GBP/USD Holds Strong Above 1.26, Eyes Breakout Past 1.27

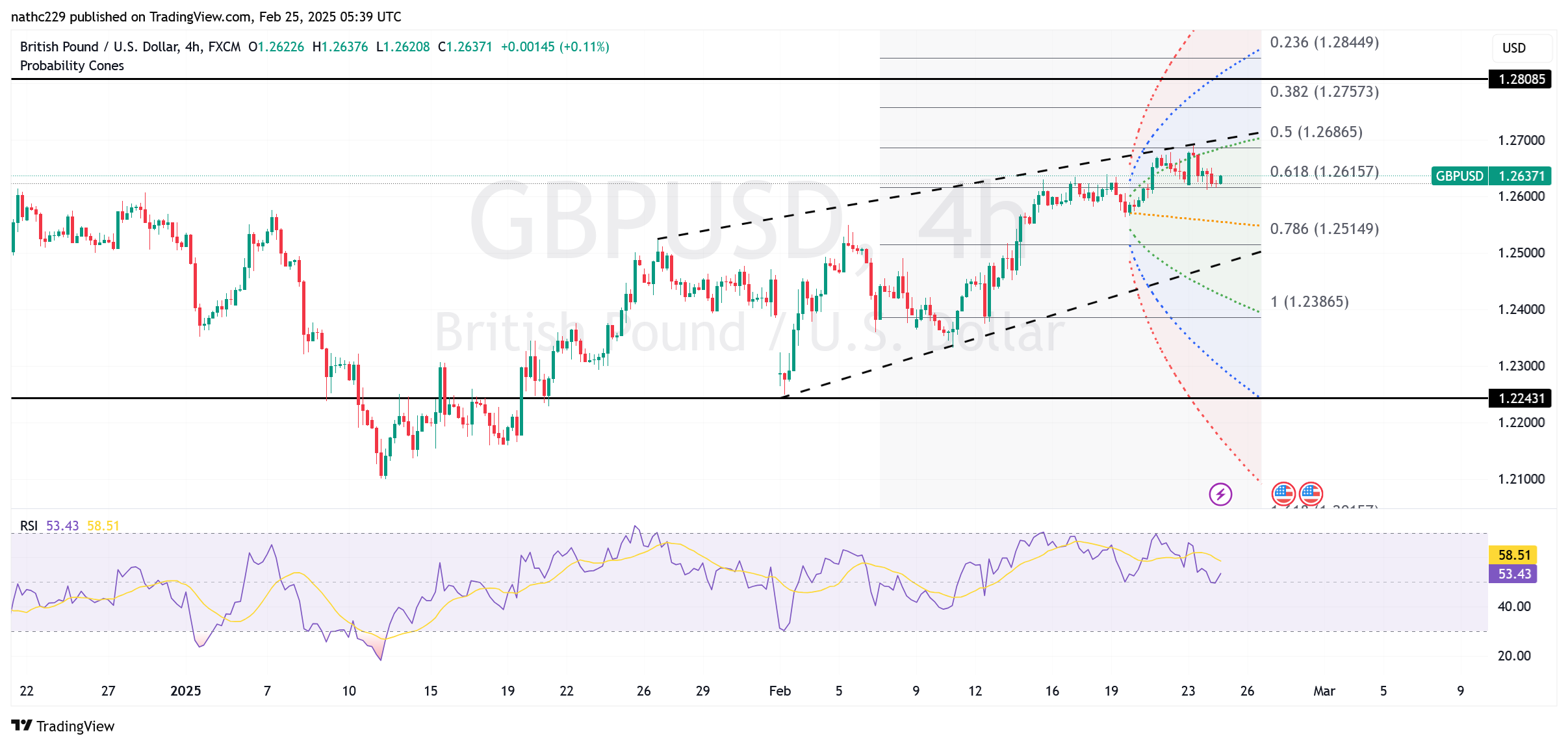

GBP/USD climbed to a fresh 9-week high of 1.2690 before facing resistance near 1.2700, with persistent UK inflation and a less-dovish BoE outlook keeping the pair well-supported. The broader uptrend remains intact, with a potential move toward 1.2731 (200-WMA) and 1.2788 (200-DMA) if bullish momentum persists. A break above 1.2767, the 50% Fibonacci retracement of the September-January decline, would open the door to early November highs near 1.30. However, risks remain, including the potential for increased U.S. tariffs and a shift in UK rate expectations if fiscal concerns rise.

Technically, GBP/USD remains above key support at 1.2613 (Monday’s low), with additional downside protection at 1.2582 (10-DMA) and 1.2470. The upper 30-day Bollinger Band at 1.2708 acts as immediate resistance, while the 200-DMA at 1.2788 is a key longer-term target. The shallow pullback from 1.2690 suggests underlying demand remains strong, with U.S. Treasury yields falling and the dollar softening.

Market focus now shifts to the BoE’s policy outlook and upcoming speeches. A dovish tone from BoE member Dhingra could trigger some profit-taking, while continued hawkish expectations would support GBP/USD’s advance. As long as the pair holds above 1.2613, the near-term bias remains bullish, with a break above 1.2708 needed to confirm further upside toward 1.2788.