EUR/USD Faces Bearish Pressures as ECB Policy Shift and Technical Breakdowns Weigh

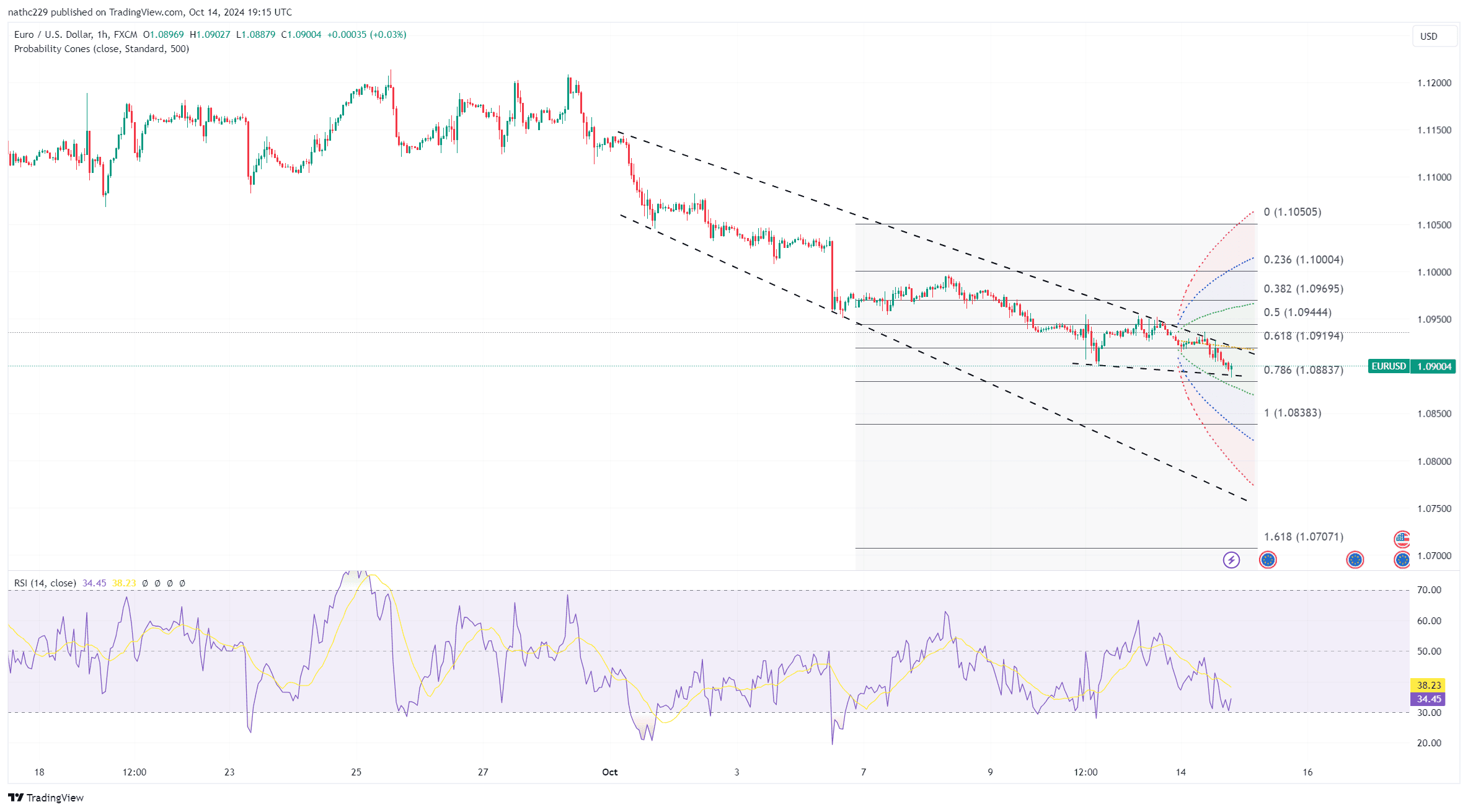

EUR/USD is trading under renewed pressure, having closed below the 100-day moving average (DMA) and daily Ichimoku cloud base at 1.0936/45. This break signals growing bearish momentum, especially after oversold conditions that limited declines last week were alleviated. Technical indicators suggest further downside potential, with the next target at the base of the 20-day Bollinger Band at 1.0883. The critical 200-DMA at 1.0875 looms as a key level to watch, as a break below it could flush out remaining long positions, potentially driving the pair lower in the lead-up to the ECB's rate decision.

The technical outlook for EUR/USD remains weak, with falling RSIs and the break below key support levels reinforcing the bearish trend. The 200-DMA at 1.0875 serves as the next critical support, and any close below this level could intensify selling pressure, as traders unwind long positions. Upside remains limited, with resistance expected near 1.0936, the 100-DMA, and further selling likely on rallies. The technical structure suggests that unless a significant shift in sentiment occurs, EUR/USD is poised to continue drifting lower, with potential for further declines toward 1.0800.

The upcoming ECB meeting will be a pivotal event for EUR/USD, with a 25-basis-point rate cut widely expected by the market. While the rate cut itself is unlikely to move the euro significantly, President Lagarde’s press conference will be closely watched for any insights on future policy direction. As in previous meetings, Lagarde is expected to maintain a cautious, data-dependent approach, minimizing the impact of forward guidance. With market sentiment already leaning bearish, any dovish signals from Lagarde could accelerate EUR/USD’s decline, reinforcing the bearish technical structure and potentially leading to a test of the 1.0775-1.0800 support zone.