EUR/USD Recovers Amid Soft U.S. Data, Technicals Remain Bearish

EUR/USD saw a recovery on Thursday, rebounding from earlier lows as unexpectedly soft U.S. economic data stirred expectations of potentially easier Federal Reserve policy. The pair neared flat for the day after U.S. weekly jobless claims hit a 10-month high and continuing claims increased significantly to 1.82 million, surpassing estimates of 1.798 million and a prior 1.79 million. Additionally, May's producer prices surprised to the downside, reinforcing the view that disinflation may be making a return—a sentiment initially sparked by softer-than-expected CPI data reported earlier in the week. These data points led to doubts about the Fed's recent SEP projection, which anticipated one rate cut in 2024, as short-term rate markets began pricing in a total of 50 basis points of easing for the year. If this trend of disinflation and weaker job growth continues, it could lower U.S. yields and narrow the German-U.S. spread, potentially boosting EUR/USD.

CFTC data shows that investors remain net-long on the euro, although current positioning is not as high as the peaks seen in 2020 and 2023. Investors contemplating long positions in EUR/USD may need to act quickly if the data continues to weaken the dollar and forces the Fed towards a more dovish stance. This shift could prompt a scramble among investors to increase their long positions in the euro.

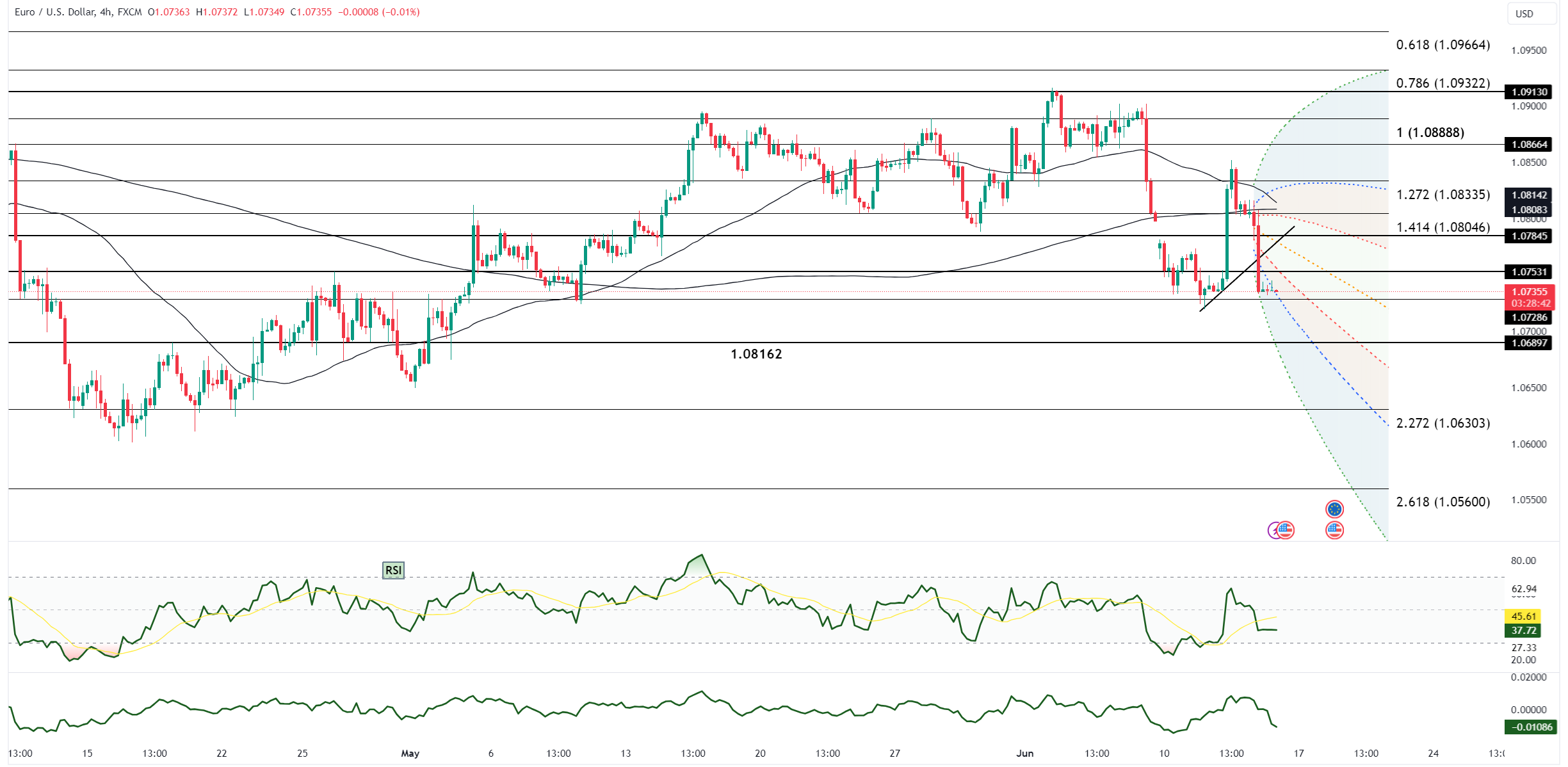

Technically, EUR/USD displayed resilience by rallying during the New York session, opening near 1.0795 after hitting 1.0816 overnight. However, the rally faced resistance as U.S. yields and the dollar fell following the PPI and jobless claims reports, reaching 1.0815 before sellers drove the pair lower. The fall of EUR/JPY and the rally of USD/CNH, along with drops in stocks and gold, added pressure on EUR/USD, pushing it down to 1.0732 before a minor bounce, ending the day down by 0.65%.

The technical outlook remains bearish with EUR/USD trading below both the 55-day and 200-day moving averages, and the Relative Strength Index (RSI) continuing to decline. The inverted hammer candle formed in June's monthly chart further supports bearish signals. Upcoming U.S. economic indicators, such as May export/import prices and the University of Michigan's June sentiment index, will be crucial in determining the pair's next move.

Market Sentiment and Future Outlook

Market sentiment remains cautious as investors weigh the implications of recent U.S. economic data. The soft jobless claims and PPI reports have already influenced market expectations for Fed policy, leaning towards a more dovish outlook. This shift has potential to lower U.S. yields and tighten the German-U.S. spread, which could support EUR/USD. However, technical indicators suggest bearish momentum, with the pair struggling to maintain gains above key moving averages and RSI showing downward pressure.

In summary, while soft U.S. economic data and dovish Fed expectations could provide upward support for EUR/USD, the technical outlook remains bearish. Investors should closely monitor upcoming economic data for further indications of market direction and potential shifts in Fed policy. This combination of fundamental and technical factors will be critical in determining the future trajectory of EUR/USD.

Open an account today to unlock the benefits of trading with CMS Financial