Sterling Bulls Face Stiff Resistance at 1.3434; Technicals Warn of Possible Short-Term Correction

Technical Analysis:

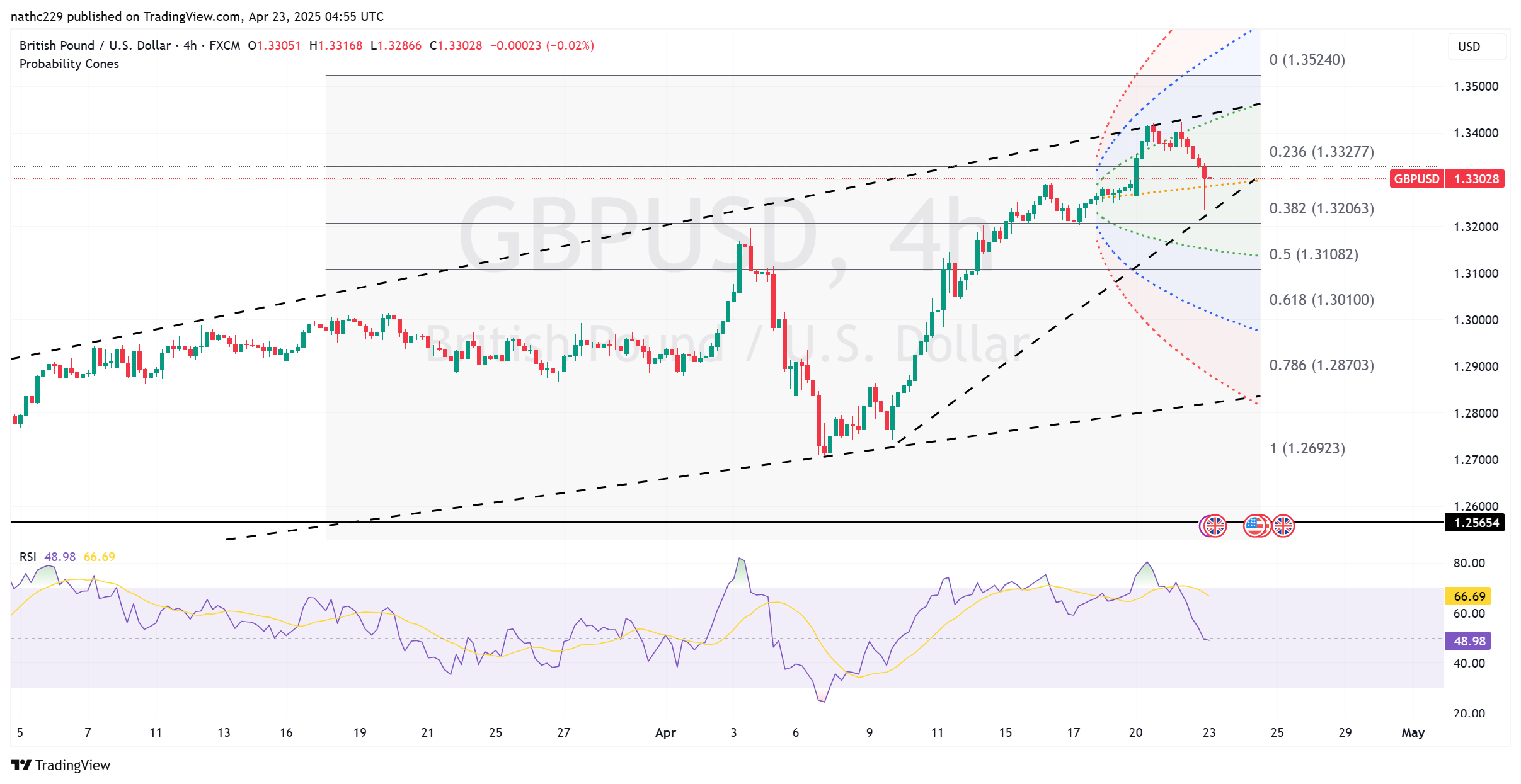

GBP/USD briefly approached its significant 2024 high of 1.3434 on Monday before retreating to trade closer to the mid-1.3350s by early North American hours, reflecting cautious sentiment among traders at these elevated levels. The sharp rally over the previous ten sessions has pushed GBP/USD well into overbought territory, as evidenced by the 14-day RSI, indicating that upside momentum might be due for a pause or a corrective pullback before further gains can be sustainably pursued.

Near-term support lies at the 5-day moving average of 1.3281, which closely corresponds with the session's low at 1.3266. Below this level, additional technical supports include the April 18 low at 1.3262 and the previous key resistance area from the April 3 high at 1.3207. A break below these supports would confirm a near-term shift in sentiment toward bearish consolidation, with potential downside targets extending toward the rising 10-day moving average currently around 1.3188.

To reignite bullish momentum, GBP/USD needs a decisive break and daily close above the critical resistance at 1.3434, the current yearly peak. Such a breakout would pave the way for a subsequent advance toward the February 2022 highs near 1.3640. However, given current overbought technical conditions and the possibility of a temporary DXY rebound after recent declines, traders should be prepared for volatility and cautious trading conditions. Near-term developments in UK PMI data and comments from BOE officials, including Governor Bailey, may serve as catalysts for renewed directional momentum, determining whether sterling resumes its bullish trend or experiences a short-term technical correction.