EUR/USD firms above 1.13 as Merz victory, softer dollar underpin bullish bets

EUR/USD moved higher in Tuesday's trading session, buoyed by renewed dollar weakness and supportive euro-zone political developments after Friedrich Merz's second-round election victory as German Chancellor. The pair recovered steadily from earlier dips, notably holding key support within the 1.1250-1.1280 area, a zone that has repeatedly acted as a reliable floor amid recent fluctuations. The euro’s resilience is largely reflective of investor positioning rebalancing toward consensus trades favoring continued EUR/USD upside, particularly amid increased clarity on Germany’s political landscape and diminished near-term political risk.

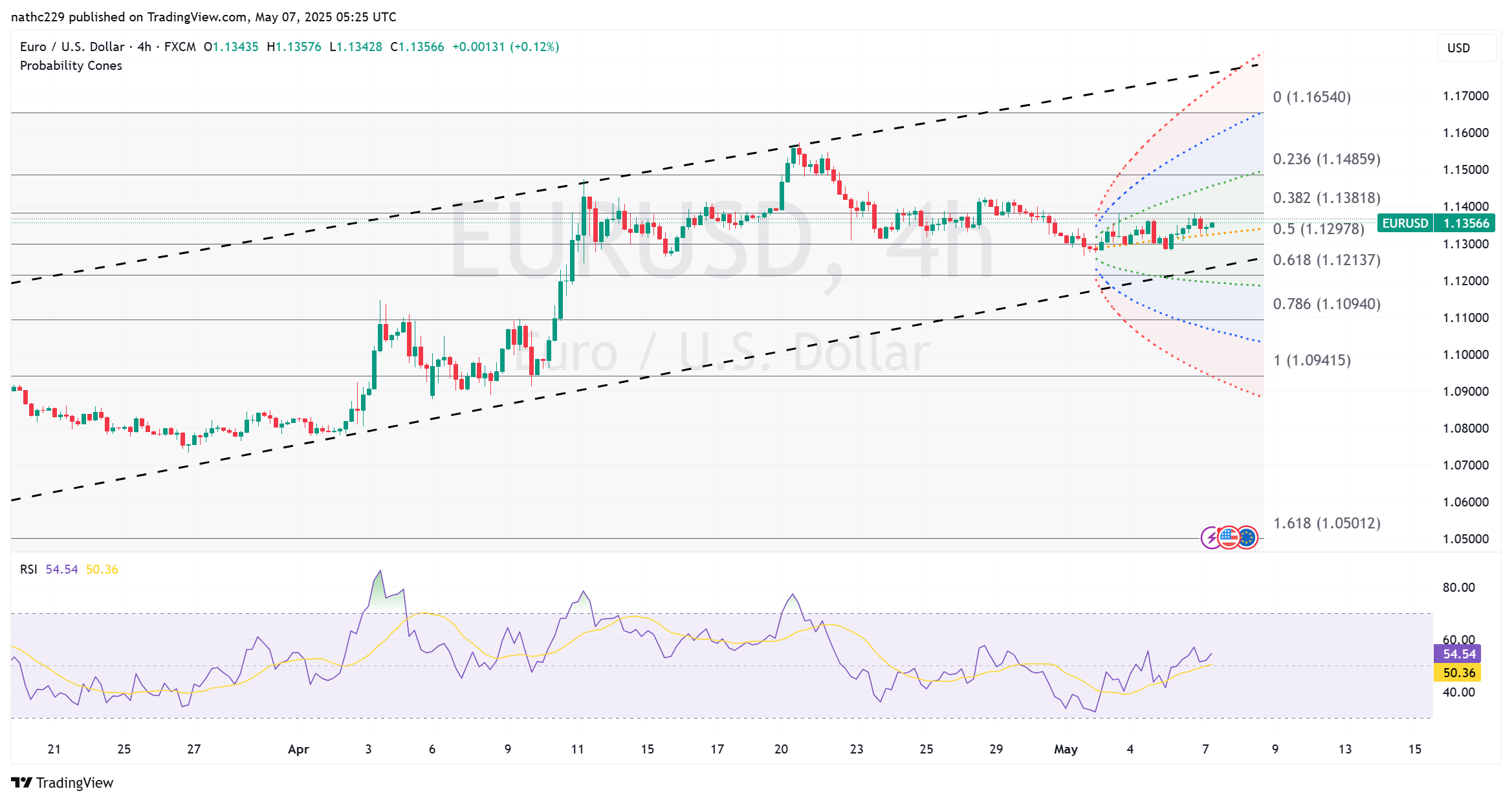

From a technical standpoint, EUR/USD remains confined to a relatively tight consolidation range, oscillating around its 200-hour moving average at approximately 1.1347. Immediate resistance is situated between 1.1400-1.1425, a level which has capped advances since late April. A sustained break and close above this region would likely attract renewed buying momentum, paving the way towards a test of 2025 highs around 1.1500. Momentum indicators on shorter timeframes, including hourly RSI and stochastic oscillators, are currently neutral to slightly bullish, underscoring market indecision but hinting at upside potential if dollar weakness persists.

Investor attention is now squarely focused on Wednesday’s critical Federal Reserve policy decision and particularly Chair Jerome Powell’s press conference. Any cautious or dovish signals from Powell regarding future monetary policy—especially amid ongoing tariff-related uncertainties—could significantly accelerate EUR/USD bullish momentum. Conversely, a hawkish tilt emphasizing inflation concerns or economic resilience in the face of trade tensions may lead the pair to retest support near 1.1250-1.1280, potentially threatening the recent consolidation pattern.