EUR/USD Upside Capped as German Political Risks and Diverging Rate Paths Favor Dollar Strength

EUR/USD posted a modest rally on Thursday, moving higher as weaker U.S. Treasury yields and narrowing DE-US spreads initially favored the euro. However, EUR/USD gains were constrained by the broader challenges facing Germany’s economy and political landscape. September’s drop in German industrial output has heightened recession concerns in the euro area, while the unexpected collapse of Germany’s coalition government has introduced political uncertainty that could lead to a confidence vote and potential elections early next year. These developments, combined with concerns over trade tensions after President-elect Trump’s inauguration, may pressure the ECB to adopt a more aggressive easing stance.

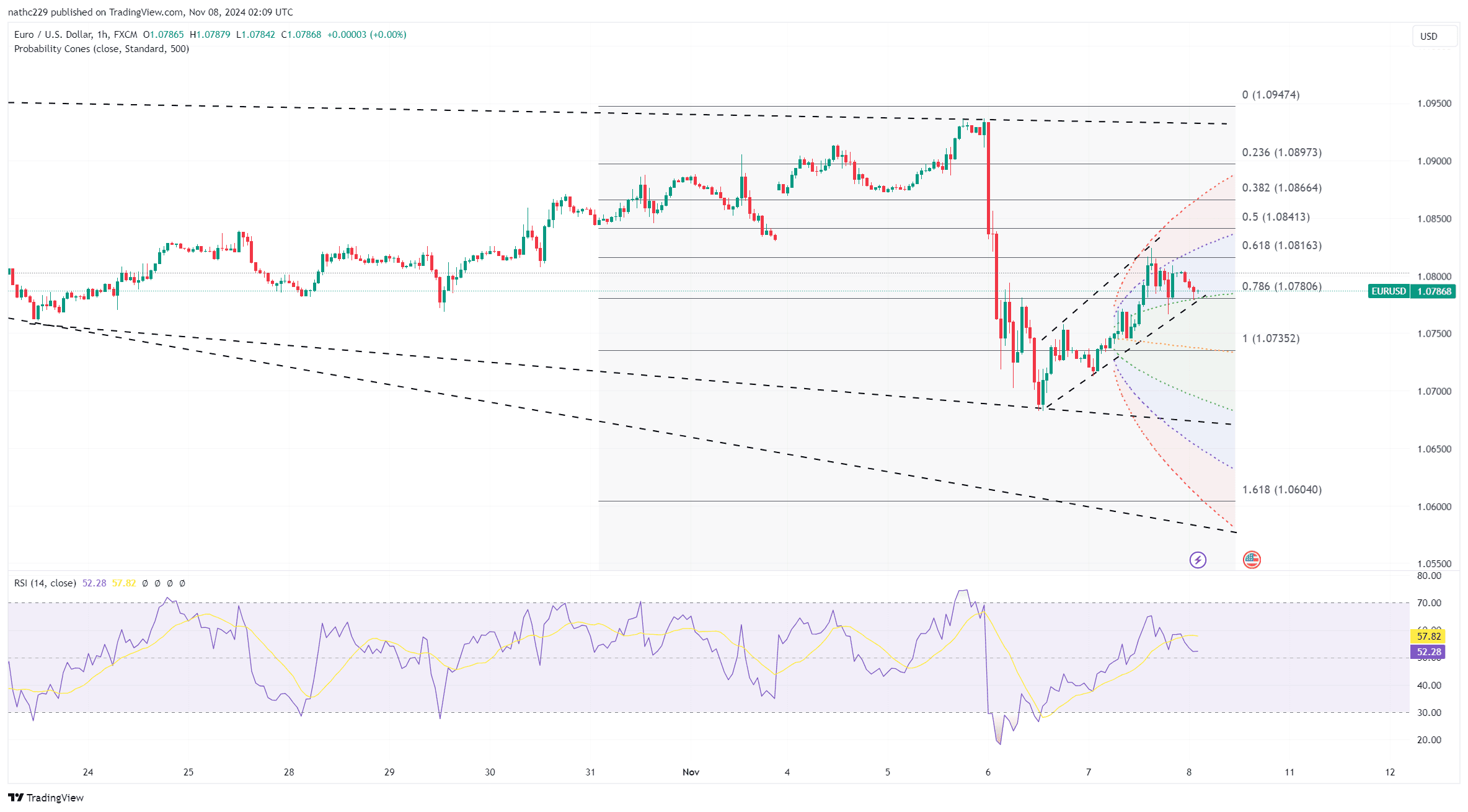

Technically, EUR/USD’s outlook remains bearish despite the day’s rally. The pair failed to close above key moving averages—the 5-, 21-, and 200-day—while monthly RSI readings suggest persistent downward momentum. EUR/USD briefly reached a high of 1.0825 but pulled back to 1.0775 following the Fed’s 25bps cut, which confirmed the dollar’s strength. With the Fed’s terminal rate now projected around 3.75%, up from 3.25%, and ECB rate cuts likely on the horizon, rate differentials continue to favor a stronger dollar, limiting EUR/USD’s potential for a sustained rally.

Going forward, EUR/USD may face increasing pressure as the dollar remains supported by diverging monetary policy paths. The upcoming U.S. University of Michigan report on consumer sentiment could influence market sentiment, particularly if it strengthens the case for a resilient U.S. economy. Unless Germany’s economic outlook improves or political risks subside, EUR/USD’s gains are likely to be fleeting, with downside risks remaining prominent as the dollar’s yield advantage over the euro persists. Support at 1.0775 remains critical, while a move below could pave the way for a test of the October low near 1.0666.