Sterling Consolidates Gains Near 1.29; CPI Data Crucial for Bullish Breakout Toward 1.31

Technical Analysis:

GBP/USD pared initial gains on Monday after reaching a session high of 1.2968 in early North American trade, ultimately closing slightly lower around 1.2908. Despite retreating modestly into the close, the pair maintained bullish composure after recovering sharply from its sub-1.29 Asian session low of 1.2883. Sterling’s early strength stemmed primarily from market optimism following U.S. tariff reports, though a subsequent rebound in U.S. yields and equities capped further upside moves, highlighting cautious trading conditions ahead of important UK inflation data.

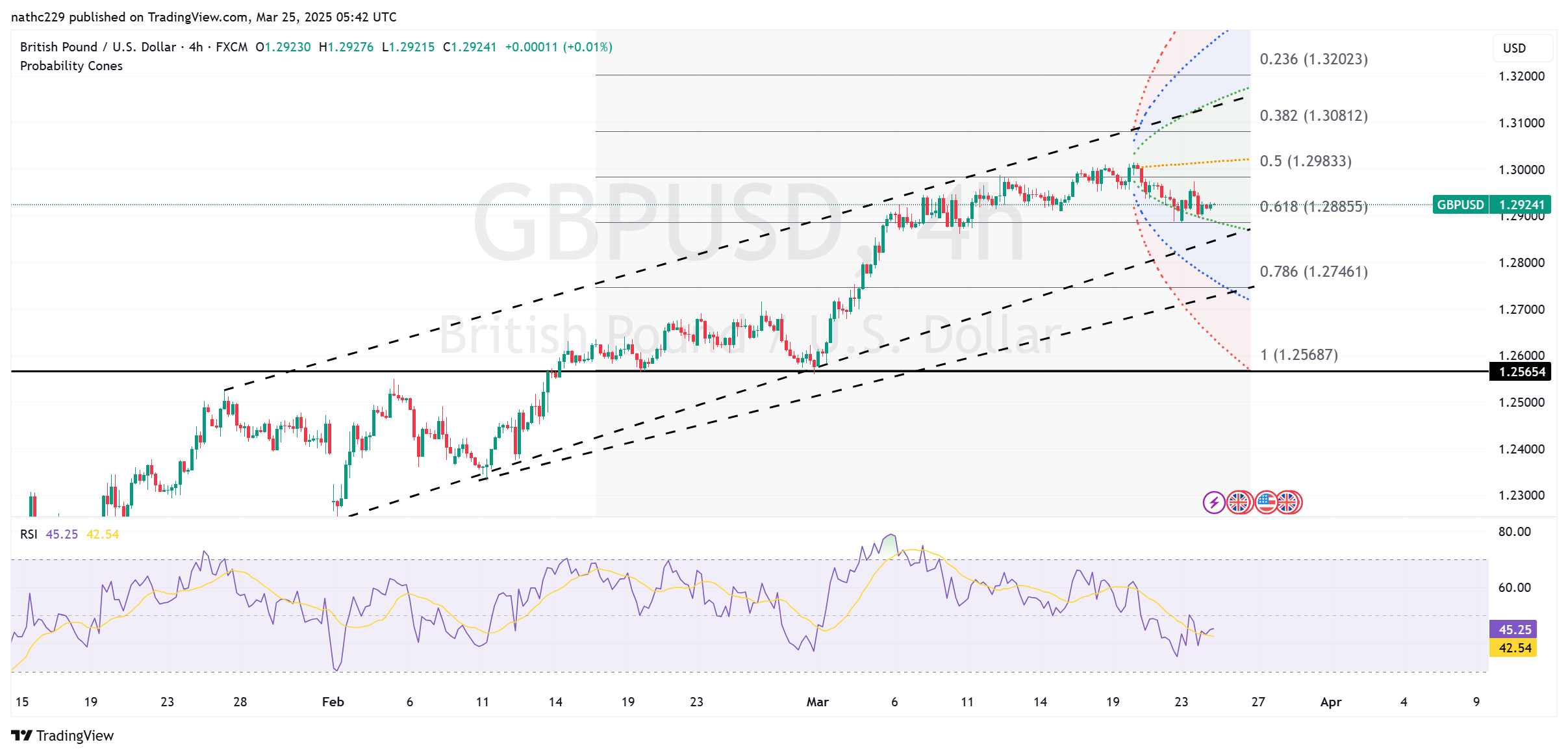

Technically, GBP/USD’s consolidation just above key near-term supports, including the Asian session low (1.2883) and the more robust support at the March 10 low (1.2862), suggests bulls retain control as long as these levels remain intact. Further, the ascending 21-day moving average near 1.2847 provides solid underlying support, indicating the medium-term bullish trend continues to hold firm. Nonetheless, a breakdown beneath the 21-DMA would threaten recent bullish momentum, potentially signaling a deeper correction toward 1.2750-60.

Resistance overhead remains layered, initially at the 10-day moving average (1.2958), followed by Monday's high of 1.2974. Ultimately, bulls are focused on challenging the critical 2025 peak of 1.3015, recorded on March 20. A successful breach of this significant technical barrier, especially if reinforced by favorable UK CPI data and further dovish shifts in U.S. rate expectations, could trigger aggressive bullish momentum toward October's highs around the key psychological level of 1.3130. Until then, traders will remain cautious, with GBP/USD likely to continue consolidating within recent ranges pending clearer directional cues.