GBP/USD Pressured Near 1.30 as Rising U.S. Yields and BoE Policy Divergence Weigh

Sterling continued to tread water around the key 1.30 level on Monday, weighed down by rising U.S. Treasury yields and broad dollar strength. The pair briefly fell to 1.2978, driven by a surge in U.S. long-term yields, which boosted the dollar. Sterling’s weakness has been exacerbated by diverging expectations for BoE and Fed policy, with the market increasingly pricing in dovish comments from BoE Governor Andrew Bailey, who speaks on Tuesday. Traders are also awaiting remarks from BoE’s more hawkish member Catherine Mann on Thursday, as the calculus for sterling lies within the relative paths of Fed and BoE rate policy.

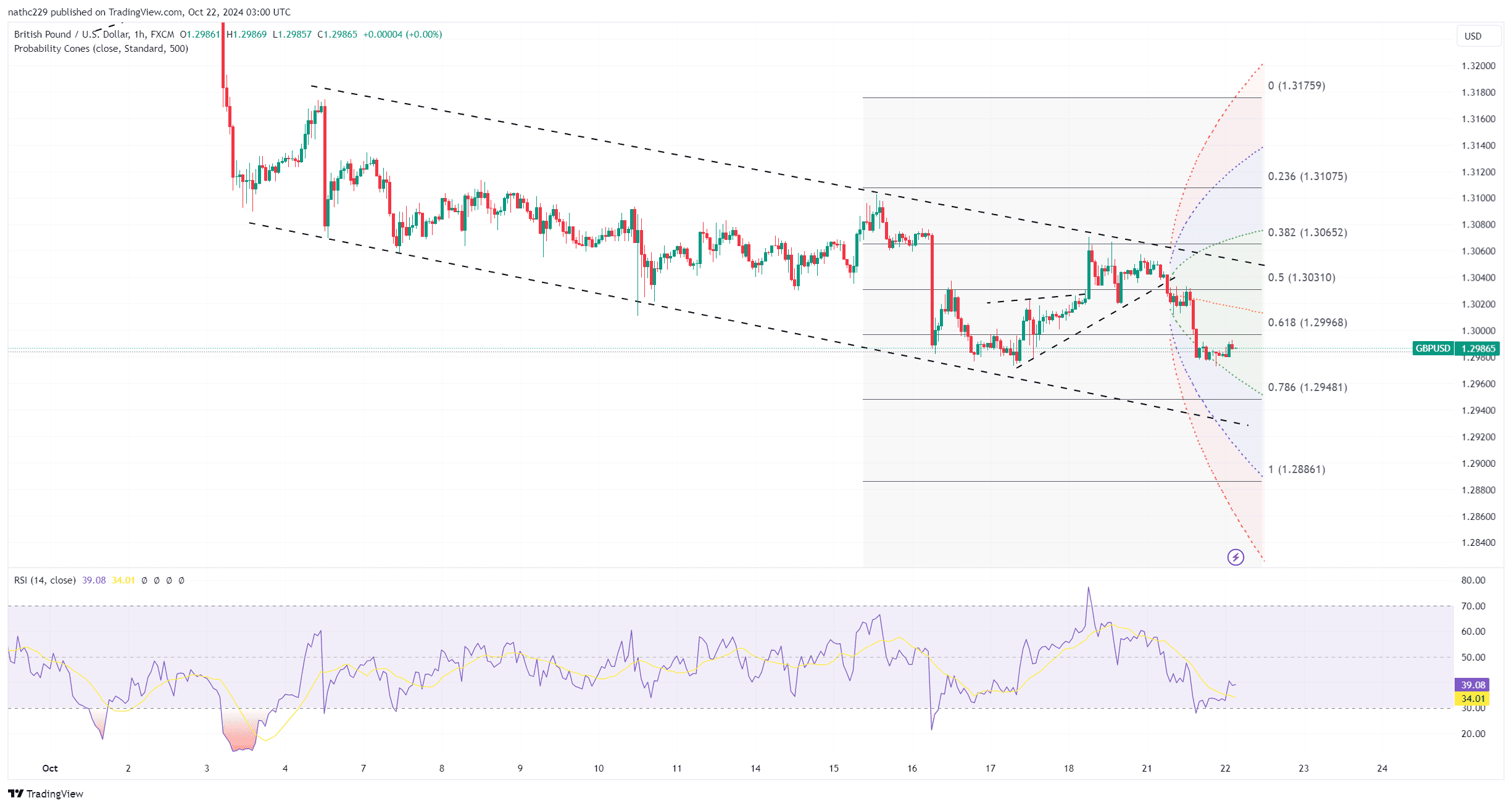

Technically, GBP/USD is facing mounting bearish pressure as it continues to trade below key moving averages. Support at 1.2975, the October 17 low, remains critical, and a break below this level could open the door to further declines towards the daily cloud base at 1.2967 and the 200-DMA at 1.2798. The pair remains capped by a falling 10-day moving average at 1.3052, with further resistance at 1.3010 (10-hour moving average) and Monday’s high of 1.3058. Bearish momentum remains intact, with the pair struggling to maintain any sustained upside, as technical indicators point to continued downside risks.

In the near term, sterling’s direction will likely hinge on BoE commentary and U.S. election developments. The rise in Trump-favorable trades has further strengthened the dollar, and any dovish rhetoric from BoE officials, particularly Andrew Bailey, could push GBP/USD lower. If BoE policymakers suggest a faster pace of rate cuts, the pair could break below key support levels, with 1.2909 (the lower 30-day Bollinger Band) coming into focus. However, a hawkish surprise from Catherine Mann or stronger-than-expected UK data could offer temporary respite, though the overall bias remains to the downside as long as U.S. yields continue to rise.