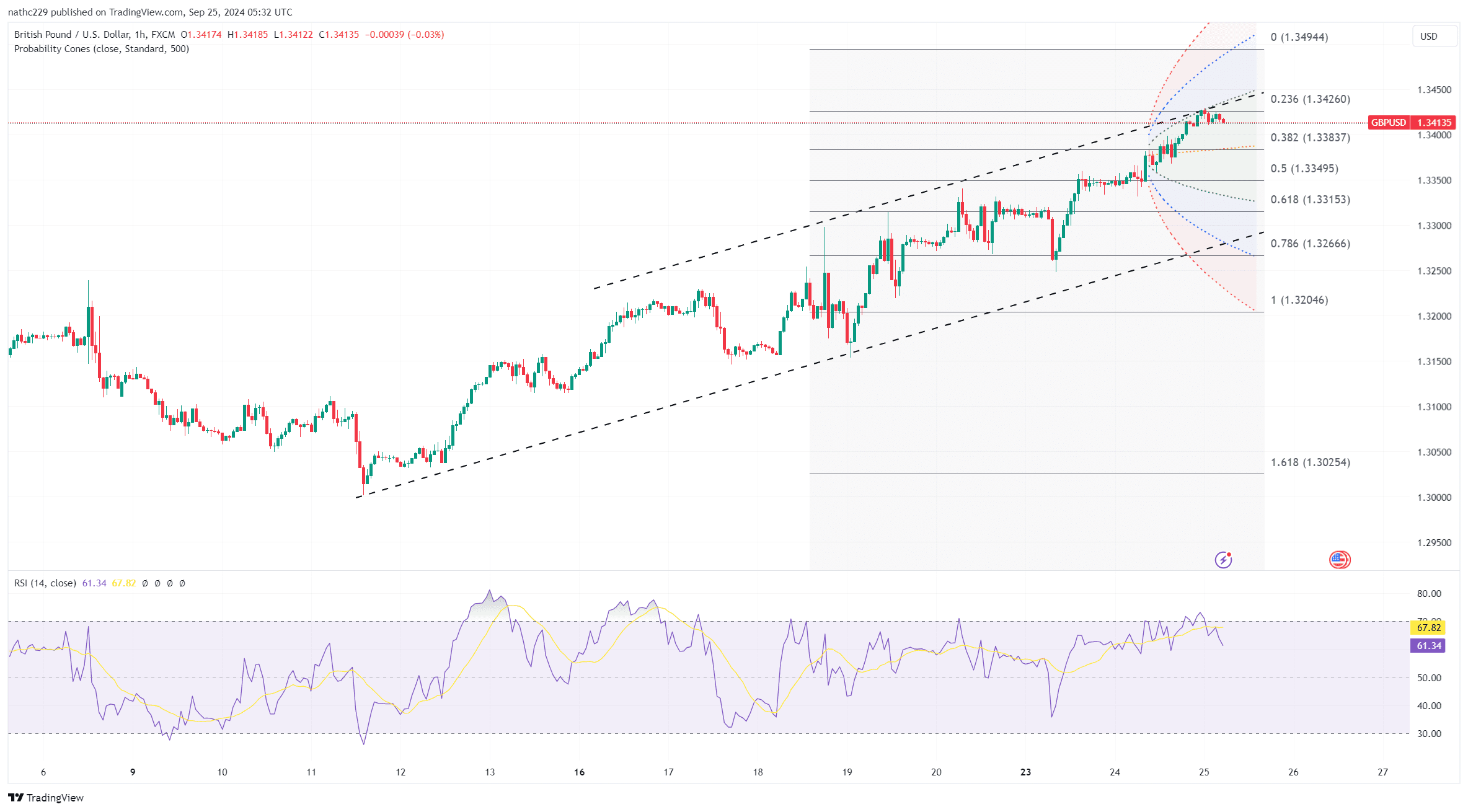

From a technical standpoint, GBP/USD continues to trade within an upward trajectory, supported by key technical levels. The pair finds support at 1.3364, near the rising 21-day moving average, with additional support at Tuesday’s high of 1.3332 and the September 23 low of 1.3249. On the upside, immediate resistance is at the psychological 1.3400 level, followed by the February 25, 2022 high of 1.3437, which will likely serve as the next target for sterling bulls. A breakout above this level could see GBP/USD testing the February 24, 2022 high of 1.3553. With sterling momentum fueled by both fundamentals and technicals, the pair appears poised for further gains in the short term.

As traders look ahead, the focus will shift to U.S. economic data, including the final Q2 GDP release and weekly jobless claims on September 26, followed by the September 27 core PCE price index, which could influence the Fed’s monetary policy outlook. LSEG’s IRPR suggests a 50% chance of a large Fed rate cut in November, with an additional 76 basis points of easing expected by December. In contrast, STIR futures indicate that the BoE may only cut 39 basis points by their December meeting. This divergence in rate outlooks continues to support GBP/USD’s upward trend, with the pair potentially targeting the early 2022 highs near 1.3437 and 1.36 as sterling dominance persists.