Inflation Concerns Keep EUR/USD Under Pressure Despite Slowing U.S. Jobs Data

EUR/USD slipped lower on Tuesday, even as U.S. jobs data pointed to potential economic softening. The September JOLTS report fell sharply to 7.443 million, below expectations and representing a significant downward revision from August. Despite this, investors remained focused on inflation risks as U.S. inflation-linked swaps and 5-year break-evens have trended higher, suggesting the Fed may cut rates less aggressively than previously anticipated. Meanwhile, continued weakness in eurozone economic indicators keeps the ECB in a dovish stance, creating a rate divergence between the Fed and ECB that supports the dollar’s strength.

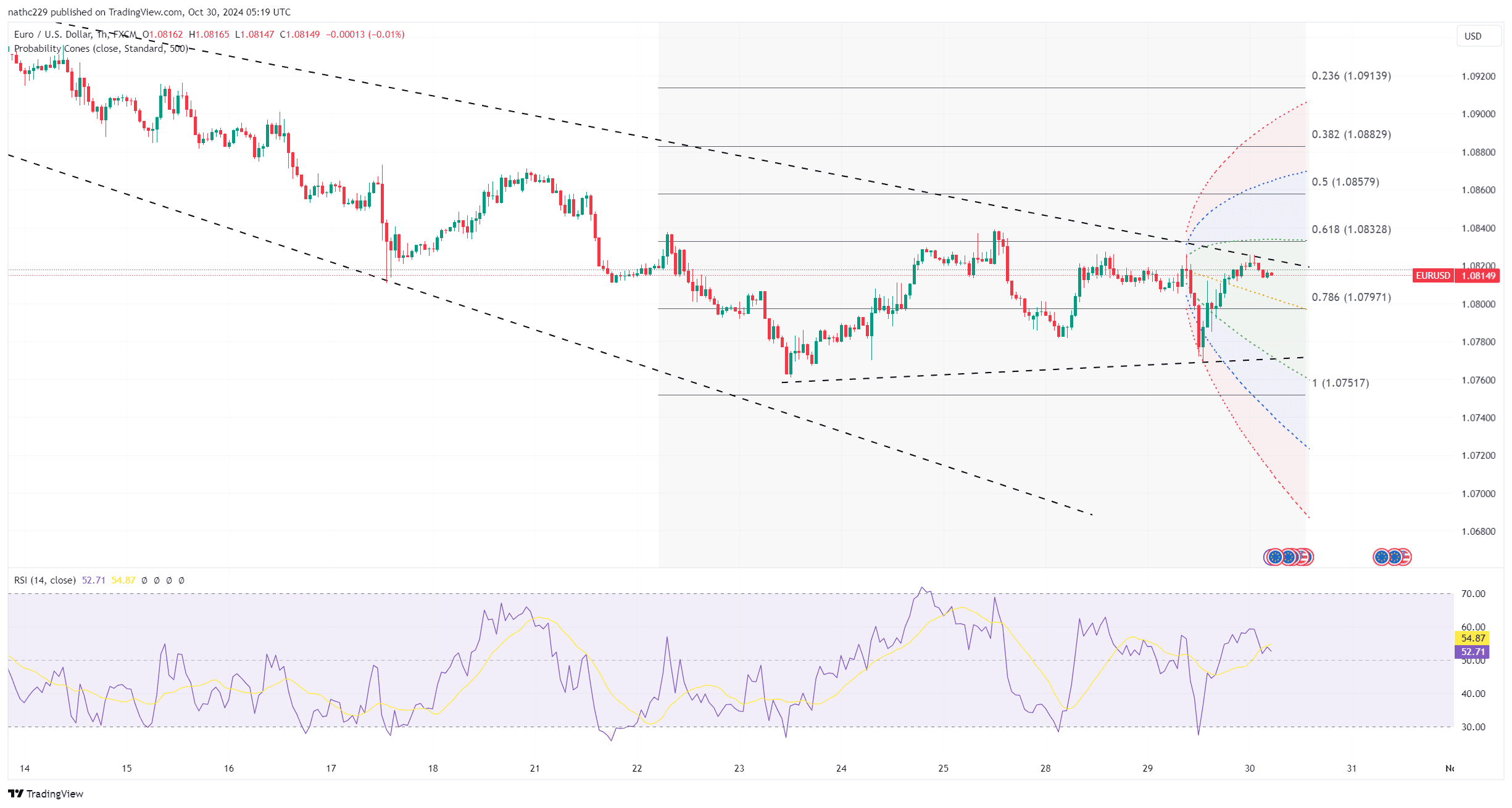

From a technical perspective, EUR/USD shows bearish signals, as the pair trades below the 5-day moving average with RSI levels pointing downward. After hitting a low of 1.0769, EUR/USD found temporary support but remains within a consolidation phase. Bears face immediate resistance at 1.0825, while downside targets include support at 1.0760. If this level is breached, the path toward 1.0700 becomes clearer, especially if U.S. inflation data later in the week reinforces expectations of a shallower Fed rate-cutting path. A break above 1.0825, however, could spark short-covering, though the broader bearish trend would remain intact.

Key events for EUR/USD include the U.S. September PCE inflation report on Thursday and October payrolls data on Friday. An above-estimate PCE figure could fuel concerns of rising inflation, driving U.S. yields higher and potentially pushing EUR/USD lower. With eurozone Q3 GDP and German HICP inflation data due on Wednesday, any weaker-than-expected results would likely add pressure on EUR/USD as the euro’s yield disadvantage widens. In the near term, the pair appears poised to remain under pressure, with bears likely to target the 1.0700 support if data risks reinforce the Fed-ECB rate divergence.