GBP/USD Finds Support Near 100-DMA as Key Budget and Election Risks Loom

Sterling’s rally was tempered Monday as GBP/USD slipped back towards the 100-DMA at 1.2971, struggling to hold above the psychological 1.30 level. With U.S. Treasury yields on the rise, the dollar found additional support, limiting sterling’s upward momentum. Sterling traders now look to the October 30 UK budget announcement, expected to include measures aimed at tackling high deficits through spending cuts and tax hikes. The fiscal tightening focus has raised concerns about the future of UK economic growth, which could keep sterling under pressure, especially as forecasts suggest inflation may remain above the Bank of England’s 2% target.

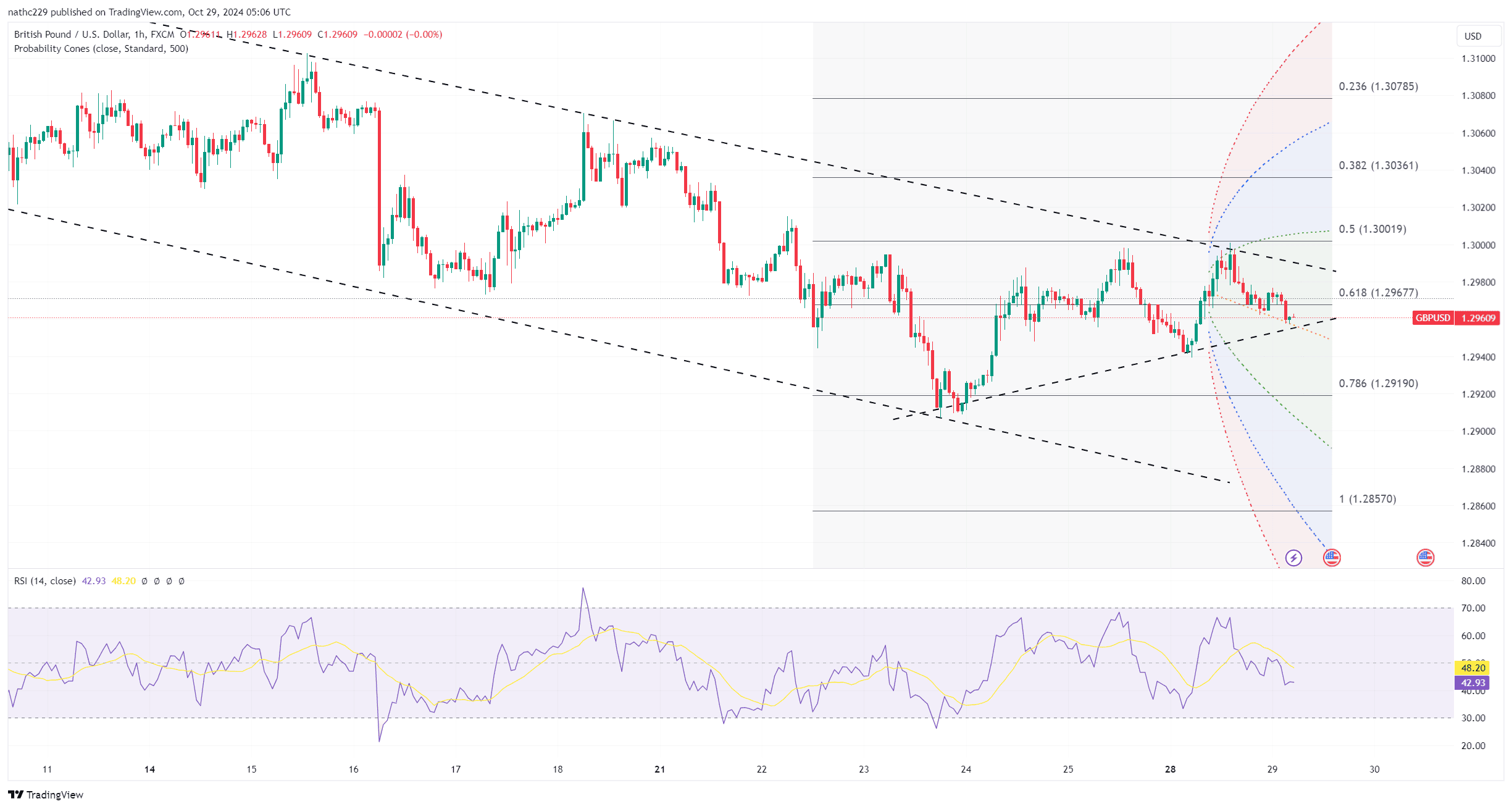

On the technical front, GBP/USD remains within a narrow range, with support at 1.2942 (Monday low) and further downside protection at 1.2908 (October 23 low) and 1.2843 (lower 30-day Bollinger Band). Resistance lies at 1.3015 (October 22 high), 1.3074 (21-DMA), and 1.3109, marking the 38.2% Fibonacci retracement of the recent downtrend from 1.3434 to 1.2908. The daily chart also shows a falling 10-DMA, which GBP/USD must close above to trigger a potential test of early October highs near 1.32. Without this, the pair risks remaining capped below 1.30, especially as U.S. Treasury yields maintain upward pressure on the dollar.

Going forward, the UK budget’s details and the November 5 U.S. election outcome are expected to be pivotal for GBP/USD’s direction. Sterling bulls need supportive UK budgetary measures to sustain gains above 1.30, while a Trump victory in the U.S. election could strengthen the dollar by keeping U.S. rates high. In the short term, GBP/USD may face continued resistance near the 1.30 level, with sterling likely to remain range-bound until there is more clarity on these key events.