GBP Softens Ahead of BoE Meeting Amid Uncertainty Over June Rate Cut Odds

The pound softened ahead of Thursday's Bank of England (BoE) meeting, with the possibility of a rate cut in June hovering near 50% odds. GBP/USD closed slightly down in North American trading, ending at 1.2495 after fluctuating between 1.2510 and 1.2470on Wednesday.

Expectations are for the BoE to maintain rates, but attention is on potential dovish signals during the meeting. A vote count favoring a rate cut could increase the likelihood of a June cut, likely driving GBP/USD lower. The London Stock Exchange Group's Interest Rate Probability Report (IRPR) suggests around 50% odds for a June cut, with an August cut fully priced in and a potential decrease of 55 basis points by December.

Meanwhile, the Federal Reserve's outlook indicates an 80% chance of a September cut, with a decrease of 44 basis points expected by the December 18 Fed meeting.

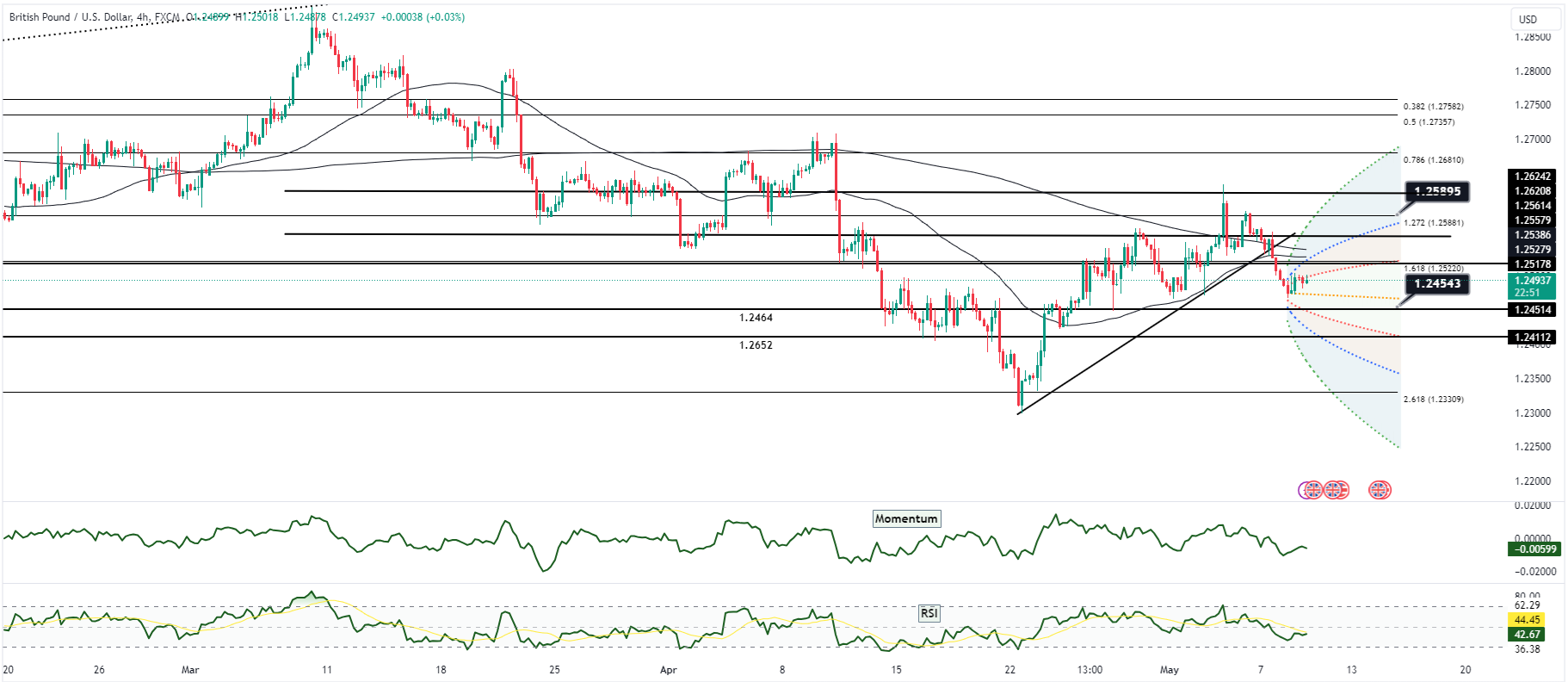

GBP/USD is currently supported at the 20-day moving average of 1.2480, with resistance levels at Wednesday's high of 1.2522, the 50-day moving average of 1.2520, and the 200-day moving average of 1.2540. Risks are tilted to the downside due to potential dovish signals from the BoE.

In early North American trading, sterling weakened further, reaching a one-week low of 1.2472 as traders adjusted positions ahead of the BoE rate decision and press conference, which could weigh further on the pound. While the BoE is widely expected to maintain rates, focus will be on the voting outcome. Any additional BoE members supporting a rate cut could increase expectations for a June cut, potentially pushing GBP/USD towards support levels at 1.2420 and 1.2305.

Both BoE and Fed members are likely to emphasize their success in managing inflation and commitment to reaching target levels. If the BoE's decision or comments are perceived as dovish, traders may react before the release of CPI data later in the month, leading to a decline in GBP/USD.