EUR/USD Extends Losses

EUR/USD sank to a two-month low on Thursday, weighed down by diverging economic data between the U.S. and eurozone. While the ECB delivered a 25 basis point rate cut, in line with expectations, the euro quickly reversed earlier gains as stronger-than-expected U.S. retail sales and the Philadelphia Fed index highlighted ongoing strength in the U.S. economy. This bolstered U.S. Treasury yields and widened the German-U.S. yield spread to its widest since early July, further supporting the U.S. dollar. ECB President Christine Lagarde’s comments during her press conference only deepened the euro’s losses, as she acknowledged weaker-than-expected economic activity, signaling that the ECB may become more focused on growth, which could prompt additional rate cuts.

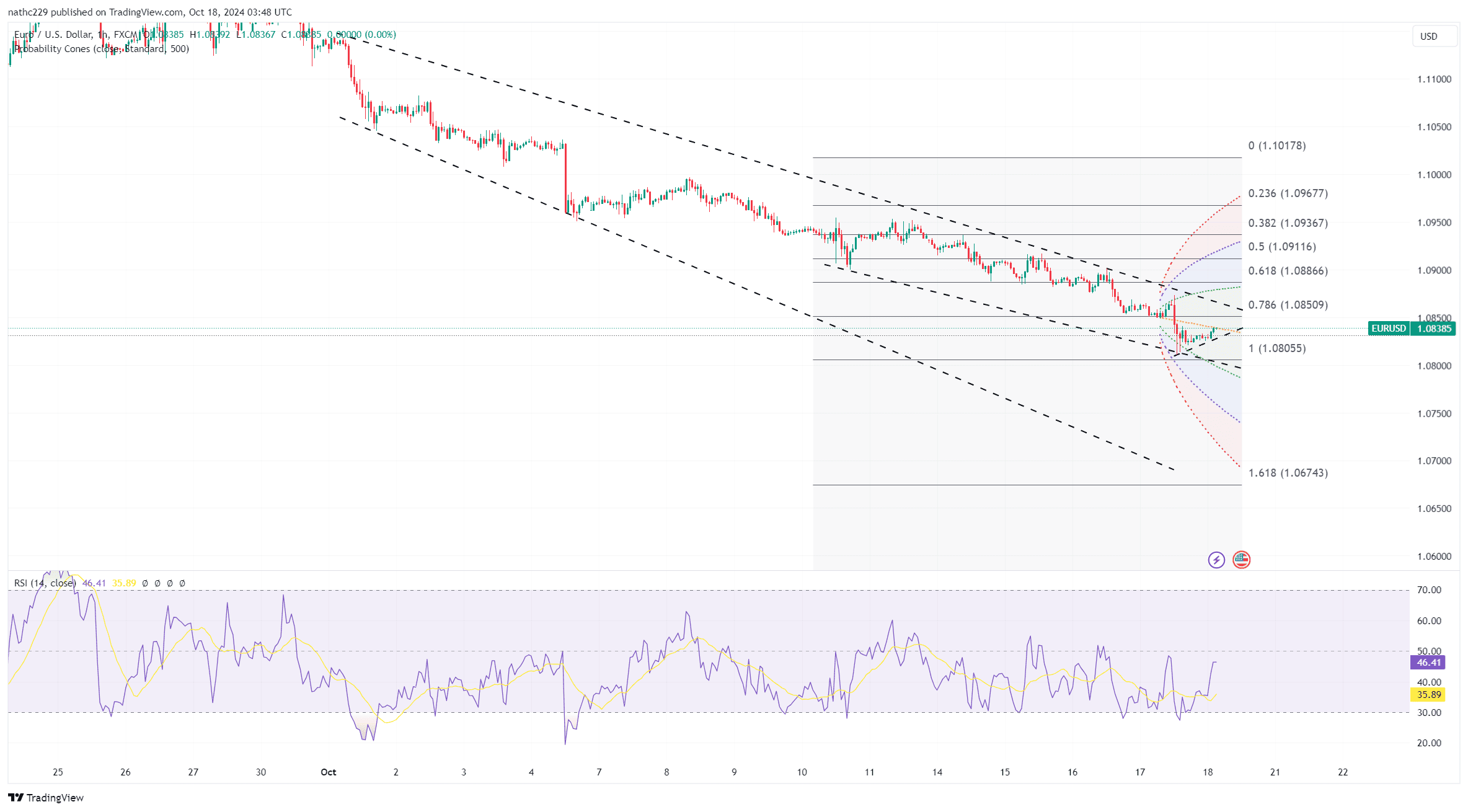

From a technical perspective, EUR/USD faces mounting downside risks, with the pair trading firmly below its 5-day and 200-day moving averages. The break below 1.0870, a key technical level, alongside falling daily and monthly RSI indicators, reinforces the bearish outlook. The 1.0775-1.0800 support zone is now the next key level for EUR/USD bears to target, and a breach of this support could open the door for a move toward the October 2023 monthly low. The widening yield differential between the U.S. and eurozone suggests that the euro is likely to remain under pressure, particularly as the Federal Reserve appears less inclined to cut rates aggressively.

Looking forward, the outlook for EUR/USD remains tilted to the downside as long as bearish technical signals persist. Traders will be closely monitoring the 1.0775-1.0800 support zone, as a break below this level would confirm further downside momentum. Additionally, upcoming Chinese Q3 GDP and retail sales data could introduce volatility during Asian trading hours, potentially influencing EUR/USD’s direction. The combination of stronger U.S. economic data and concerns about eurozone growth suggests that EUR/USD could face additional losses in the near term, with little relief in sight for euro bulls.