EUR/USD Faces Technical Risks Despite Recent Rally as Market Reassesses Euro Strength

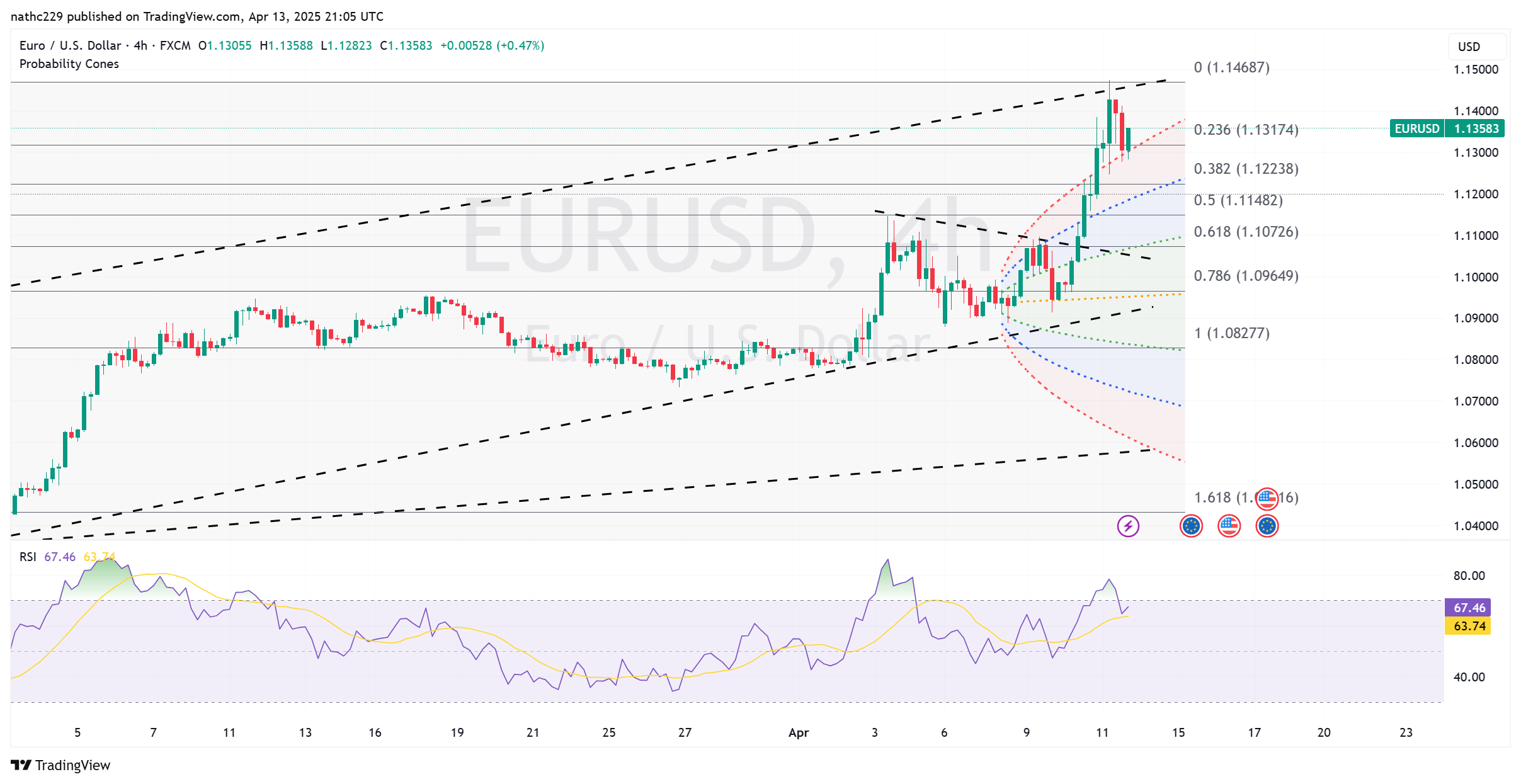

Technical Analysis:

EUR/USD surged to a fresh three-year high of 1.1474 overnight but gave back significant gains in the New York session, reflecting an emerging caution among traders despite ongoing weakness in U.S.-linked assets. After opening around 1.1335, the pair initially attempted a recovery toward 1.1411, only to fall sharply as investors selectively re-engaged with U.S. equities and Treasury yields moderated from recent highs. EUR/USD eventually touched an intraday low of 1.1277 before settling close to 1.1300, concluding the session with a gain of approximately 0.85%, though notably below earlier peaks.

Technically, EUR/USD remains supported by robust upward momentum indicated by rising daily and monthly RSI readings, underscoring bullish strength in the short term. However, the pronounced long upper wick formed on the daily candlestick raises concerns about potential trend exhaustion and signals significant selling pressure near recent highs. Resistance levels to watch closely include Friday’s high of 1.1411 and the critical multi-year peak at 1.1474. A firm break above these thresholds is necessary to sustain bullish confidence and open targets at the psychologically important resistance region between 1.1500 and 1.1600.

Conversely, the failure to maintain intraday highs combined with growing fundamental concerns about the sustainability of euro appreciation amid U.S. tariff threats highlights growing downside risks. Immediate support at 1.1277 will be key in the short term. A decisive break below this point would likely intensify bearish pressure, potentially accelerating declines toward the psychologically and technically significant support near 1.1200, and possibly deeper toward the next cluster of key technical supports in the 1.1050–1.1100 zone. Traders should remain cautious, balancing short-term bullish technical signals against increasing fundamental headwinds and potential shifts in market sentiment.