GBP/USD pair experienced a notable decline on Thursday, testing the crucial support level of 1.28, following the release of U.S. retail sales and jobless claims data

The GBP/USD pair experienced a notable decline on Thursday, testing the crucial support level of 1.28, following the release of U.S. retail sales and jobless claims data that pointed to a less severe economic slowdown than anticipated. This data led to an increase in U.S. interest rates, which tempered expectations for more aggressive rate cuts by the Federal Reserve in the near term. Previously, the pair had been rising, driven by market sentiment that had been expecting the Fed to take a dovish approach, particularly after softer U.S. payroll figures. This sentiment had led futures markets to price in over a 50% chance of a 50bps rate cut in September and further cuts ranging from 5 to 25bps by the end of 2024. However, the latest U.S. economic data has prompted a significant reassessment, reducing the likelihood of such aggressive monetary easing.

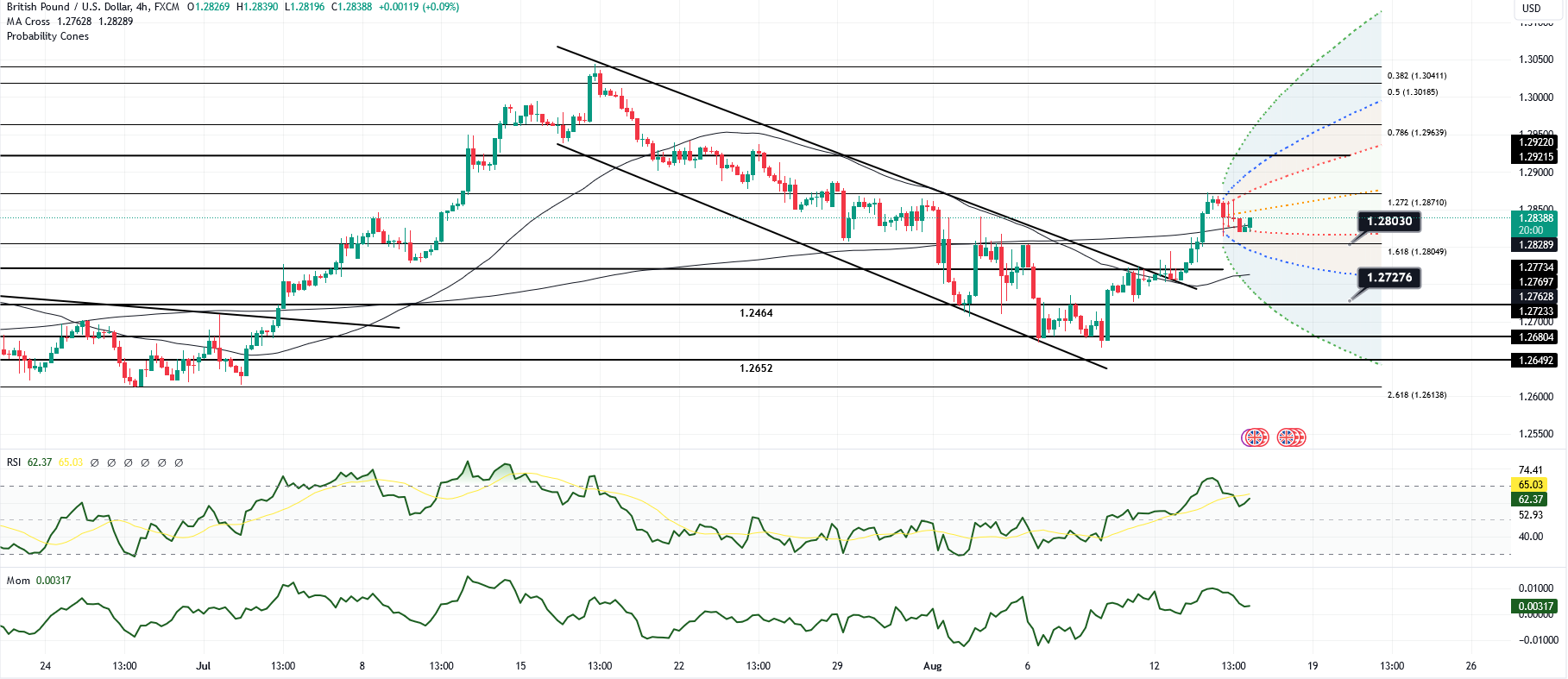

From a technical standpoint, GBP/USD is currently supported at the 1.2782 level, which corresponds to the top of the daily Ichimoku cloud, with additional support found near Thursday’s low of 1.2798. The pair faces resistance around 1.2870, a level that has capped gains over the last three days, with further resistance at 1.2939, the high recorded on July 24. Despite the recent dip, the pair’s ability to hold above 1.28 suggests that there is still potential for a recovery, especially if the upcoming UK economic data delivers positive surprises. Market participants are particularly focused on the July UK retail sales report, due on Friday, which is expected to show a significant improvement over June’s figures. A better-than-expected result could trigger a rally in GBP/USD, pushing the pair towards the 1.30 level, a psychological and technical milestone.

Fundamentally, the reduced likelihood of a 50bps rate cut by the Fed is a key factor for the GBP/USD trajectory. The earlier expectations for such a drastic move may have been premature, given the current inflationary environment in the U.S., with both headline and core inflation remaining close to 3%. The Fed’s cautious stance, highlighted by its emphasis on data dependency and its efforts to maintain market stability, suggests that any rate cuts are likely to be more gradual than previously thought. The IRPR’s reduction of the 50bps cut probability to 26% reflects this more tempered outlook. This recalibration indicates that the Fed is more likely to opt for smaller rate adjustments, which would prevent any perception of losing control over the economic situation.

In conclusion, while GBP/USD has faced downward pressure in response to stronger U.S. economic data, the overall technical and fundamental picture still points to the potential for a rebound. Should the UK retail sales data exceed expectations, Sterling could regain strength, challenging resistance levels near 1.2870 and potentially aiming for the 1.30 level.