EUR/USD Rallies on ECB Expectations but U.S. Payrolls Pose a Threat

EUR/USD moved higher on Thursday, reaching an 11-session peak of 1.0888 as eurozone inflation data and ECB President Christine Lagarde’s comments hinted that the central bank may opt for a slower rate-cutting pace. October’s eurozone HICP inflation rate exceeded forecasts at 2.0%, and core HICP remained steady at 2.7%, which could prompt the ECB to take a more cautious approach on rate cuts. Additionally, tightening German-U.S. yield spreads provided support to EUR/USD, helping the pair rally above its 200- and 21-day moving averages.

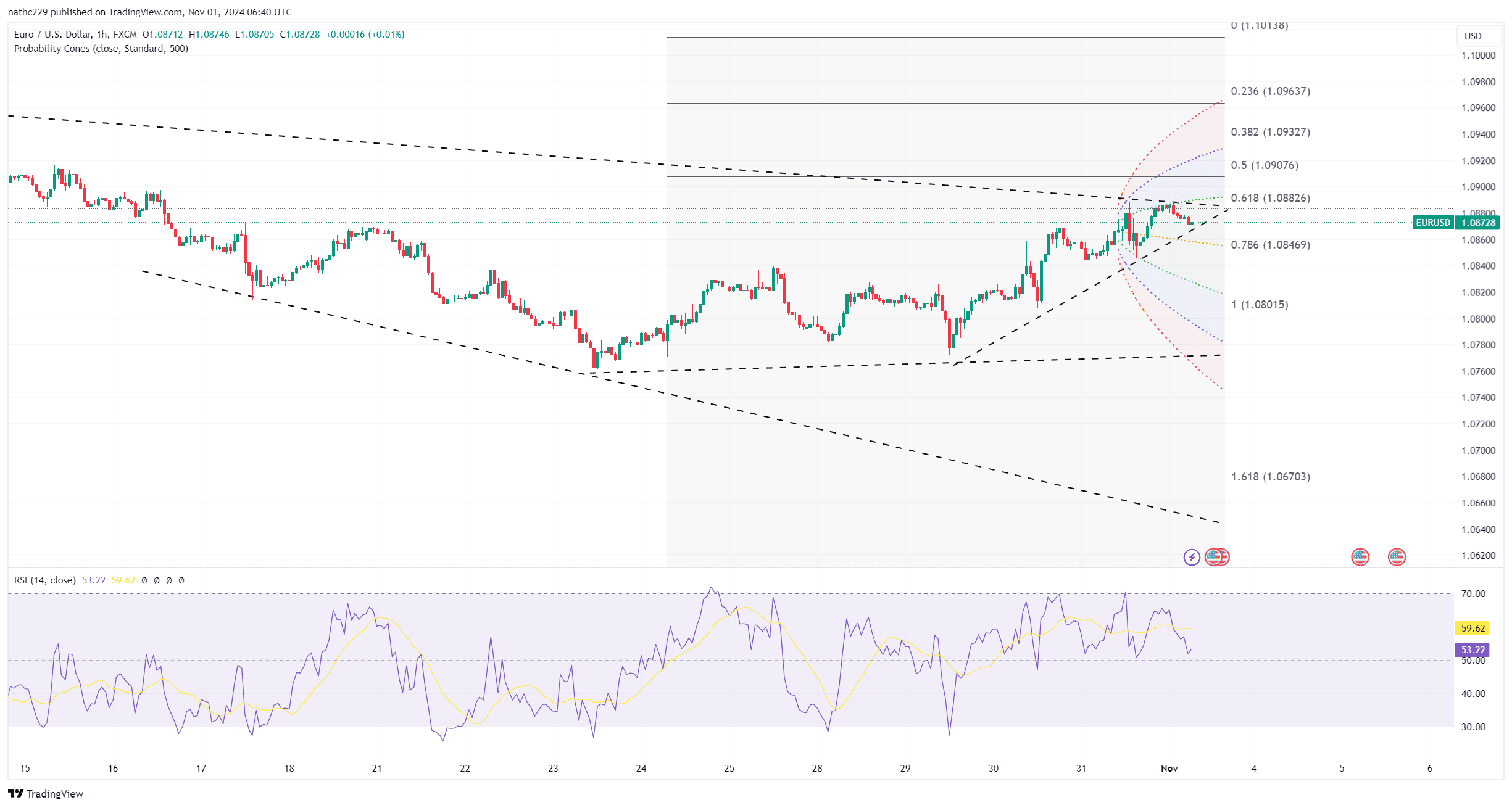

On the technical side, EUR/USD faces mixed signals. While the daily RSI points upward, the monthly RSI is still in a downtrend, suggesting the rally may lack sustained momentum. The formation of a doji candle signals investor indecision as the pair struggled to hold gains. Immediate resistance is noted at 1.0888, while support is around 1.0845 and further down at 1.0800. For EUR/USD bulls to take control, a break above the 1.0900 level is essential, but this will likely hinge on upcoming U.S. data.

The U.S. October payrolls report on Friday poses a significant risk to EUR/USD’s recent gains. Positive surprises in payrolls or a lower unemployment rate would likely bolster U.S. dollar strength as investors price in a less aggressive Fed cutting cycle, supported by solid employment figures. Such a scenario would challenge EUR/USD bulls, possibly driving the pair back toward key support zones as the dollar’s yield advantage remains intact. The EUR/USD rally may face continued pressure as investors await more clarity on inflation and employment trends from both sides of the Atlantic.