GBP/USD Bulls Target Fresh Highs Above 1.31 as Sterling's Uptrend Accelerates

GBP/USD bulls have asserted dominance, briefly pushing the pair above the psychologically important 1.3000 threshold to register yet another 2025 high at 1.3009. Closing at 1.3005, sterling confirmed bullish control, marking its 11th new annual high since March 4. This upward move remains part of a broader bullish trend initiated from sub-1.2200 lows earlier in the year, reinforced by macroeconomic developments and persistent USD selling pressures. Sterling’s continuous outperformance, backed by macro fundamentals, has seen the pair trade comfortably above its rising 10-DMA (1.2932), underscoring the sustainability and strength of this rally.

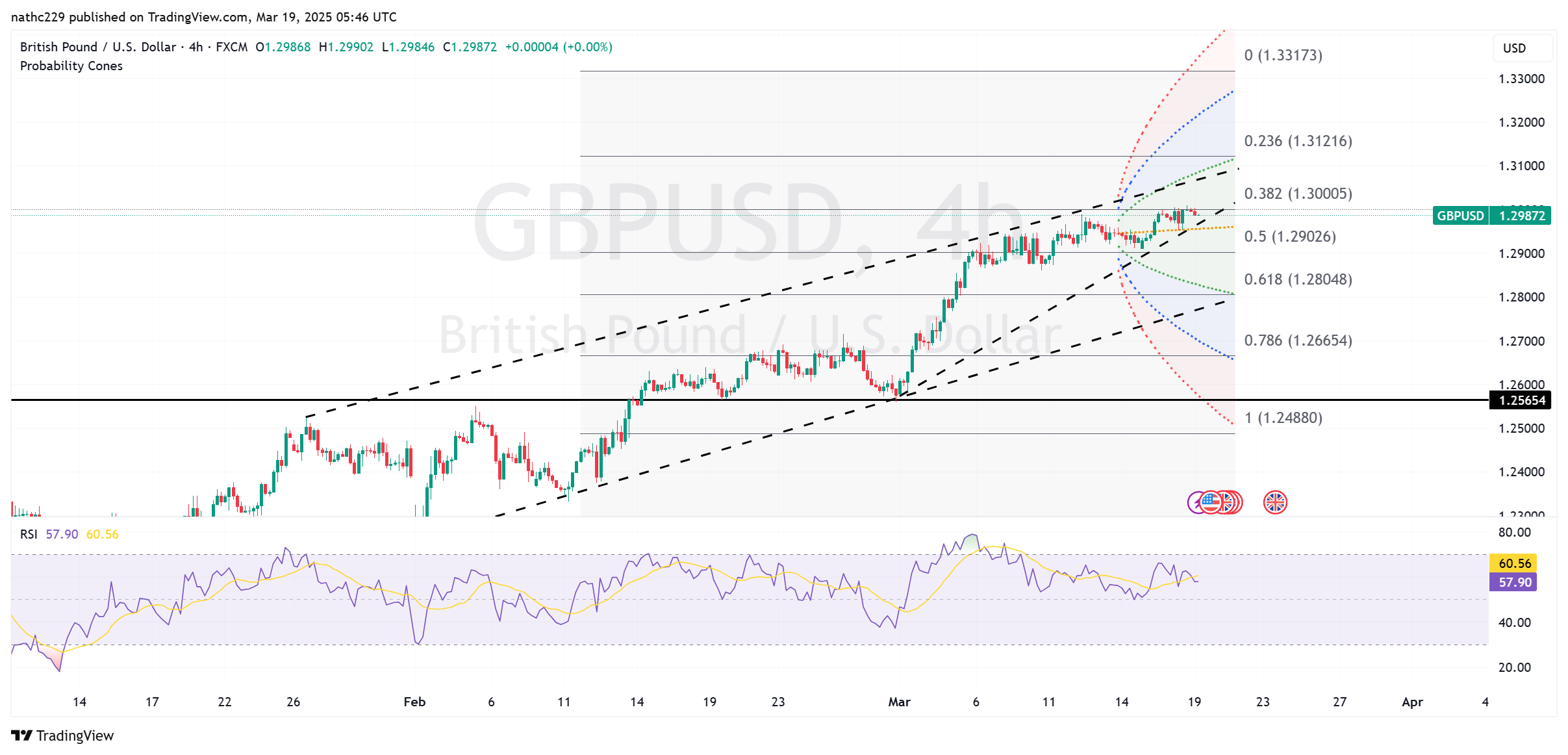

Technical resistance is well-defined near the latest high of 1.3009. A convincing breach would quickly target the November 6 high of 1.3046 and subsequently the upper boundary of the 30-day Bollinger Bands at 1.3082. Beyond this, the major objective for bulls is the October 7 high at 1.3133. Momentum indicators, such as RSI and MACD, remain positively aligned on daily charts, indicating ample room for further gains before becoming overbought.

Near-term support begins at the intraday low of 1.2953, although the key pivot remains the ascending 10-DMA line at 1.2932, which has consistently underpinned the uptrend since early March. A break below this moving average could trigger a modest correction toward stronger horizontal support at 1.2862, recorded as the March 10 low. Nonetheless, given the broader bullish narrative, dips to these lower levels will likely be short-lived, viewed as attractive opportunities for fresh long positions by market participants.