Euro Weakness Persists as ECB and Tariff Risks Loom

EUR/USD remains weak, ending the week around the critical 1.04 level, pressured by uncertainty ahead of the March 4 tariff deadline and the ECB policy meeting next week. Aggressive U.S. tariffs on Canada and Mexico could set a bearish tone for global trade sentiment, indirectly weighing on the euro. Additionally, with French President Macron expressing doubts about trade talks, the euro faces increasing headwinds.

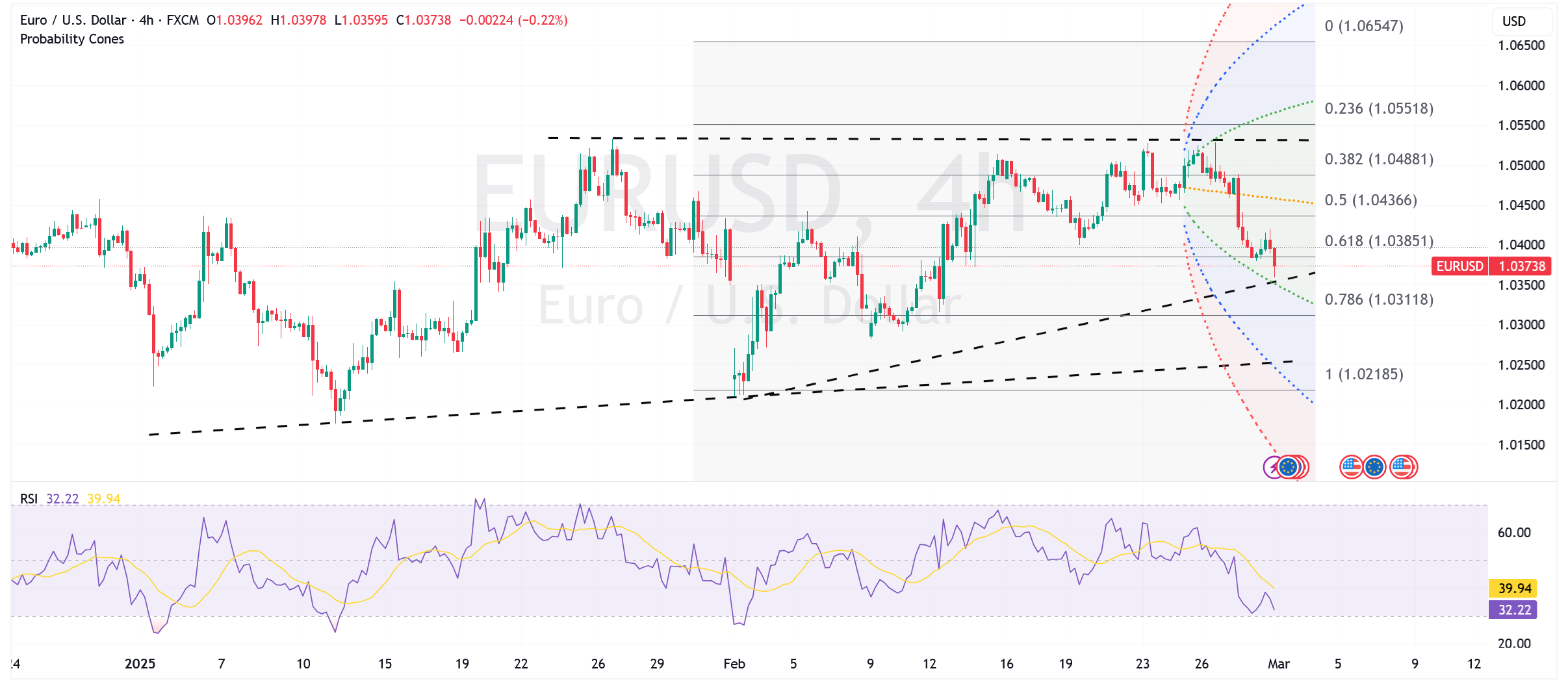

EUR/USD fell 0.2% to its lowest in two weeks, pressured by rising EU-U.S. tariff concerns and expectations of an ECB rate cut. Key support at 1.03 is now in focus, with resistance at the 21-day moving average near 1.0417 likely to limit short-term gains.

Technically, EUR/USD trades within a tight range (1.0380-1.0420) with significant support at the 55-day moving average near 1.0390-95. A sustained break below this level could trigger a move toward the 1.0300 psychological support area. Resistance remains at 1.0450-60 (200-hour moving averages), followed by stronger selling interest near 1.0500-1.0530.

With a 25 basis point ECB rate cut widely anticipated, guidance and economic projections will determine EUR/USD’s near-term direction. Given persistent trade uncertainties and a likely dovish ECB stance, the path of least resistance remains lower, with a potential retest of 1.03 increasingly likely if trade tensions escalate further.