EUR/USD Rises on Weak Dollar, Faces Key Resistance Ahead of Critical Week for Global Markets

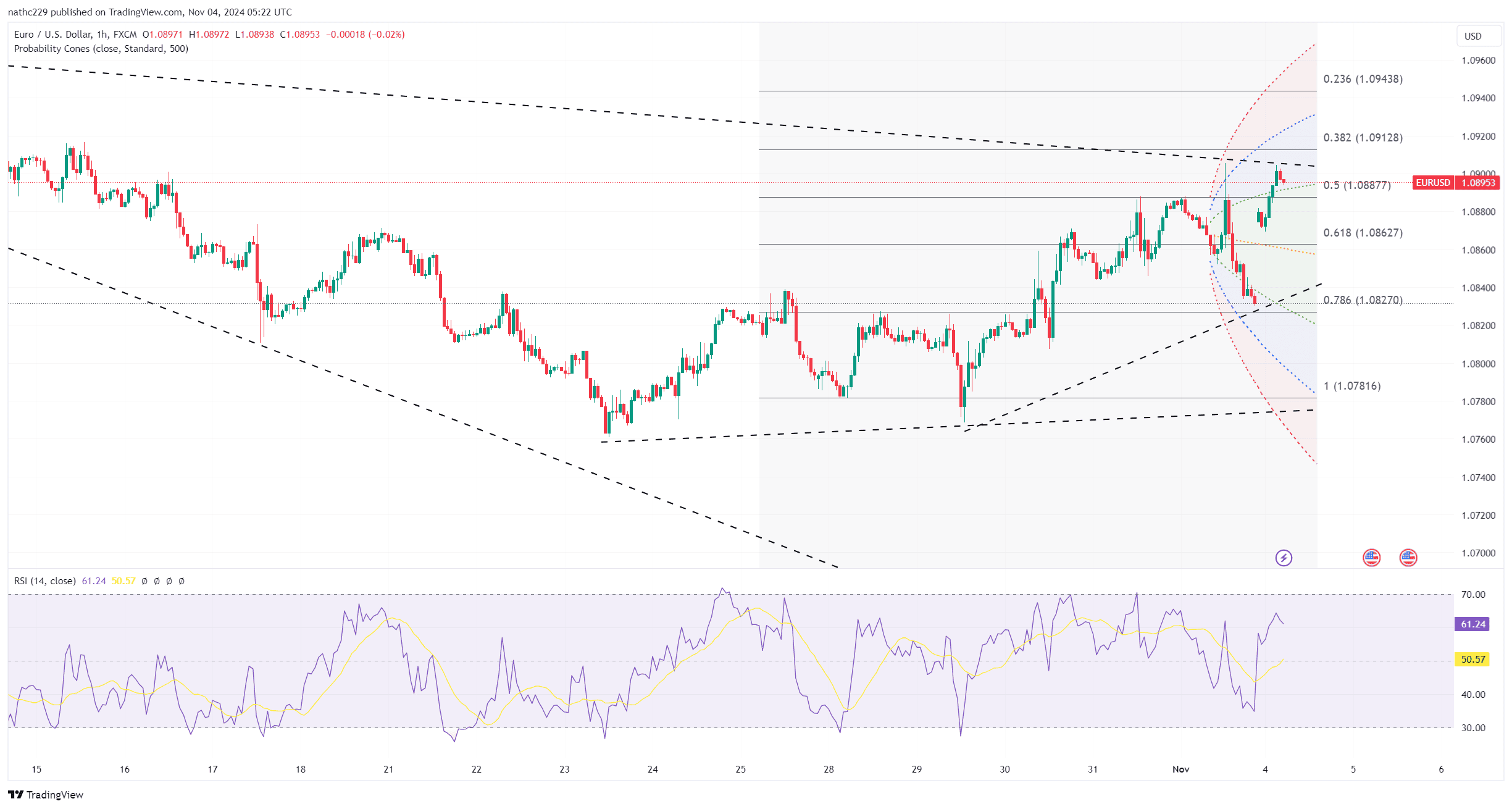

EUR/USD surged at the start of the week, gaining 0.6% as a dip in the dollar’s strength boosted the pair. The initial rally took EUR/USD above the 21-day moving average to a high of 1.0869, signaling that bulls are attempting to gain control. With the eurozone economic calendar featuring PMIs and investor confidence, EUR/USD bulls will watch for data that could further validate the current upward momentum. Daily charts show positive momentum indicators, with contracting 21-day Bollinger bands hinting at a potential breakout, although the coiling of the 5, 10, and 21-day moving averages maintains a neutral bias. A decisive close above 1.0869 could encourage further gains toward 1.0934, while a strong base has formed near 1.0783, the 78.6% retracement of the June-September rally.

On the technical front, EUR/USD has bullish undertones, but mixed signals remain. The daily RSI is supportive of further gains, while the contracting Bollinger bands suggest a larger move could be on the horizon. Key resistance at 1.0869, representing the 21-DMA, would need to be cleared for the bulls to target 1.0934. Downside risk remains anchored at 1.0783, which aligns with the August low and forms a solid support level. Large option expiries this week at 1.0850 and 1.0900 add another layer of complexity, likely contributing to support and resistance levels as traders position for a critical week in global markets.

This week is set to be one of the busiest in recent memory, with significant events across multiple regions. The U.S. election on Tuesday could add uncertainty, while the FOMC is expected to cut rates by 25 basis points on Thursday. Should the Fed adopt a dovish tone, it may add downward pressure on the dollar, supporting EUR/USD. Conversely, resilient U.S. data, including factory orders, ISM services PMI, and preliminary consumer sentiment, could renew USD strength, particularly if data comes in strong. Additional focus will be on China’s anticipated fiscal stimulus announcement, U.K.’s budget update, and multiple rate decisions globally. Given these influences, EUR/USD’s movement is likely to be volatile, with bulls needing sustained momentum to overcome critical resistance levels.