GBP/USD Surges to Fresh 2025 High; Bulls Eye 1.30 on USD Weakness

GBP/USD rallied sharply to a new 2025 high of 1.2952, supported by broad-based dollar weakness driven by recession fears and ongoing tariff tensions. Sterling’s gains reflect its emerging safe-haven appeal, despite lingering UK fiscal concerns. The immediate outlook remains bullish, though momentum may be tempered by uncertainty surrounding upcoming U.S. CPI and UK inflation data.

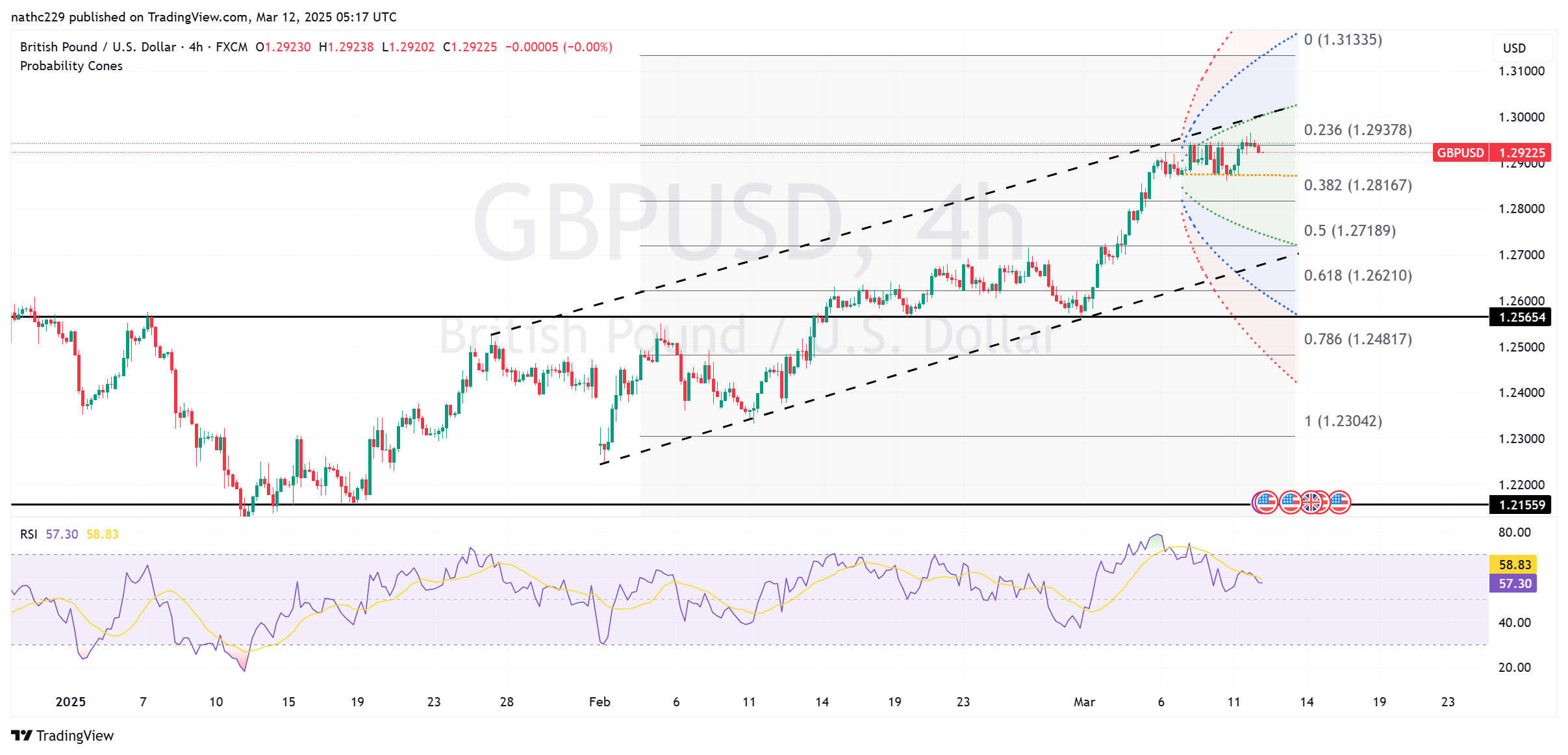

From a technical standpoint, GBP/USD faces resistance at Tuesday's high (1.2952), with a sustained break opening a path toward 1.3000 and potentially November 2024 highs near 1.3046. Short-term support lies at 1.2880, followed by stronger support near the convergence of the 200-day and 10-day moving averages at 1.2790/88. RSI remains supportive, pointing to possible further upside.

In the short term, GBP/USD direction hinges on Wednesday’s U.S. CPI figures and next week's UK inflation and BoE decision. Should U.S. data remain weak, GBP/USD could decisively breach 1.2952, targeting 1.30 and beyond. Conversely, signs of stronger U.S. data or renewed UK fiscal concerns might trigger a corrective pullback toward key support at 1.2790/88.