EUR/USD Faces Bearish Pressures Amid Rising US Inflation and Yield Gains

EUR/USD remained under pressure, hitting a fresh two-month low as U.S. inflation data and rising yields drove the dollar higher, overshadowing the tightening of German-U.S. yield spreads. The pair began the day near 1.0940 but quickly moved lower following the release of U.S. weekly jobless claims and September CPI data. Although above-estimate jobless claims initially pushed down U.S. Treasury yields and weakened the dollar, the market focus quickly shifted to the stronger-than-expected CPI report, which raised concerns about persistent inflation. This prompted a rebound in U.S. yields and the dollar, leading EUR/USD to give up its gains and trade down to 1.0900 before slightly bouncing back. By the end of the session, the pair was down -0.27%, reflecting the dominance of bearish factors.

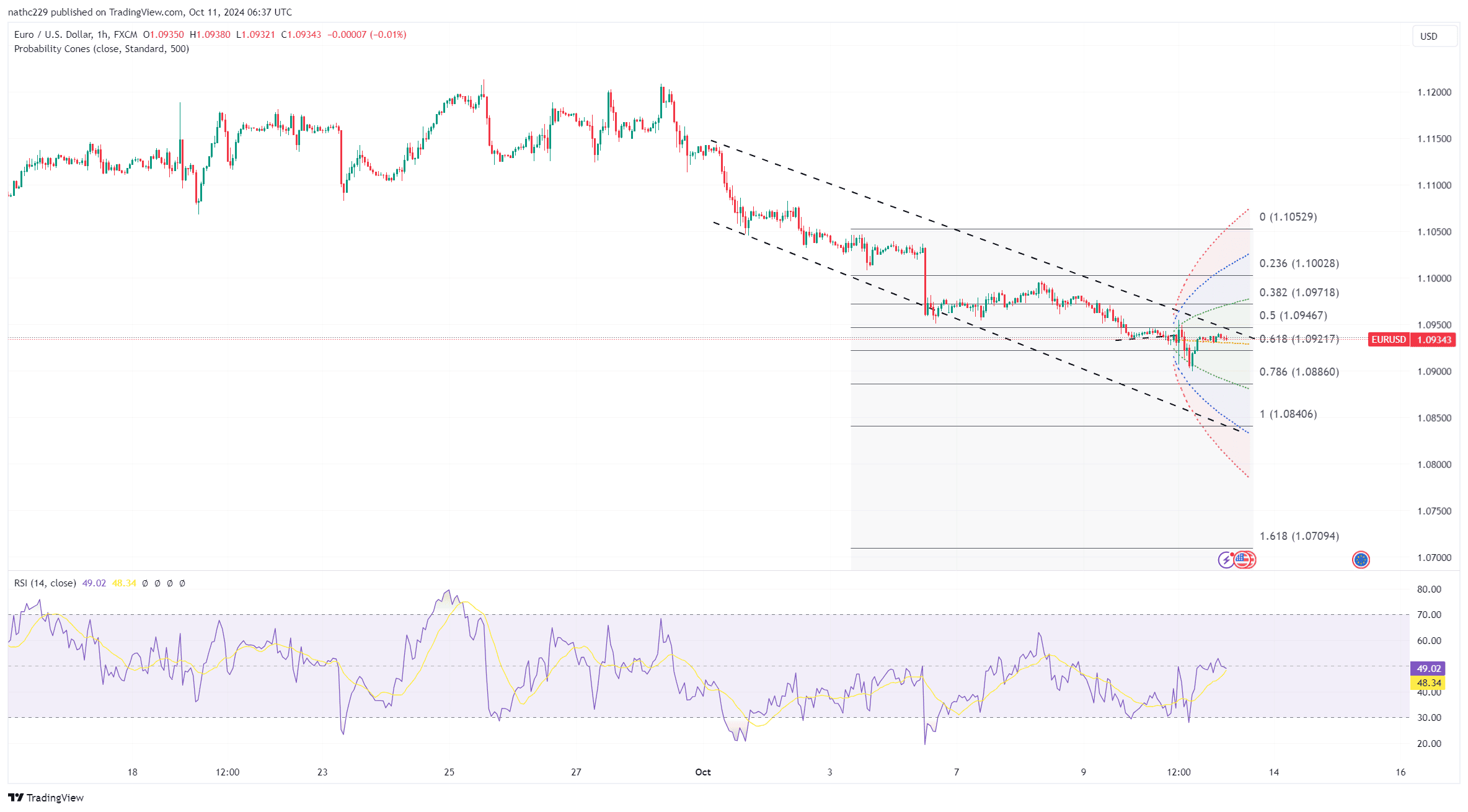

From a technical perspective, EUR/USD is signaling further downside risks, with the pair falling below important support levels such as the daily Ichimoku cloud base and the 5-day moving average. The declining daily and monthly RSI suggests that bearish momentum remains strong, and there is room for further downside before oversold conditions are reached. With the pair unable to sustain any rally above 1.0950 and consistently testing the 1.0900 region, market sentiment leans heavily toward further declines. The next major support area lies in the 1.0775-1.0800 range, where traders may look for signs of stabilization if the pair continues to weaken.

Looking forward, U.S. economic data releases on Friday, including September PPI and October University of Michigan inflation expectations, will be key drivers for EUR/USD. A higher-than-expected PPI print could reinforce concerns that inflationary pressures remain elevated, potentially pushing U.S. yields higher and further supporting the dollar. This would likely put additional pressure on EUR/USD, with a test of the 1.0775-1.0800 support zone becoming increasingly likely. Market participants will also pay close attention to comments from Federal Reserve officials, as any signals of a more balanced or less dovish stance could add to the dollar’s strength. However, any data suggesting a slowdown in inflation could provide a temporary reprieve for the euro, but the pair’s overall bearish outlook is likely to persist in the absence of a meaningful recovery above 1.0950.